Bitcoin funds see $400 million in spending amid fears of recession

Key receivers

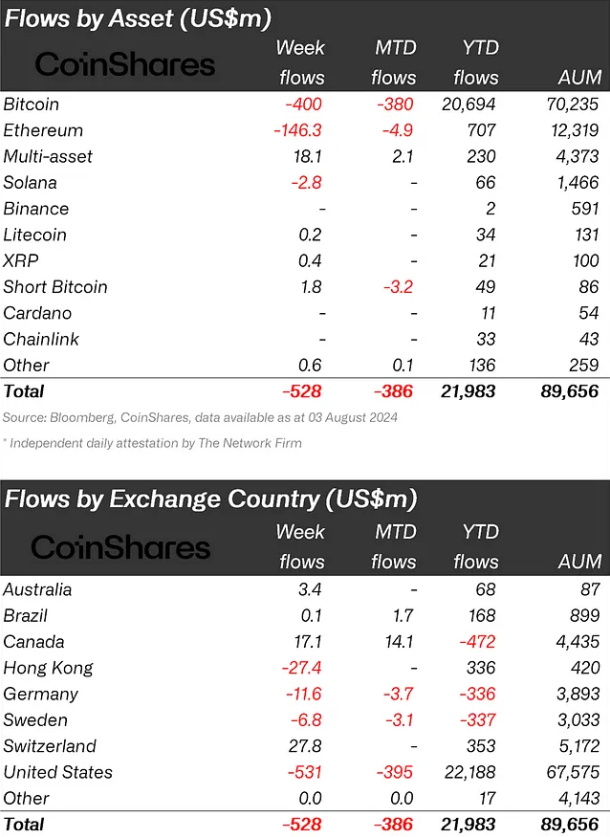

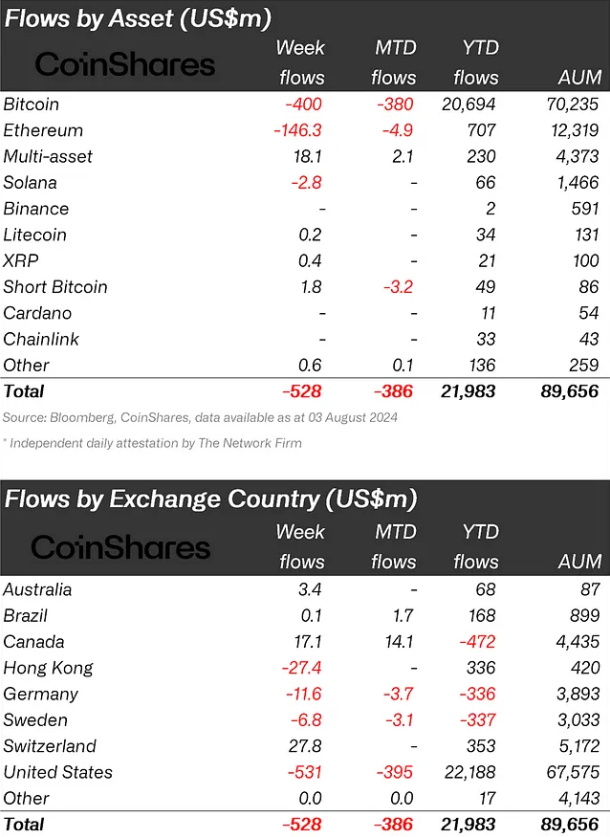

Digital asset investment products saw spending of $528 million, the first decline in 4 weeks. Ethereum products experienced an outflow of $146 million, new US ETFs gained $430 million, and Grayscale lost $603 million.

Share this article

![]()

Bitcoin (BTC) funds saw a $400 million withdrawal from the crypto exchange-traded product (ETP) last week's $528 million withdrawal, marking the first decline in four weeks. According to asset management company CoinShares, this shift is due to fears of a US recession, geopolitical concerns and widespread market liquidity in most asset classes.

As BTC funds ended a 5-week inflow, short bitcoin positions recorded $1.8 million in inflows, the first significant move since June.

Ethereum products experienced an outflow of $146 million, which brings the total net outflow after the start of US exchange funds (ETF) to $430 million. However, this figure offset $603 million in outflows from grayscale trusts and offset $430 million in outflows into new US ETFs.

Regionally, the US led with $531 million in spending, followed by Germany and Hong Kong with $12 million and $27 million, respectively. Canada and Switzerland brought in $17 million and $28 million respectively.

Trading volume in ETPs reached $14.8 billion, 25% of the total market, below the average level. The price adjustment resulted in a $10 billion decrease in total ETP assets under management.

Blockchain stocks continued their downtrend with an additional $18 million in outflows in line with outflows from broader tech-related ETFs.

Share this article

![]()