Bitcoin ETFs could surpass gold ETFs in size within a month.

Key receivers

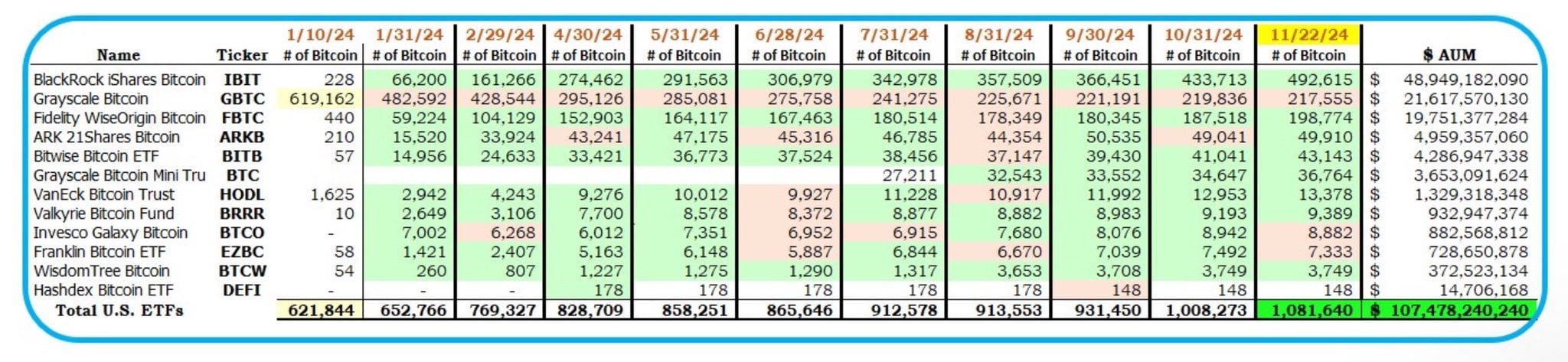

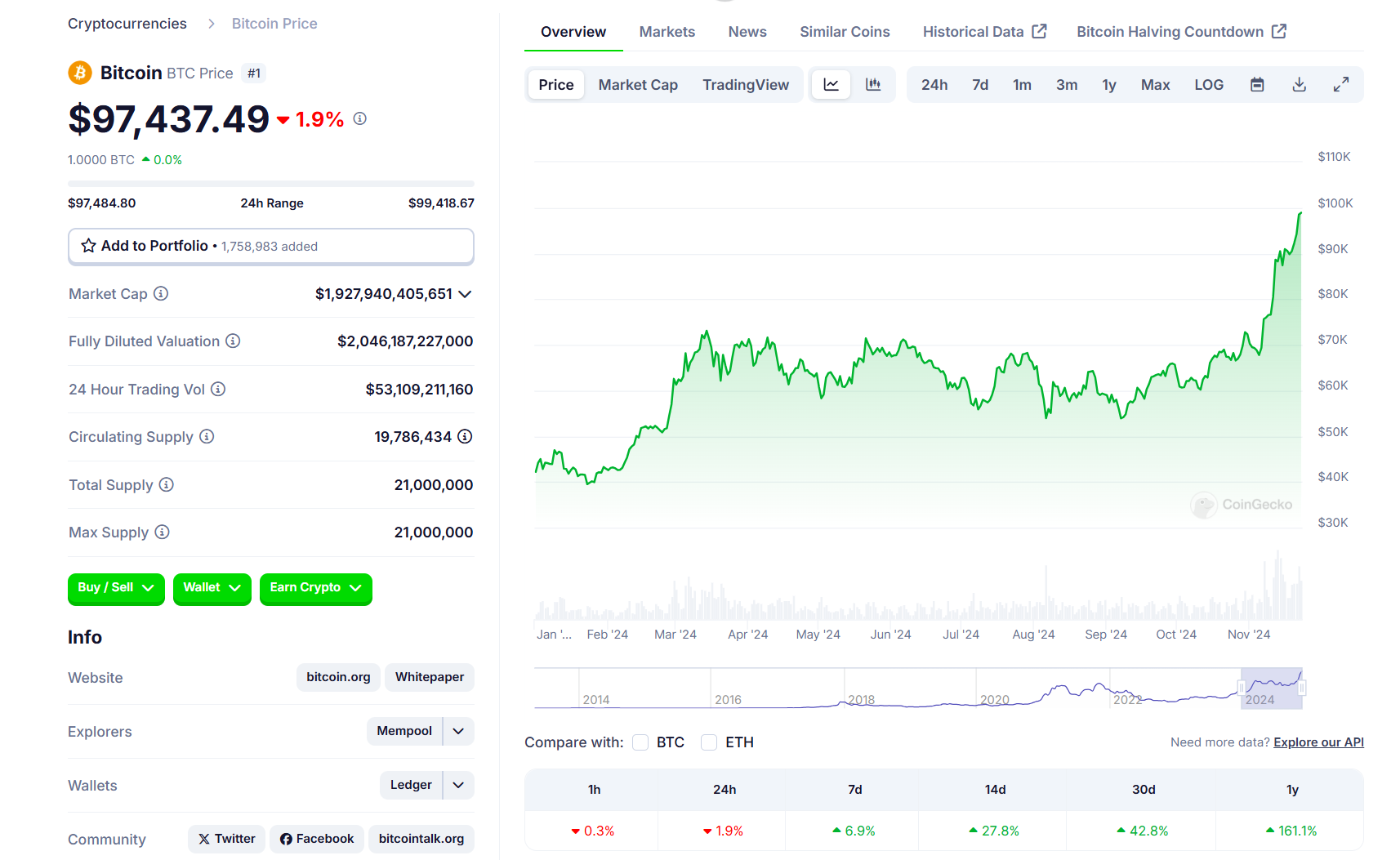

US Bitcoin ETFs are expected to surpass gold ETFs in size by Christmas, with current assets at $107 billion. BlackRock's iShares Bitcoin Trust continued to be a key player this week, accounting for 73% of net flows into Bitcoin ETFs.

Share this article

If US Bitcoin ETFs maintain their current holdings, they will reach the size of gold ETFs. Bloomberg ETF analyst Eric Balchunas suggests these funds may overshadow gold ETFs by Christmas.

As of November 23, combined data from Balchunas and HODL15Capital shows that as of November 23, Bitcoin ETFs in the US have reached $107 billion in assets, which represents 86% of the total net assets of all gold ETFs.

“They will delay gold ETFs by $23 billion, a good shot longer than Christmas,” Balchunas said.

Bitcoin ETFs are closing the gap with Satoshi Nakamoto. These funds currently hold approximately 98% of Satoshi's estimated Bitcoin reserves, which is likely to overtake the most likely Bitcoin creator to become the world's largest Bitcoin owner next week.

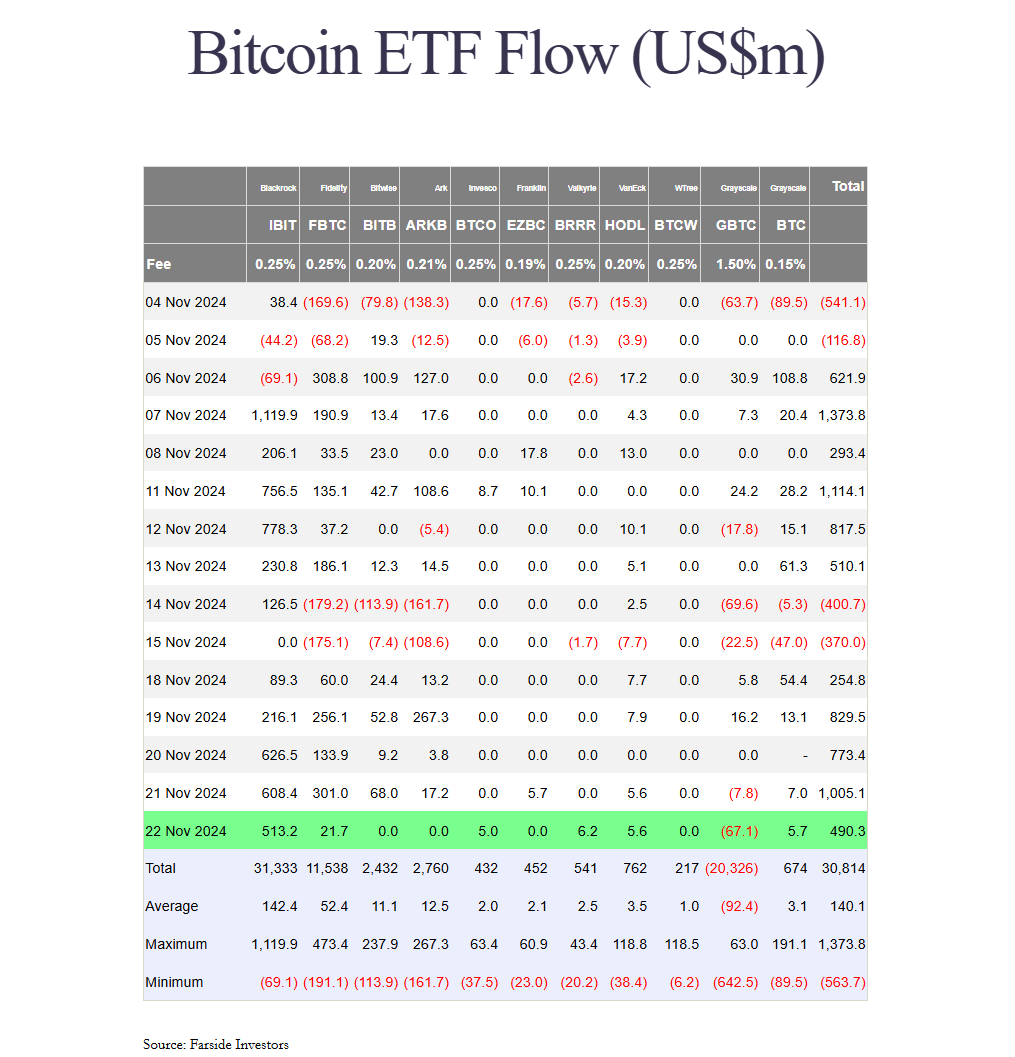

This week alone, US spot Bitcoin ETFs saw net inflows of about $3.3 billion, with BlackRock's iShares Bitcoin Trust (IBIT) accounting for 62 percent of the total, according to Farside Investors data.

IBIT continues to expand its diversification into net assets with BlackRock's iShares Gold Trust (IAU). In the year In the year As of November 22, IBIT holds $48.4 billion worth of bitcoins, while IAU's assets are valued at around $34 billion.

The rise of Bitcoin raises concerns about its stability compared to gold

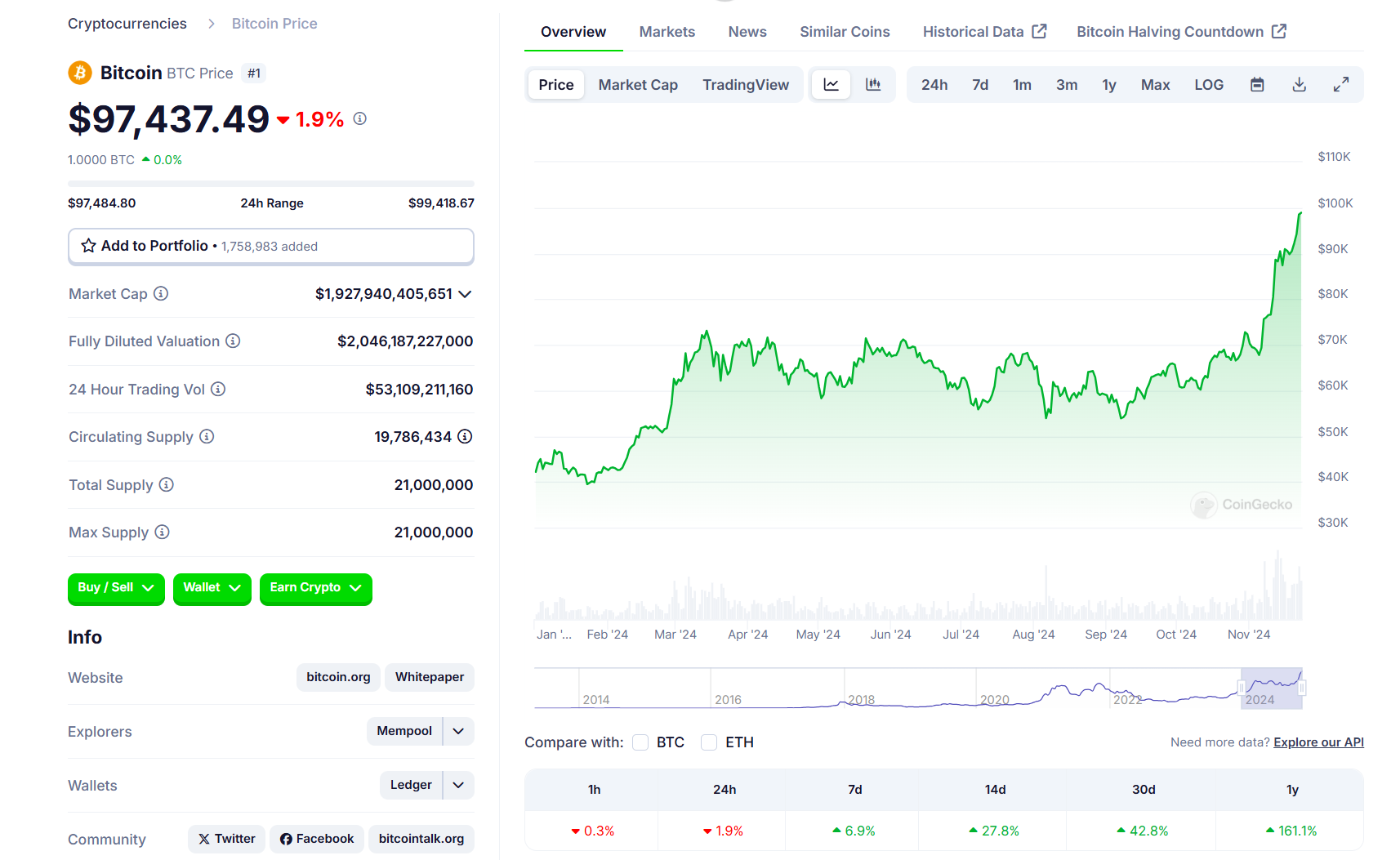

On Friday, the world's largest crypto asset set a new all-time high of $99,500, approaching the six-figure mark. For Bitcoin advocates, the bull market is still in its infancy.

VanEck's Bitcoin target for this cycle is $180,000. The asset manager reiterated its forecast in its latest report, backed by bullish indicators such as funding rates, relative unrealized profit (RUP) and retail interest.

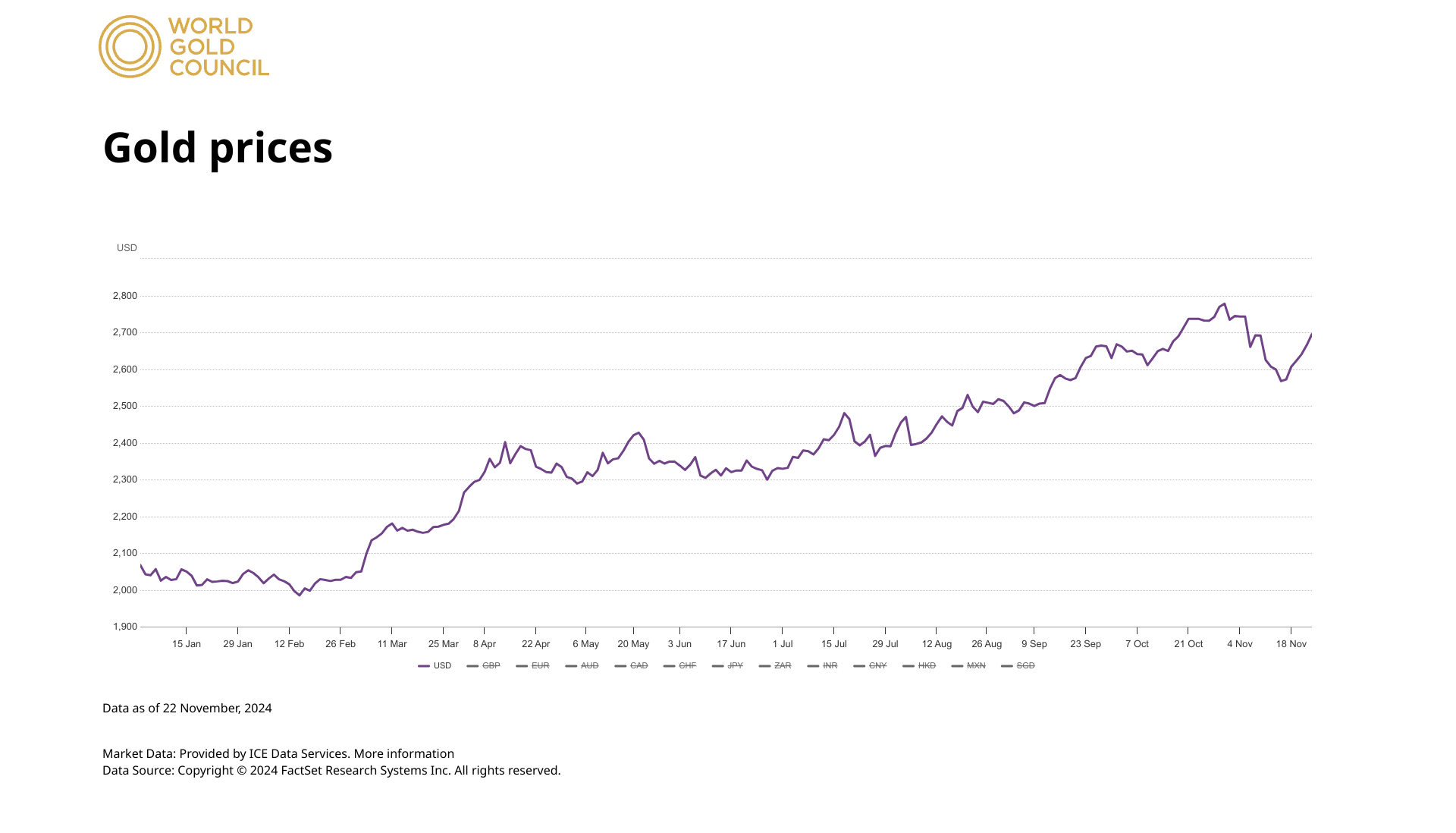

However, State Street, which manages more than $4 trillion in assets, thinks investors are becoming overly optimistic about Bitcoin's potential and ignoring the stability and long-term value that gold offers.

George Milling-Stanley, chief gold strategist at State Street Global Advisors, warns that bitcoin's current rally could create a false sense of security among investors. According to the analyst, unlike gold, which has a long history, the future of Bitcoin is uncertain.

“Bitcoin, pure and simple, is a comeback play, and I think people are jumping into comeback plays,” Milling-Stanley told CNBC.

Milling-Stanley emphasized that Bitcoin promoters, who liken it to gold mining, are creating a false sense of synchronicity that mimics the allure of gold.

“There is no issue of mining. This is a computer system, pure and simple. But they called it mining because they wanted to look like gold – maybe take some of the aura from the gold.

While gold returned around 30% year-to-date, Bitcoin stole the show with an impressive 160% increase. Its market share now exceeds Silver and Saudi Aramco.

Share this article