Bitcoin ETFs end five-day streak of gains as Bitcoin falls below $93,000

Key receivers

US Bitcoin ETFs saw $435 million in outflows as the price of Bitcoin fell below $93,000. MicroStrategy Makes Largest Bitcoin Purchase, Gaining 55,500 BTC, Worth Up To $5.4 Billion

Share this article

US Bitcoin ETFs experienced massive outflows amid Bitcoin's retreat below $93,000 on Monday.

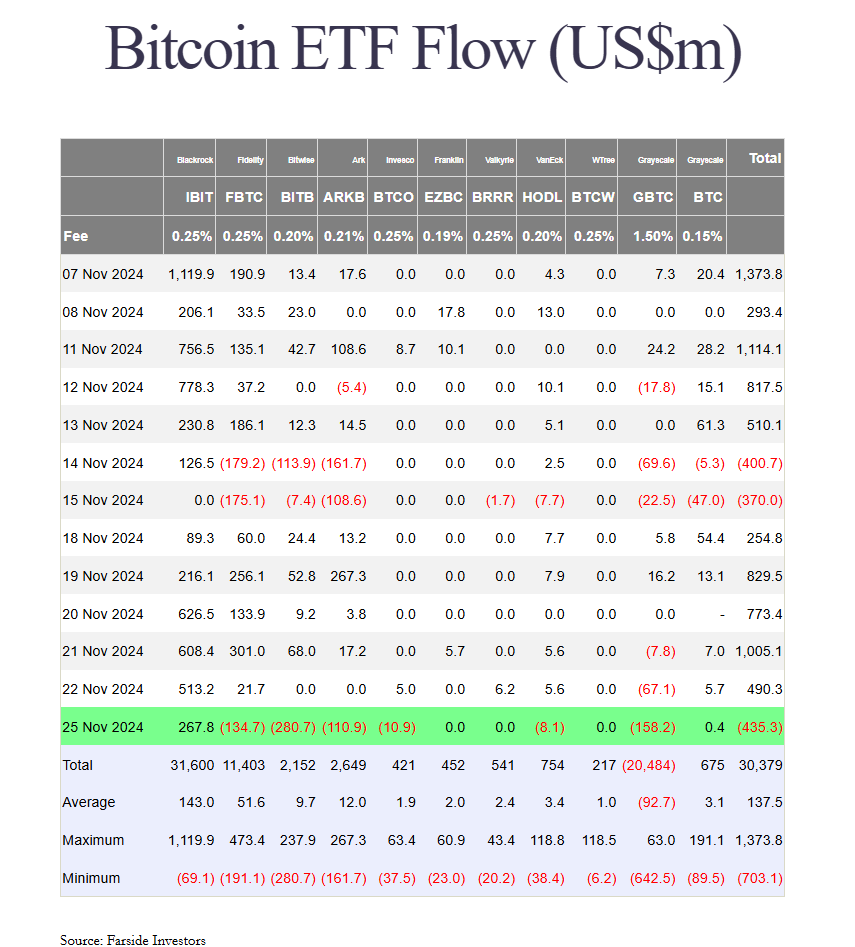

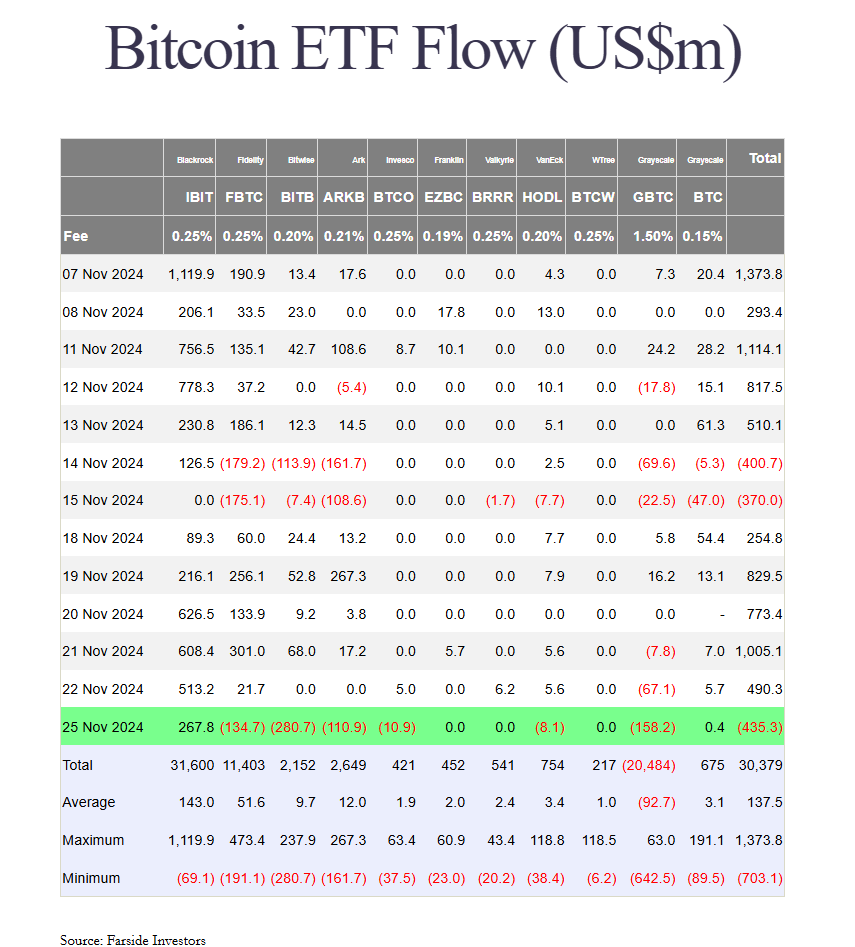

Eleven Bitcoin ETFs saw a total of $435 million in net outflows, with only BlackRock's iShares Bitcoin Trust (IBIT) and Greyscale's Bitcoin Mini Trust (BTC) attracting inflows.

According to data from Farside Investors, IBIT took in about $268 million in net income, while BTC took in $400,000.

Bitwise's Bitcoin ETF (BITB) and Grayscale's Bitcoin Trust (GBTC) have faced withdrawals from investors. BTB recorded its highest payout of up to $280 million, while GBTC saw its most significant daily redemption in three months, reaching $158 million.

Fidelity's Wise Origin Bitcoin Fund ( FBTC ) and ARK Invest's Bitcoin ETF ( ARKB ) saw withdrawals of $135 million and $111 million, respectively. The Invesco and Valkyrie funds lost a combined $19 million.

U.S. bitcoin ETFs saw a sharp turnaround from last week's performance, with $3.3 billion in outflows, while BlackRock's iShares Bitcoin Trust (IBIT) secured more than 60% of its total inflows.

The defeat came as the broader crypto market turned bearish.

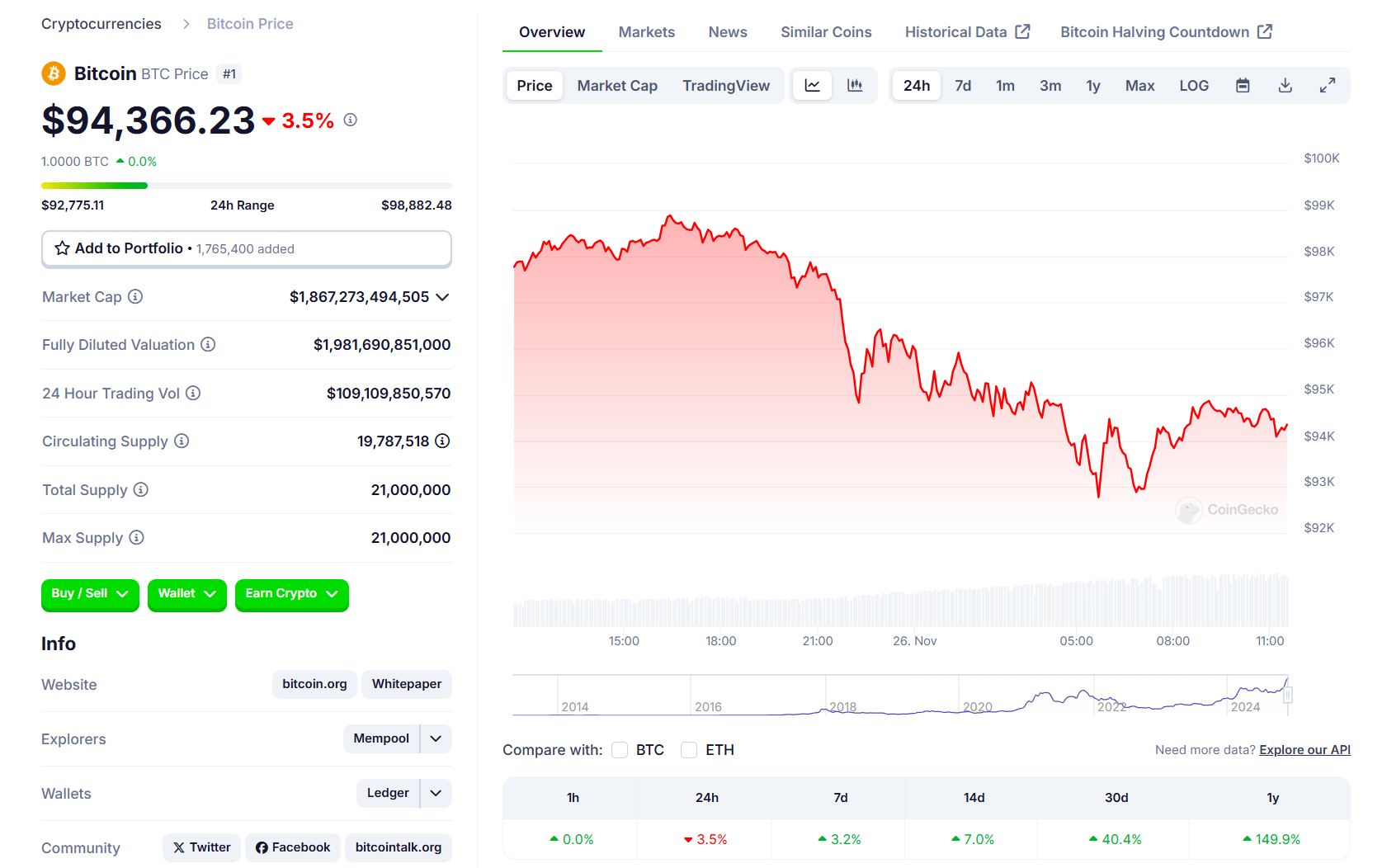

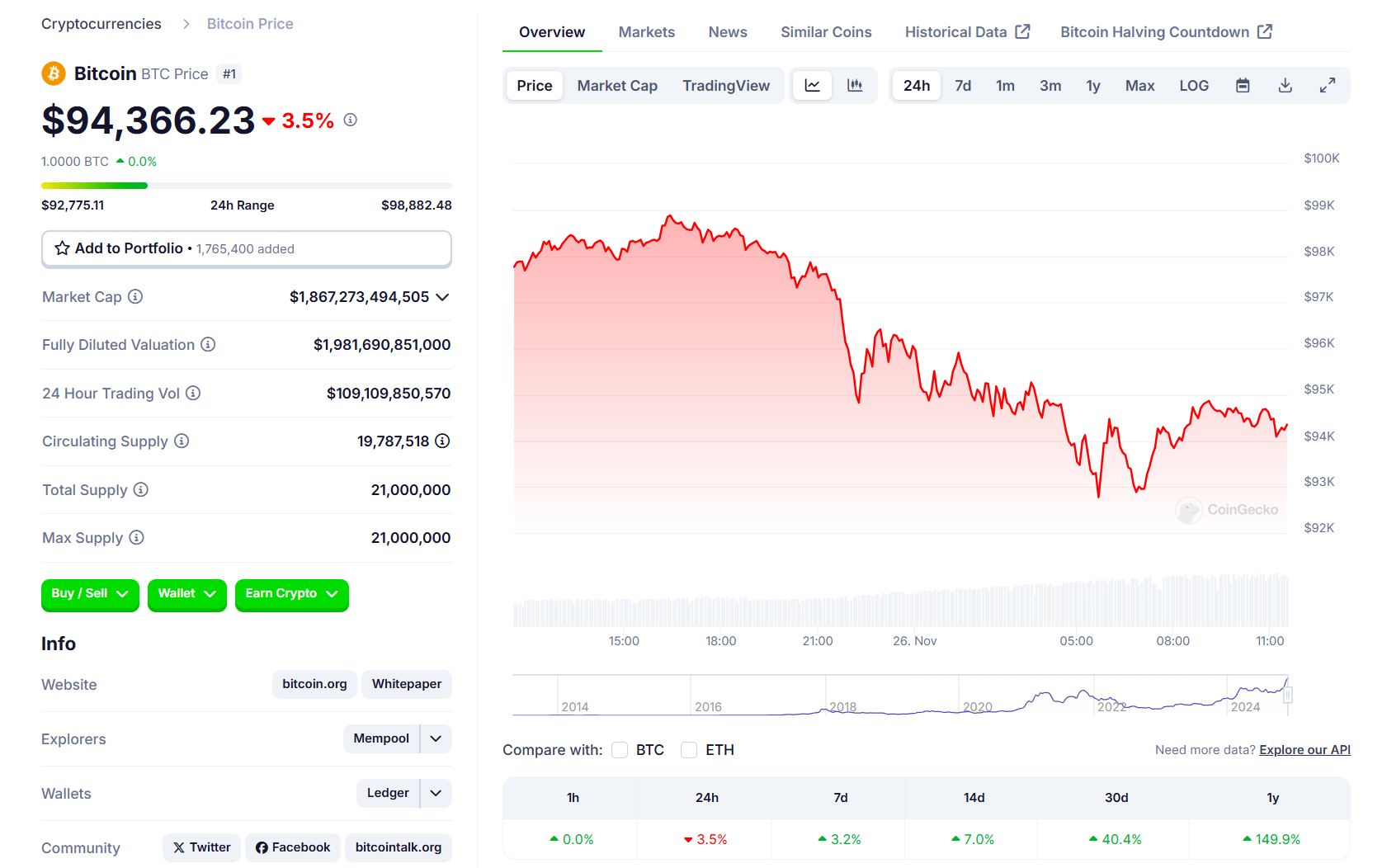

According to data from CoinGecko, Bitcoin recently failed to make a push of $100,000, falling below $93,000. The major crypto is now trading around $94,300, down 3.5% in the last 24 hours.

The decline comes amid increasing selling pressure from long-term holders who have sold more than 461,000 BTC since the asset's recent peak above $99,000, Crypto Briefing reported.

Despite the bearish trend, there is speculation that it could recover if the price stabilizes and rekindles investor interest. On Monday, Microstrategy announced that it had acquired another 55,500 BTC worth $5.4 billion. It is the company's largest bitcoin purchase to date.

Market participants are monitoring macroeconomic conditions, including inflation data and Federal Reserve statements, which may influence recent price action.

Share this article