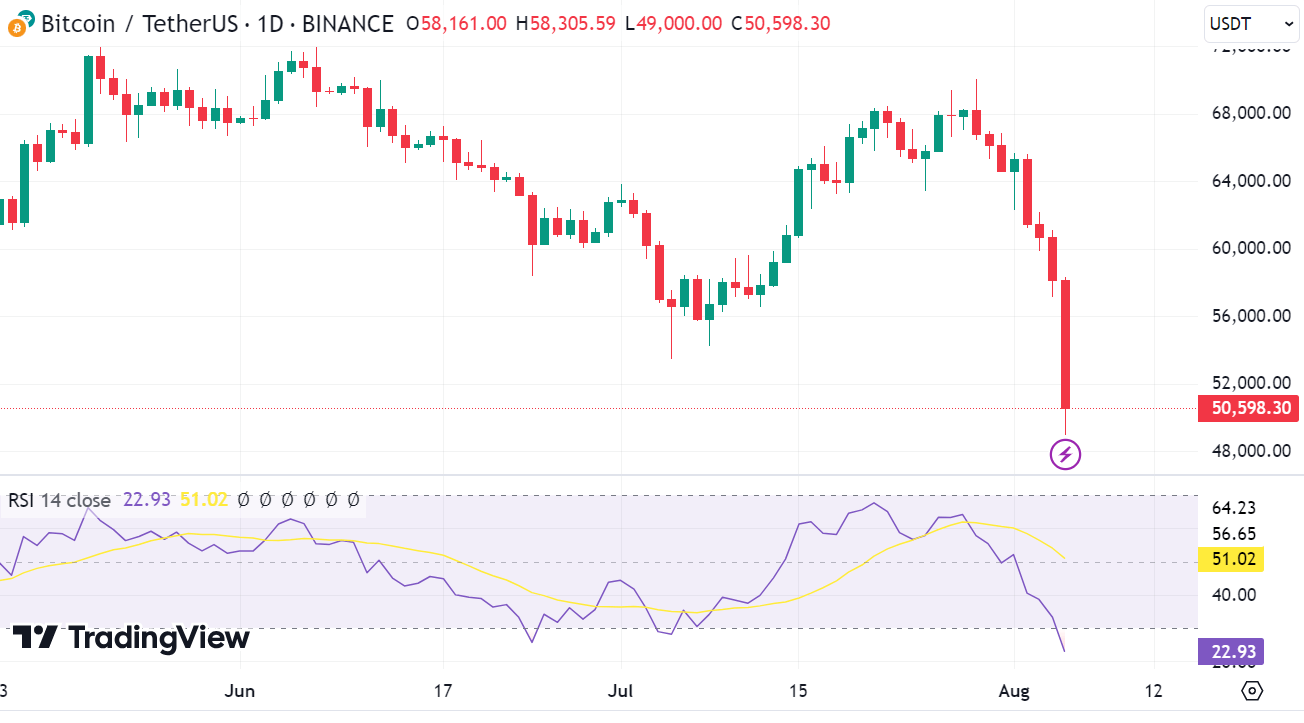

Bitcoin falls amid major crypto salesoff, testing $49,000

Bitcoin tests $49k before returning to $51k amid selloff in $270 billion crypto market. Fears of a U.S. recession and rising Japanese prices fueled market volatility. FBI warns of crypto scams amid rising market volatility

According to data from CoinGecko, the cryptocurrency market experienced a major crash today, shedding nearly $270 billion in value in 24 hours. Leading this decline, Bitcoin fell 20% to $49,121, its lowest level since February at $53,091.

Ether fell a whopping 21%, falling to $2,300, erasing its gains for the year. Other cryptocurrencies such as Binance's BNB and Solana have also suffered significant losses.

The Bank of Japan has raised the interest rate

This dramatic fall in the crypto market coincided with a massive sell-off, particularly in the Asia-Pacific markets, with Japan's Nikkei 225 down 7%.

The Bank of Japan's decision to raise benchmark interest rates to a 16-year high triggered this sell-off, sending shockwaves through financial markets.

The sharp rise in JPY/USD is reducing yen trading positions and contributing to the sharp fall in US stocks. For those who don't understand how this works, a brief explanation

1) Many traders were borrowing Japanese Yen (JPY) at low interest rates,… pic.twitter.com/sfi0Hva56M

— Adam Khoo (@adamkhootrader) August 5, 2024

The US Nasdaq entered correction territory, marking its worst three-week session since September 2022, further contributing to the decline in risk assets, including cryptocurrencies.

The market reaction was influenced by Japan's monetary tightening and recent actions by the US Federal Reserve.

Although the Fed chose to hold the benchmark rate steady, it did not show the rate cut in September that many market experts had already expected.

This uncertainty added to the market's anxiety, prompting traders to bid on the 100% chance of a US base rate cut in September.

The threat of an American recession

The sell-off reflects growing concerns about a US recession and rising geopolitical tensions.

Tony Sycamore, market analyst at IG, highlighted that Bitcoin and other cryptocurrencies are risky assets and are highly susceptible to market volatility. He pointed out that Bitcoin is currently testing critical support levels and needs to hold the $53,000 mark to prevent further decline.

However, at press time Bitcoin was trading at $51,657, well below a support level, although it has rebounded from around $49k.

The FBI has issued a warning

The volatility of the cryptocurrency market has increased security concerns. The FBI has issued a warning about fraudsters using market risk to steal users' money.

The FBI advises users to be wary of unsolicited messages or calls indicating account problems, and urges them to investigate any issues through official channels. The agency's warning comes at a time when crypto-related fraud and hacking incidents are on the rise.

Hackers stole nearly $1.4 billion worth of crypto in the first half of 2024, more than double what was stolen in the same period in 2023.

This increase is due to the increase in value of various tokens including Bitcoin, Ethereum and Solana. Ari Redboard, global head of policy at TRM Labs, said that although the security of the cryptocurrency ecosystem has not changed fundamentally, tokens have become a more attractive target for high-value criminals.

As Bitcoin and other cryptocurrencies move through these tumultuous times, investors and users should be vigilant about market conditions and potential security risks.