Bitcoin, Ethereum traders eye $ 1.4 billion end of options

The cryptocurrency market is gearing up for short-term volatility, with roughly $1.4 billion worth of Bitcoin and Ethereum options expiring today.

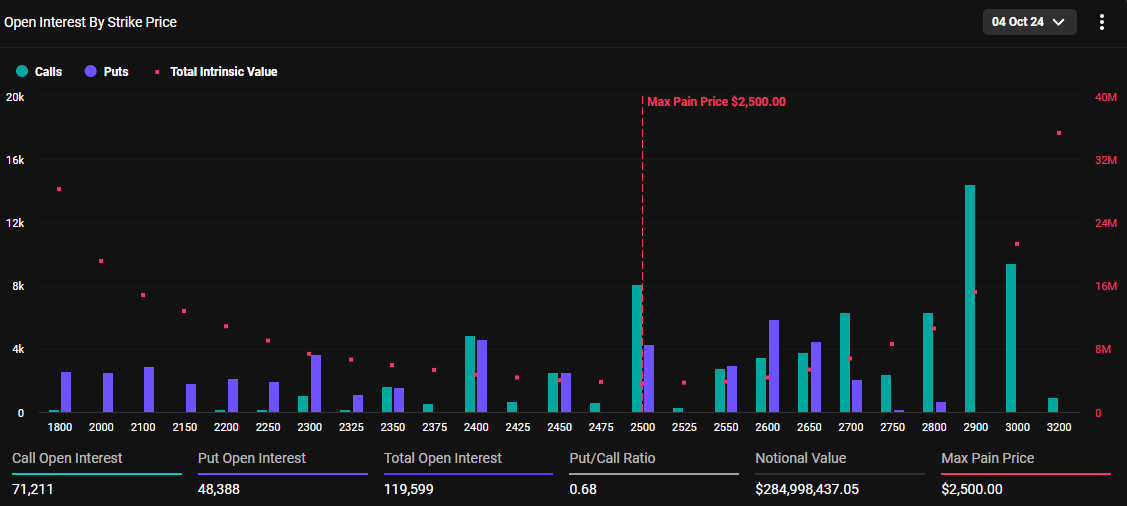

With Bitcoin options totaling $1.066 billion in notional value and Ethereum options $284.99 million, traders are looking at the expiration date on the potential impact on prices.

Analysts predict market volatility among options that expire.

Data on Deribit has 17,448 Bitcoin options contracts expiring on October 4. The contracts have a call ratio of 0.75 and a maximum pain point of $63,000.

At the same time, the Ethereum options market has 119,599 contracts to expire. Today's expiring Ethereum contracts have a call ratio of 0.68 and the maximum pain point is $2,500.

Read more: Introduction to Crypto Options Trading

n options trading, the call-to-call ratio serves as a key sentiment indicator by comparing the volume of trading options to call options. A call to call ratio of 0.75 for Bitcoin indicates that more call options are being traded, indicating market sentiment. Similarly, Ethereum's call ratio of 0.68 also suggests optimism, as more calls are being exchanged.

For those unfamiliar with the concept, a call ratio below 1 generally indicates bearish sentiment, as many investors expect market gains. Conversely, a ratio greater than 1 usually reflects bearish sentiment, indicating the risk of a market crash.

Price implications based on BTC and ETH peak pain points

The current market prices of Bitcoin and Ethereum are below their respective peak pain points. BTC is trading at $61,209 and ETH at $2,381. This means that if the options expire at these levels, it generally represents a profit for the option holders.

Options traders' results may vary depending on the specific strike price and position they hold. In order to accurately assess potential gains or losses at expiration, traders must consider their entire option position against current market conditions.

Analysts at Greeks.live suggest that additional market conditions may emerge that will influence overall trends and affect trader decisions. Therefore, before reaching a conclusion on the option business, a comprehensive evaluation is necessary.

“Friday's unemployment rate and non-farm payrolls data, and the breezy A-share market right now, are very comfortable compared to the US stock market. However, the crypto market is more connected to US stocks, and the only connection between A-shares and crypto may be that many people are speculating on stocks and out of gold, knocking the value of u fiat currency,” they wrote.

The analysts say that the crypto markets are entering the grave before the historically brutal month. A shakeout is when otherwise “weak hands” are triggered to sell based on fearful market conditions. Geopolitical tensions can worsen sales, which will continue to increase.

“Today is going to be a big day. Very important jobs data is coming in the next 7 hours, which will have a huge impact on the US stock market. We could get a super pump or a heavy dump. Israel is going to retaliate against Iran today. Bitcoin hold $60,000 for a bounce. “It should, but if it breaks $60,000, we could see a quick dip to $56,000-$57,000. The best strategy is to hold your positions and not shake,” Ash Crypto advised.

Meanwhile, crypto markets are secretly optimistic amid a flurry of US economic data. The Federal Reserve's decision to cut interest rates amid cooling inflation spurs optimism for risky assets. Economists expect further deflation in 2024, but that remains to be seen. This is as the Fed continues to exercise its dual mandate – to achieve high employment and keep prices stable.

Read More: 9 Best Crypto Options Trading Platforms

Therefore, traders are advised to be careful, because historically, the expiration of options often leads to short-term volatility in the market. Weekends will also be crucial as they are often characterized by high volatility.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.