in short

The key location market metric shows a higher level, listing to the second highest level this year. Options traders are pushing further down into the $80,000 position. Bitcoin could see a bull trap below $80,000 before year-end recovery, Decrypt said.

Bitcoin suffered its fourth consecutive weekly loss after 724, despite last week's losses.

The price for the world's largest digital asset is 24.43%, the worst since 2018.

Syndedon, I'm going to go hard on Christmas, I'm eligible for the ID platform of the options. Decrypt.

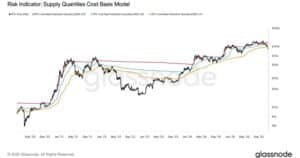

Although dark, the one-chain metric suggests a question.

The 10% depth of the paid area indicates the ability to increase the degree of fuel movement in 2025 and the ability to sell pressure, and in 2025 it was rotated to the second highest level.

The last time the indicator turned upside down was after a period of continuity in March and April, which helped make the bottom look like a 64% bull run.

In the year From November 21, it is more than 87,400 dollars more than 87,400 dollars and more than 24 hours more than 24 hours from 82,100 dollars.

December's policy is a chaotic record of the Federal Reserve after a tough week, from 40% of the week to 70% of the 70%.

However, Dawson is skeptical of the reunion. “A pessimist is cautious, but I'm cautious about falling into a bull trap,” he said.

It stops the most persistent market pressures, most digital asset repositories are getting business below the value of the network, hindering their ability to accumulate. It is the same with Bitcoin and Etherum currency painted in red.

Analysts said the cut meant “sticky inflation fears”, the analysis added.

What's next?

Dawson is optimistic about recovering to $100,000 in the first quarter of 2026, but has carried it for the rest of 2025.

Traders looking at the high construction area of the $80,000 $85,000 $85,000 price will have a negative play in the options market. “

“Wouldn't be surprised if the ambition goes from roughly $90,000 at the end to over $70,000 to $1,000 in the middle,” he said.

Although sentiments are in the “extremely fearful” range, the conclusion is that the weekend correction has improved slightly.

FASE's policy decisions, December 1 and interest rate decisions until December 10, can confirm PIVoallal in setting the tone for Bitcoin and the broader financial markets in the coming weeks.

Daily claim news newspaper

Start every day with all the news stories, plus original features, podcasts, videos and more.