Bitcoin Heading To $40,000 After Higher Than Expected CPI?

The cryptocurrency market took a hit, losing more than $60 billion in market capitalization following unexpectedly high inflation data in the United States.

This development has significantly cooled expectations of an interest rate cut by the Federal Reserve in March, sending ripples through financial markets, including Bitcoin speculation.

Bitcoin inflation has fallen more than expected

The core consumer price index (CPI) in the U.S., excluding food and energy costs, rose 0.4 percent from December. It posted the biggest gain in eight months and beat analysts' forecasts. The CPI rose 3.9% year-on-year, keeping pace with the previous month's rate.

This inflation has dampened optimism for the Federal Reserve's interest rate cuts. And some analysts are discussing the possibility of resuming rate hikes to ensure broader price stability.

For example, Kathy Jones, chief fixed income strategist at Charles Schwab, suggested delaying the rate cut. She also explained the role of housing costs in the CPI increase.

“The Fed sees this as another reason to wait until May or June, but the trend direction is still low. Much of the increase is due to housing, so it's a waiting game to see when those costs come down,” Jones said.

Read more: How to protect yourself from inflation using cryptocurrency

The inflation data had an immediate effect on the price of Bitcoin. It declined over 3.50%, falling below the $50,000 upper limit to around $48,300. The decline reflects broader market sentiment, with the total cryptocurrency market capitalization dropping to $1.78 trillion.

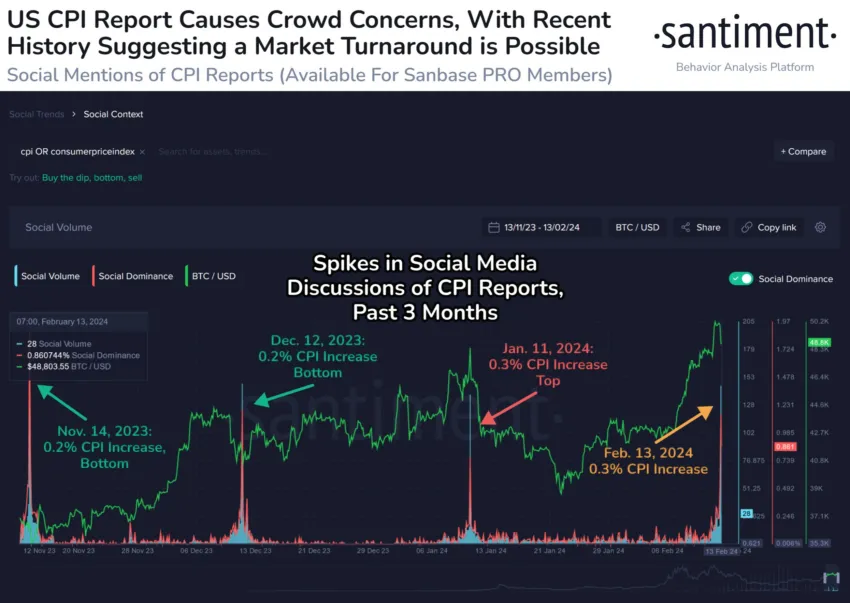

Blockchain analytics firm Santiment has provided an overview of the situation, citing the unexpected CPI result and its impact on the cryptocurrency and equity markets. The firm said that market volatility and the possibility of buying should be sold on fear, which earlier CPI reports have led to medium-term market corrections.

With Bitcoin falling below $49,000 today after breaching $50,000 for the first time in more than 2 years, public sentiment may have been over-corrected by this mild pullback. If there is significant panic selling, the dip buying equity will be significantly more effective and sentiment will turn negative, sentiment analysts explained.

Despite Santiment's optimism, a technical analyst known as CryptoCon has hinted that Bitcoin may correct towards $40,000. He discussed historical price patterns and the behavior of the 20-week exponential moving average. This analysis suggests a typical cyclical pattern for Bitcoin, where the current level may require a deep correction.

Read more: Bitcoin price prediction for 2024/2025/2030

The question is whether Bitcoin will face a further fall to $40,000 or if the market stabilizes, offering new investment opportunities. With the next CPI report scheduled for March 12, all eyes will be on the Federal Reserve's policies and, in turn, how they will affect the crypto market and Bitcoin.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.