Bitcoin mining facing profitability

The cost of producing Bitcoin is putting a lot of pressure on Bitcoin miners, whose machines are struggling to make a profit due to the price crisis of the digital asset.

According to data platform Macro Micro, the average mining cost of one BTC rose to $83,668 at the beginning of June, but has fallen slightly to $72,000 since July 2.

Bitcoin mining machines could not be profitable

James Butterfill, CoinShares head of digital research, shared data showing that the price of Bitcoin hovered around the average production cost during the April halving event. According to the data, half of the 14 miners, including BitDigital and Riot Platforms, spend more than the average cost to mine their BTC, while Tether-backed Bitdir and Hut8 are below the average.

Read More: Making Passive Income From Crypto Mining: How To Get Started

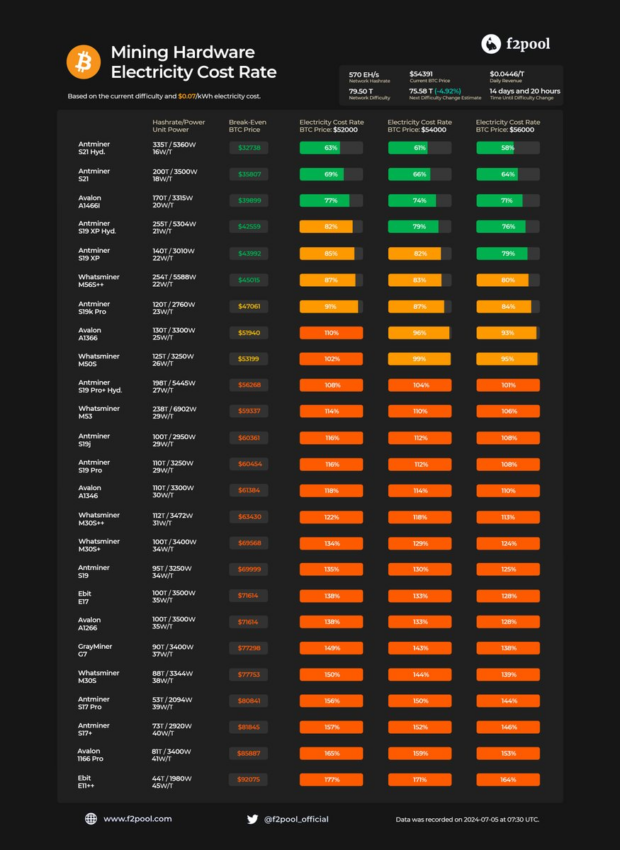

This situation is further confirmed by F2Pool, Bitcoin mining pool operator. As of July 4th, only ACC machines above 23 W/T are profitable.

According to F2Pool data, only six Bitcoin mining machines, including Antminer S21 Hydro, Antminer S21 and Avalon A1466I, are profitable in Bitcoin price at $39,581, $43,292 and $48,240 respectively. Similarly, while other machines such as Antminer S19 XP Hydro, Antminer S19 XP and Whatsminer M56S++ are profitable, the price of Bitcoin exceeds $51,456, $53,187 and $54,424 respectively.

However, Bitcoin mining difficulty dropped significantly on July 5th, one of the most notable declines since the FTX crash. This could make many machines profitable, F2pool said. They stated that ASICs with 26 W/T units or less would be profitable at a price of $54,000 per BTC. He added that they estimate energy costs at $0.07 per kilowatt.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Last week, BeenCrypto reported that Bitcoin miners were approaching the capitation level last seen during the FTX exchange crash. As a result, miners shut down unprofitable machines and ramped up selling activities, unloading approximately 30,000 BTC worth $2 billion last month.

“All miners operating well below their break-even point are eventually either shutting down their inefficient machines or exiting the industry altogether. […] Perhaps many of them stayed longer than expected because they expected a huge increase in the price of bitcoin, which was more than compensated, explained Solo CKPool manager Kon Kolivas.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.