Bitcoin Institutional Adoption BCC Brings it to a new time

Key Controls

Institutional investment investments are changing Beakon character and accessibility for social investors is increasing.

STOP BITCOIN ETFS now ride the share of the 138 billion of property, anniversary, fences and development.

Bottomlessness improves only the chance of exchange, not just a digital gold but also exchange.

Bitcoin (BTC) has become a long way from shrubes of injury in a bruising money survey. Neutral disruption to open the door, and it will now ensure the power of staying bitcoin now, and the standards of bitcoin will now make it grow.

The US approved by the United States is marked with a clear clear clear indicator of the January 2024. Bitcoin – Don't know Native Native plagies, but now can be conducted through disease, pension, money and community products.

This growing institution is doing more than treating a price of bitcoin – it's your appearance in our mid. Bottomlessness, strong infrastructure and simple access is the medium of the actual value of a valid value and eventually, finally, in the form of exchange forms.

Big money brings calm

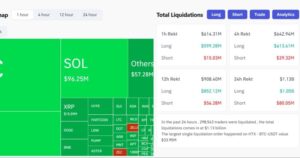

The capital of the Institution works different from the retail. In general investors often respond emotionally, to sell or sell in district, which large institutions extensive institutions is tempted to do an old. This feature has begun to calm market cycles.

TBP X will show the flow shift. At the beginning of 2024, US Batiko Installs contain repeated networks such as Blackkic Immendment, such as Blackrock Immendment, as a coin of the coral corners. That is, in February – March 2025 political uncertainty and tariffs have fallen on property classes, Bitcoin included on property courses, bitcoin included in the property classes, bitcoin included on property classes. But in general, institutions come from their dips than clay sales.

The fact of playing information Over 100% of the 29 to 20222222 cycle, the higher cycle is so stable up to 158%. From the beginning of 2024, up to 35% of the exchange of 35% about 35% down, from S & P 500 (22%) and Gold (0%).

The lower flexibility investment is not just nurses. Merchants, payment revelations and users use all by predicted priceless pricing. Ointon data still show that most of the billic activity will be driven by storage and estimated, more stable value may encourage the use of a more stable price.

Big money accepts a bitcoin adoption?

The establishment of institution is accelerating the adoption of the public. Self-controversy beti. Retail and corporate investors may find exposure through the well-known traditional investment products.

In 18th months, the US Bitcoin Etfs has more than $ 143 billion in the country in the administration (Am). Although most of the model is held by retail investors, investment involvement is growing fast, retirement, retirement, and other professional professionals. When these bodies begin, they begin to expand adoption service, even if their customers and itsological.

Erik Erik Edlman, cooperator of Eildlman's federal mortrants (registered investment counselor) employed $ 253 billion

Edman's Investors “Larry Robbon from 10% of the 10% of the most important” of the most important ” His thinking was easy

“My crypto is no longer an approximate state. It's unable to do so.”

Currently, with Medic investment counselors, it currently manages more than $ 146 trillion dollars as a second. It represents more than $ 14.6 trillion dollars from 10% “mediation” assignments – over 330% of $ 3.4 trillion dollars. A lot of conservatives 1% Shift imports in $ 1.4 trillion for $ 1.4 trillion for $ 1.4 trillion.

Related: “TRUD TRUD TRUDY BITCOIN AND EMEREUME ENT” recognition

The total of $ 34 trillion of US $ 34 are slowly moving. Wisconsin and Indiana Money in the United States are described in detail in the Visus territories. These activities are crucial – once bitcoin or Bitcolin or Bitcoin or Bitcolin or BitcoFoo, logical psychology and system barriers.

Bitcoin Institutionality is not just a wall path story story. It's a change in a bitcoin role – the source of the content to an alternative financial system.

Of course, this evolution is out of business. Focus, Lawyer accident, and territory regions may disrupt the original identity. Similar power driving will eventually be scarred the Beach's immigration borders finally.

This article does not contain investment advice or advice. Each investment and commercial activity includes vulnerability, and they must conduct their own study when making readers make decisions.