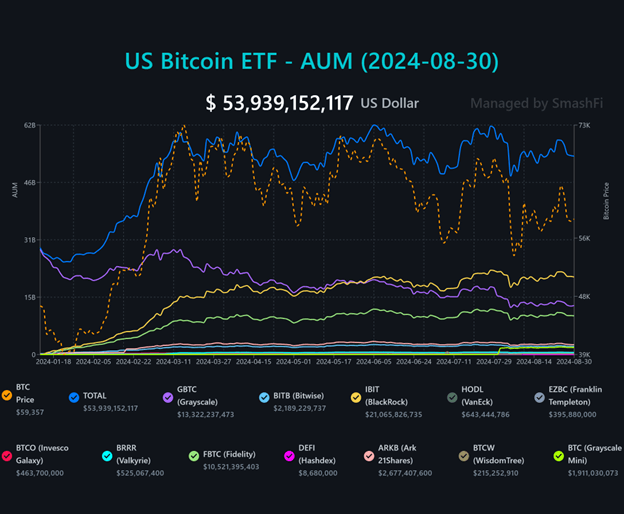

Bitcoin ETFs outperform Ether ETFs as BlackRock IBIT leads its peers

Bitcoin ETFs attracted $5B in net inflows while Ether ETFs saw $500M in net inflows. BlackRock's IBIT leads the way with over $224 million in one-day earnings, currently holding over 350,000 BTC. Ether ETFs are struggling due to liquidity issues and Greyscale's $2.5B cost.

Recent trends in the cryptocurrency exchange-traded funds (ETF) market have shown significant differences in the performance of Bitcoin and Ether ETFs.

On the foreside investors have a hard time comparing Bitcoin ETF Flow data to Ethereum ETF Flow data and comparing Ethereum spot ETFs to their Bitcoin counterparts. Since their launch, Ether ETFs have experienced net inflows of nearly $500 million, a stark contrast to the $5 billion in net inflows recorded by BTC ETFs in the same period since their initial launch.

Several factors contribute to this difference. To begin with, Bitcoin's “first mover advantage”, high liquidity and lack of equity opportunities in Ether ETFs make Bitcoin more attractive to institutional investors.

Additionally, an unexpected outflow of $2.5 billion from Grayscale Ethereum Trust (ETHE), far exceeding the bank's initial estimate of $1 billion, further depressed the Ethereum ETF's performance. Grayscale introduced the Mini-Ether ETF to hedge against these outflows, but managed to attract $200 million in revenue.

In contrast, BTC ETFs showed resilience and strong performance with US-based BTC ETFs posting an impressive eight-day winning streak, with net inflows totaling $202 million led by BlackRock's iShares Bitcoin Trust (IBIT).

On August 26 alone, IBIT attracted over $224 million in net revenue, bringing its total Bitcoin holdings to over 350,000 BTC, solidifying its dominance in the market.

Competitive funds managed by Franklin Templeton and WisdomTree also saw positive inflows, while others including Fidelity, Bitwise and VanEck reported negative flows. In particular, Greyscale's Bitcoin Trust (GBTC) has seen a decline in redemptions over the past two weeks, indicating stability in the market.

As investors' confidence in Bitcoin ETFs grows, asset managers are increasingly looking for hybrid ETFs that offer exposure to both Bitcoin and Ethereum, reflecting the changing nature of the cryptocurrency investment landscape.