Bitcoin ETFs have been trading around the world for years—here’s how they’ve done it

12 months ago Benito Santiago

Bitcoin will launch in 2024 as traders in the US await the SEC's approval of the first real Bitcoin ETF in the United States, which is undoubtedly the most difficult goal for the crypto industry in the last decade.

But Bitcoin ETFs In fact, they are not new. They have been doing business worldwide for years. Even in America, ETFs and crypto-based mutual funds are everywhere, and things have changed for the better for these markets: although some lawmakers and Despite the economic collapse, anarchy and threat to the sacred principles of democracy. Regulators in America can talk about crypto. Instead, trading activity around these alternative assets has brought some life to markets that have been battered by the global pandemic.

From Brazil and Chile to the American neighbors in the northern part of Canada, investors in these markets are dipping their toes into the future with several cryptocurrency ETFs. And these markets give a glimpse of what US investors can expect when the Bitcoin ETF finally hits US soil.

Here's how Bitcoin ETFs have performed around the world:

Table of Contents

ToggleCryptocurrency ETFs in Brazil

Crypto ETFs on Brazil's B3 exchange have seen a mixed bag of returns over the past year. The top performers were funds tracking heavyweight cryptocurrencies such as Bitcoin and Ethereum. The QBTC11 ETF, which is linked to the price of Bitcoin through the CME CF Bitcoin Reference Rate Index, has posted a 145% return through 2023. The BITI11 and BITH11 currencies are also benchmarked against the Bloomberg Galaxy Bitcoin Index and Nasdaq Bitcoin Reference Price respectively. It has returned over 100% in the past year.

Meanwhile, many top crypto ETFs have struggled to keep up. The NFTS11 ETF is down 45.71%, covering anchor NFTs and metaverse coins such as Axie Shards, The Sandbox, Blur and Apecoin on the MVIS CryptoCompare Media & Entertainment Leaders Index. The META11 fund, which is tied to an index of a collection of metaverse and crypto culture coins such as Apecoin, Decentraland, Shiba Inu, Polygon and Ethereum, posted a decline of 0.37%.

In total, the Brazilian exchange now hosts 13 crypto ETFs with more than $285 million in assets under management. Trading activity was brisk, with leading ETFs seeing daily volumes ranging from $10 million to $725 million.

While these funds are still a small slice of the total asset pie in Brazil, these funds inject a shot of adrenaline into the Brazilian ETF market. Investors are chasing blockbuster returns from high-flying cryptos, while issuers are scrambling to bring more options to market. Compared to other markets around the world, Brazil has really rolled out the red carpet for crypto ETFs.

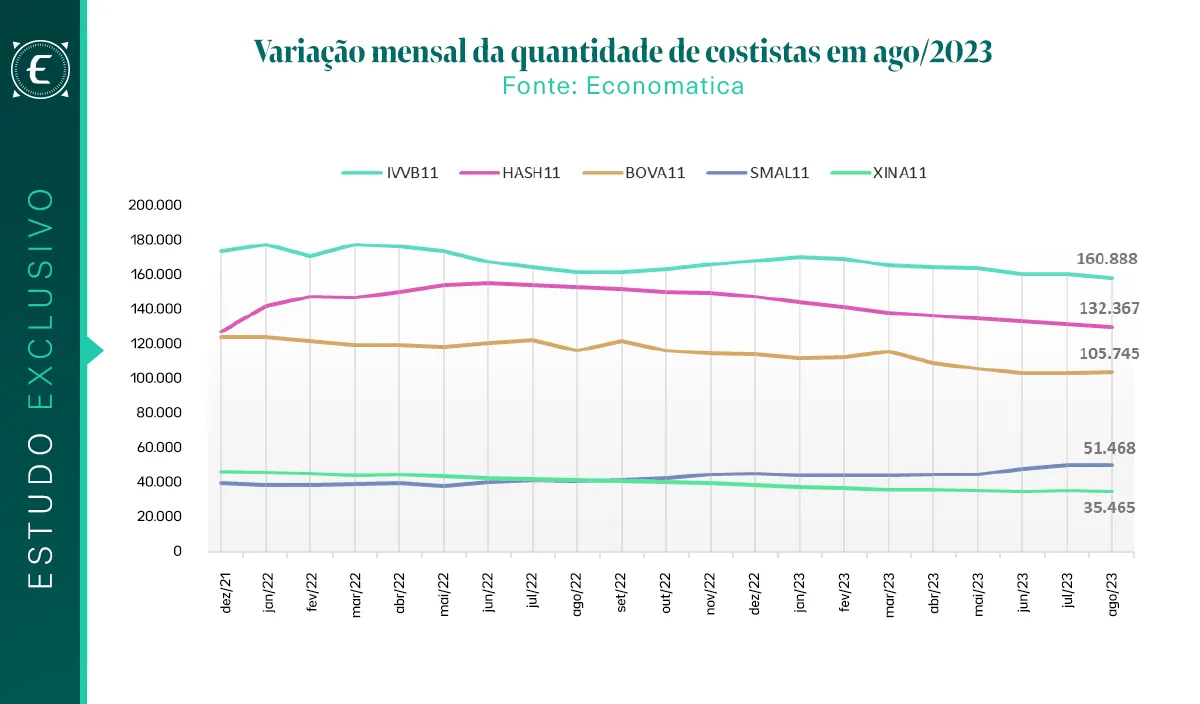

HASH11, Brazil's first crypto ETF, is currently the second most traded ETF in the country, just behind IVVB11 and the S&P 500. BOVA11, which tracks the Brazilian stock market (Bovespa), ranks third in the B3 list.

Chile's interest in crypto

While Brazil is running ahead with several crypto ETFs, Chile is taking a more measured approach to this digital asset class. In the year In March 2021, the Santiago Stock Exchange accepted the first Bitcoin ETF: the Objective Bitcoin ETF from Canadian issuer Objective Investments.

This pioneering fund trades in US dollars under the ticker BTCCL and holds Bitcoin directly. By tracking actual bitcoins rather than derivatives, it provides a clear path to exposure. But with only one crypto ETF available so far, Chile is dipping its toes into these waters rather than diving head first.

The ETF has more than $1 billion in assets under management just two weeks after its launch.

In addition to BTCCL, Chileans also have the option of trading Brazil's HASH11, although not as an ETF, but as an investment fund that uses HASH11 shares as its underlying asset. This is a solution that makes it easier for institutional investors to obtain regulatory approval while maintaining the security they need.

In the year At the end of 2023, this fund reported more than $145 million in assets under management.

Canadian cryptocurrency ETF dominance

Canadians are also more crypto-friendly than Americans when it comes to trading crypto ETFs. First approved in early 2021, these ETFs allow investors to participate in the digital currency market through traditional investment accounts, including tax-free savings accounts or registered retirement savings plans, making them long-term investments and tax-attractive. Efficiency.

Canadian cryptocurrency ETFs, notably the Objective Bitcoin ETF ($1.6 billion in assets) and the Objective Ether ETF ($237 million in assets), offer streamlined access to major digital currencies. The Evolve Ether ETF, at $61.75 million, with $144 million in assets, and the Evolve Cryptocurrencies ETF, at $28.6 million, separate options for Ethereum and combined crypto exposure.

At the low-fee end, the CI Galaxy Bitcoin ETF and Ethereum ETF manage $410 million and $94 million, respectively, attracting investors with a minimal fee of 0.4%. Similarly, Fidelity's Advantage Bitcoin and Ether ETFs offer trusted low-cost entry points into the cryptocurrency market, holding $140 million and $2 million respectively.

Also, the 3iQ CoinShares Ether ETF and the 3iQ CoinShares Bitcoin ETF are available to retail investors with $53 million and $38 million respectively.

Why Bitcoin traders are so talented

Cryptocurrency ETFs are changing the way individuals interact with digital currencies, providing a bridge between traditional finance and the Wild West world that many associate with crypto. For those unfamiliar with the tech-heavy blockchain and digital wallet terms, these funds offer a simple way to invest in cryptocurrencies. They package the complexities of crypto into a recognizable structure – much like traditional stocks – making them accessible to a wider audience.

And that's why many people are so upset about the approval of Bitcoin ETF in the United States. A pure bitcoin ETF requires the issuer to manage the underlying asset, not the derivative, which differentiates bitcoin ETFs from the bitcoin futures ETFs currently trading on the US market.

That has the potential to have a huge impact on Bitcoin and cryptomarkets in general. In theory, all non-tech-savvy investors holding Bitcoin ETF shares will now be indirectly part of the BTC ecosystem, making it vulnerable to fraud due to its larger market size. And then there are the expectations about the scarcity of the property.

There is only so much Bitcoin to go around. If there is strong demand for Bitcoin ETF shares in the US, this buying pressure will make BTC more scarce because ETF issuers must hold the same amount of value in the asset. And given that the United States has the most active stock market in the world, we are talking about a significant impact on the liquidity of the coin. And this limits the issuance of new Bitcoin every four years (roughly) as BTC mining rewards are halved, with the expected Bitcoin halving in April.

As regulations become clearer and technologies become more robust, we expect to see wider adoption and expansion of these currencies. For investors, being educated and cautious is key. Balancing innovation with protection is critical for regulators. Perhaps this is why the SEC has been dragging its feet for 10 years. But with Bitcoin ETFs now set to begin trading in the US, the impact could change the course of the digital asset market.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and are not financial, investment or other advice.