Bitcoin ETFs see the third largest daily income on the downside.

Share this article

![]()

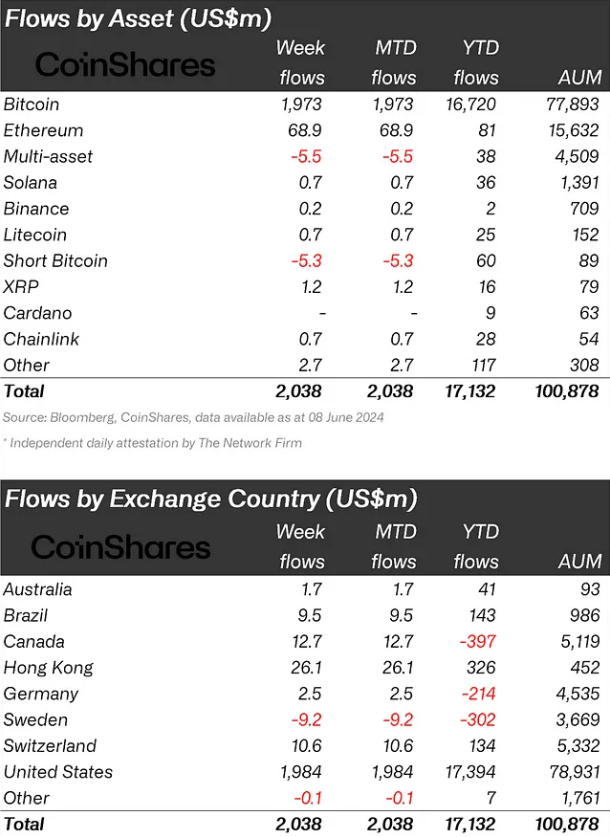

Crypto investment products have seen massive inflows of $2 billion so far in June, fueled by hopes of a devaluation in the US. According to asset management firm CoinShares, these products have generated a combined $4.3 billion in revenue over the past five weeks.

Bitcoin continues to be a major focus for investors, with $1.97 billion in revenue for the week. Conversely, short bitcoin products experienced outflows for the third consecutive week, totaling $5.3 million.

Ethereum saw a significant increase in interest, with its best week of earnings since March, totaling $69 million. This may be in response to the SEC's unexpected decision to allow spot-based ETFs. Meanwhile, the rest of the altcoins experienced less activity, although Fantom and XRP brought in $1.4 million and $1.2 million respectively.

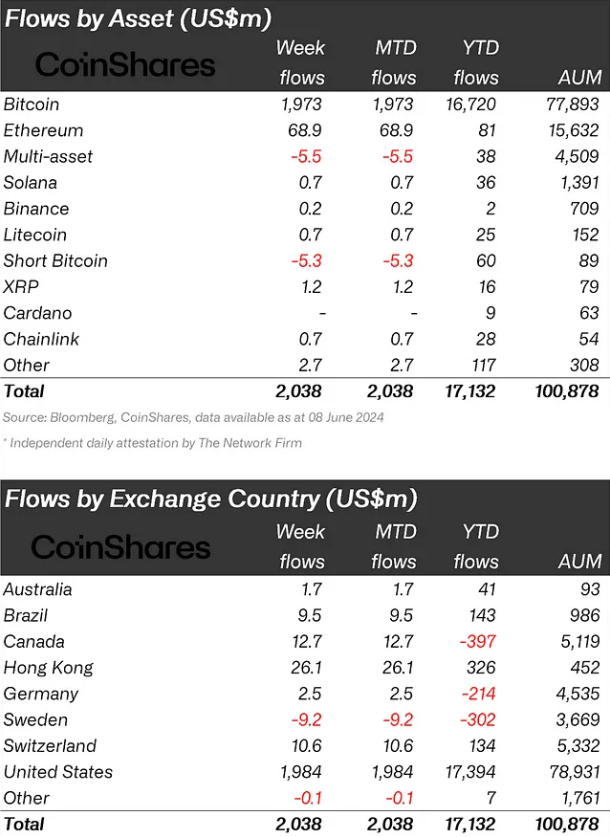

Regionally, the US recorded an estimated $1.98 billion in revenue last week alone, the third-biggest daily revenue on record for the first day of the week. The iShares Bitcoin ETF has now surpassed the Grayscale Bitcoin Trust, boasting $21 billion in assets under management.

Hong Kong took second place last week with more than $26 million, and it also had the second-biggest year-to-date gross of $326 million.

The trading volume of crypto exchange-traded products (ETP) rose to $12.8 billion for the week, a 55 percent increase compared to the previous week. In a notable shift, revenue flows were recorded across all suppliers, with the usual flow from established firms declining.

CoinShares analysts attribute this shift in market sentiment to better-than-expected US macroeconomic data, which has led to expectations of monetary policy rate cuts. The positive market movement pushed total assets under management above $100 billion for the first time since March this year.

Share this article

![]()

The information on or included in this website is obtained from independent sources that we believe to be accurate and reliable, but we make no representations or warranties as to the timeliness, completeness or accuracy of any information on or accessible from this website. . Decentralized Media, Inc. Not an investment advisor. We do not provide personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may be out of date, or may be incomplete or incorrect. We may, but are not obligated to, update any outdated, incomplete or inaccurate information.

Crypto Briefing may include articles with AI-generated content created by Crypto Briefing's own proprietary AI platform. We use AI as a tool to deliver fast, useful and actionable information without losing the insight – and control – of experienced crypto natives. All AI-added content is carefully reviewed, for accuracy, by our editors and writers, and we always draw from multiple primary and secondary sources to create our stories and articles.

You should not make an investment decision in an ICO, IEO or other investment based on the information on this website and you should never interpret or rely on any information on this website as investment advice. If you are seeking investment advice on an ICO, IEO or other investment, we strongly recommend that you consult a licensed investment advisor or other qualified financial professional. We do not receive compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities or commodities.

See full terms and conditions.