Bitcoin may face $20,000 when the world money supply decreases

Bitcoin's 15% correction in the third week of December marked its biggest weekly price decline since August. Experts attribute the decline to the impact of global macroeconomic conditions, warning that if these pressures intensify, Bitcoin may see a further decline.

However, Bitcoin also has internal factors to counterbalance the negative impact of the macro.

Global liquidity has fallen in the past two months

According to The Kobeissi Letter, Bitcoin price has historically shown a 10-week lagging correlation with the Global Money Supply (Global M2). In the last two months, Global M2 has fallen by 4.1 trillion dollars, which indicates a further decline in the price of Bitcoin if the trend continues.

Global M2 is a key economic indicator that measures the total money supply, including cash, demand deposits (M1), deposits and other liquid assets. Global M2 volatility often affects both stock and cryptocurrency markets.

“As the global money supply hit a new record of $108.5 trillion in October, Bitcoin hit an all-time high of $108,000. But over the past 2 months, the money supply has fallen by $4.1 trillion to $104.4 trillion, the lowest since August. The correlation is still there.” If it continues, this means that in the next few weeks, the price of Bitcoin will drop to $20,000 – Kobeisi's letter predicted.

A month ago, Joe Consorti, head of development at Bitcoin watchdog Theya, warned of a possible 20%-25% Bitcoin correction based on similar indicators. That prediction appears to be coming true.

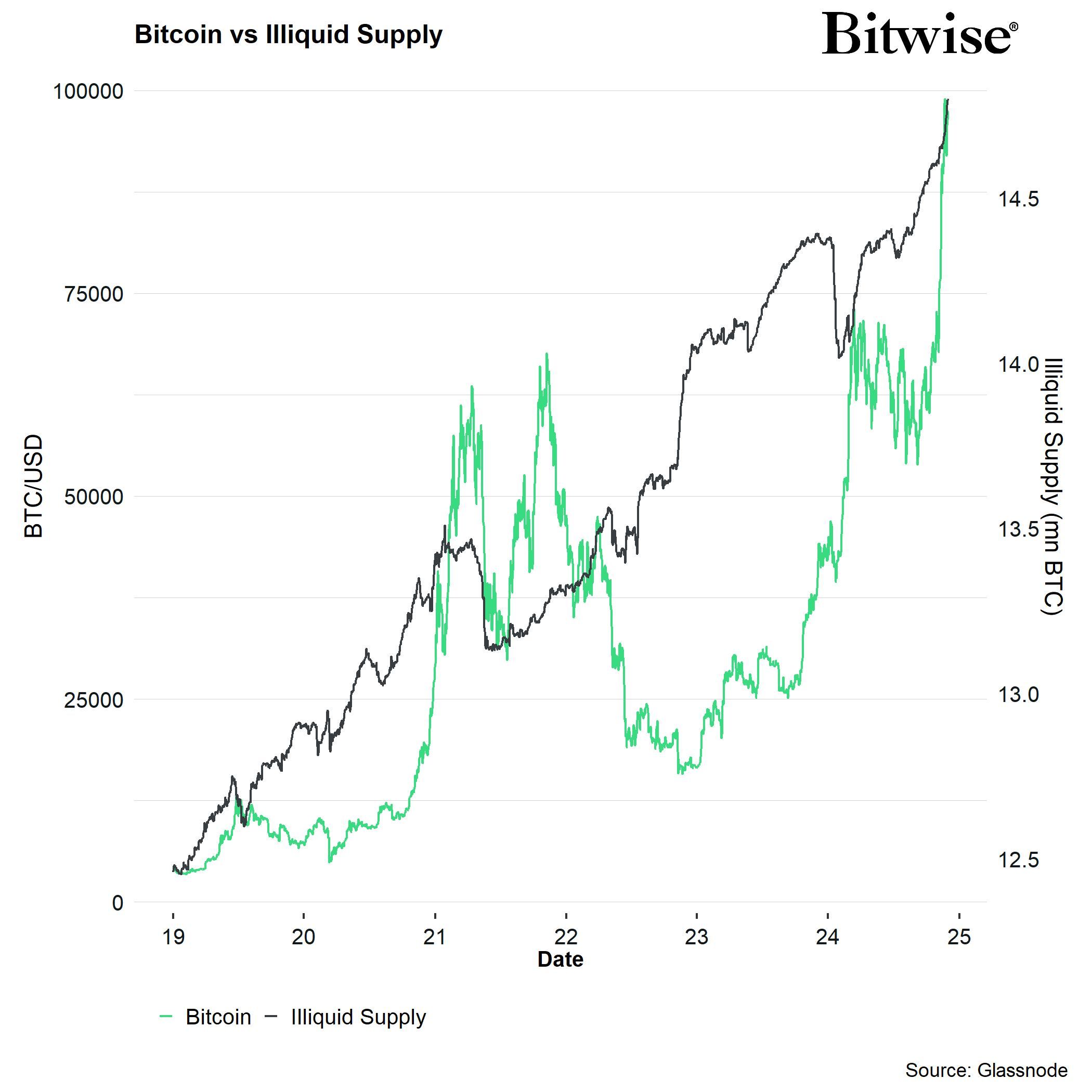

Bitwise's head of research, Andre Dragoš, shares a similar view. Bitcoin is expected to remain under pressure due to increased liquidity in the United States. However, this liquidity squeeze highlights an intrinsic Bitcoin factor that could keep the balance: Bitcoin's growing illiquid supply.

A higher illiquid supply indicates an increased scarcity of Bitcoin, which can support the price due to supply demand volatility.

“Bitcoin is currently balancing expectations of rising macro headwinds from a) declining US and global liquidity and b) strong BTC supply shortages. Eventually, many on-chain factors will erode the bearish macro factors, but this will probably end in early 2025 some time.” It creates flexibility (and perhaps some attractive buying opportunities). – Andre Dragoš commented.

At press time, Bitcoin is trading around $94,000, down 6% over the weekend, according to BeInCrypto data.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.