Bitcoin ETFs averaged nearly 1 million in October earnings

Since launching in January 2024, spot bitcoin exchange-traded funds (ETFs) are having one of their strongest months in October, with more than $3 billion in inflows.

This surge in demand has caused ETF issuers to purchase bitcoin at levels far in excess of the newly minted supply.

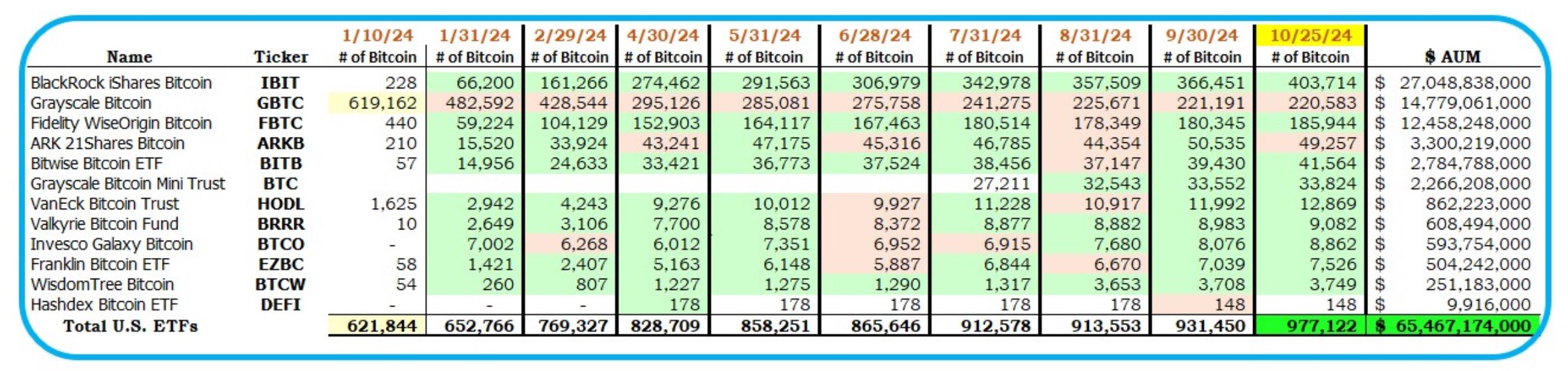

US Spot Bitcoin ETFs Amass 45,000 BTC in October

During the trading week of October 21-25, the 11 spot Bitcoin ETFs bought a combined 15,194 BTC, nearly five times the 3,150 BTC produced during that period, according to data from HODL15Capital. This week's inflows reached around $1.83 billion, reflecting an unprecedented surge in BTC buying by ETF issuers.

“If you sell any bitcoin today, this week or this year, it was bought by ETFs. US Bitcoin ETF demand outstrips new supply, but weak hands willingly sell their BTC day after day, week after week,” wrote HODL15 Capital.

Read more: What is a Bitcoin ETF?

Since early October, these issuers have collectively purchased 45,557 BTC. In the year If spot ETFs are accepted on January 10, 2024, this is the fourth highest month for BTC purchases.

Meanwhile, aggressive buying brought ETF issuers' combined BTC holdings close to one million BTC. As of October 25, Bitcoin ETF issuers collectively held 977,122 BTC — 22,878 BTC short of the million-BTC threshold. BlackRock has the largest BTC reserves, with approximately 403,714 BTC, which is equivalent to 2% of the total supply of Bitcoin.

In particular, if the ETF's current stock levels continue, their combined holdings could soon exceed that of Satoshi Nakamoto, the anonymous creator of the top wealth.

“It's less than 10 months old and ETFs are 97% to hold 1 million BTC, and 87% to surpass Satoshi as a major,” said Bloomberg ETF analyst Eric Balchunas.

Read more: How to invest in Ethereum ETFs?

Market observers note that ETF issuers now hold a significant supply of BTC, and their influence on market liquidity and price stability may continue to grow.

Indeed, as ETFs continue to accumulate large amounts of assets, there is likely to be significant volatility risk during periods of significant inflows or outflows, particularly in the relative supply of BTC. Analysts warn that such attention could increase price sentiment in response to market volatility.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.