Bitcoin, Ethereum network activity shows a high risk of decline

Key receivers

Bitcoin Wells is selling or distributing their tokens. Both BTC and ETH have experienced significant declines. The top two cryptocurrencies are at risk of a major selloff.

Share this article

Volatility has permeated the cryptocurrency market, resulting in over $160 million in outflows in the past 24 hours. Bitcoin and Ethereum are now sitting on weak support, which could lead to further losses.

Bitcoin and Ethereum Retrace

The recent movement of Bitcoin and Ethereum seems erratic, and without significant improvement, the two major cryptocurrencies may suffer major corrections.

Bitcoin appears to have formed a bart pattern following Tuesday's decline. Bitcoin rallied from a low of $18,700 and briefly touched $20,390 on Tuesday. However, it retraced, erasing gains to reach a low of $18,480.

From a chain perspective, investors are showing little interest in stockpiling Bitcoin at current prices. Addresses with between 1,000 and 10,000 Bitcoin sold or distributed about 50,000 coins worth about $950 million last week. The increasing selling pressure may soon hurt the price of Bitcoin.

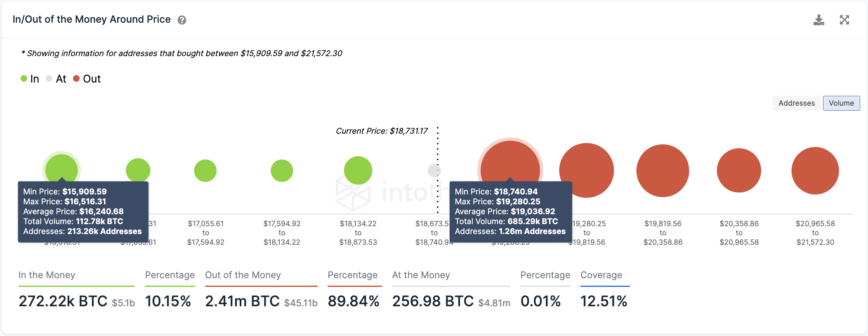

Trading history shows that Bitcoin sits below a significant wall of supply with many walls of demand underneath. About 1.26 million addresses bought 685,000 Bitcoin at an average price of $19,000. Another decline could encourage these investors to exit their positions to avoid further losses. Given the lack of support levels, Bitcoin may drop to $16,240.

Bitcoin needs to reclaim the $19,000 support as soon as possible to have a chance to break its pessimistic outlook. If successful, it could signal a critical break above the $20,000 psychological level and move towards a high of $20,390.

Ethereum has seen high volatility in the last 24 hours, dropping the market price around 150. According to IntoTheBlock data, the number of addresses joining the network has increased from 64,000 to 80,000 since September 26, which is typically a sign of brutality.

However, given Ethereum's proximity to Bitcoin and other risk assets such as stocks, there is reason to believe it could drop further. Ethereum broke below $1,420 on September 18 and has yet to return to the key level. $1,420 is considered an important benchmark for Ethereum as the number two crypto hit an all-time high at the end of the 2017 to 2018 bull run.

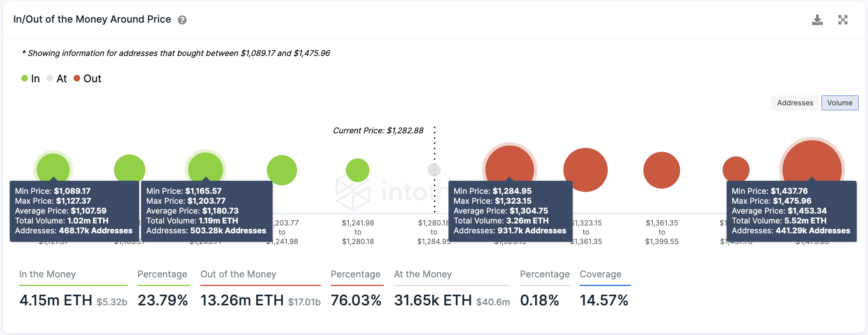

IntoTheBlock's IOMAP model shows that further downward pressure could take Ethereum to $1,180, with 500,000 addresses holding around 1.19 million ETH. But if this support level fails to hold, the correction may extend to $1,000.

Ethereum would need to climb and print above $1,300 on a daily basis to reject the bearish trend. If successful, it could recover and rise to $1,450.

Editor's Note: This piece incorrectly stated the number of new addresses that joined the Ethereum network at the time of publication. Updated to include the latest information and analysis on Ethereum.

Disclosure: At the time of writing, the author of this article owned BTC and ETH. The information in this article is for educational purposes only and is not investment advice.

For more key market trends, subscribe to our YouTube channel and get weekly updates from leading Bitcoin analyst Nathan Batchelor.

Share this article

The information on or included in this website is obtained from independent sources that we believe to be accurate and reliable, but we make no representations or warranties as to the timeliness, completeness or accuracy of any information on or accessible from this website. . Decentralized Media, Inc. Not an investment advisor. We do not provide personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may be out of date, or may be incomplete or incorrect. We may, but are not obligated to, update any outdated, incomplete or inaccurate information.

You should not make an investment decision in an ICO, IEO or other investment based on the information on this website and you should never interpret or rely on any information on this website as investment advice. If you are seeking investment advice on an ICO, IEO or other investment, we strongly recommend that you consult a licensed investment advisor or other qualified financial professional. We do not receive compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities or commodities.

See full terms and conditions.