Bitcoin Price Analysis: Economic Headwinds Push Price Down

Bitcoin tested the $92,000 level yesterday after falling from the weekly high of $102,000 as selling pressures increased. Macroeconomic factors cast doubt on the strength of the market as sticky inflation becomes a concern. Spot crypto ETFs posted big flows on Wednesday following the release of the Fed meeting notes.

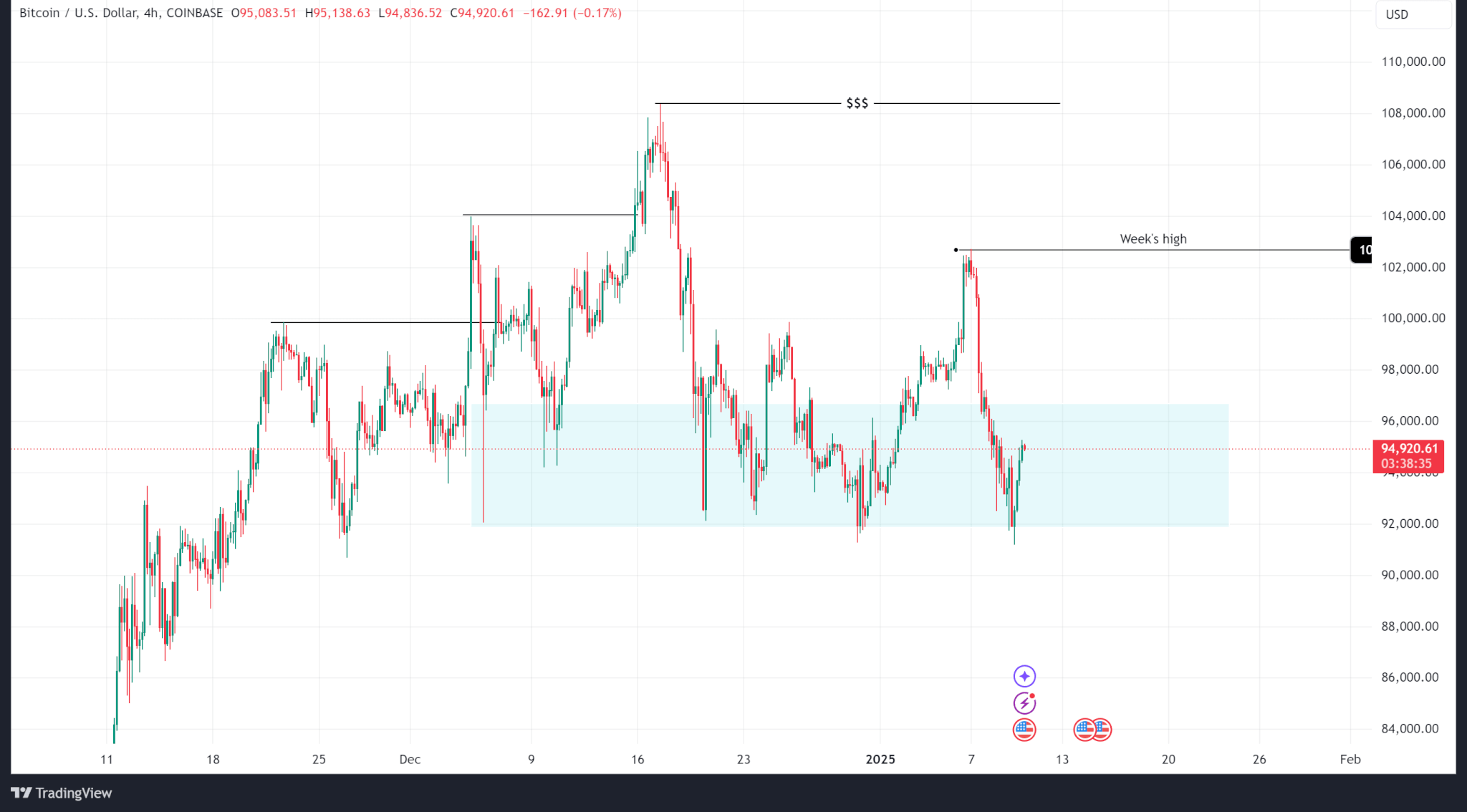

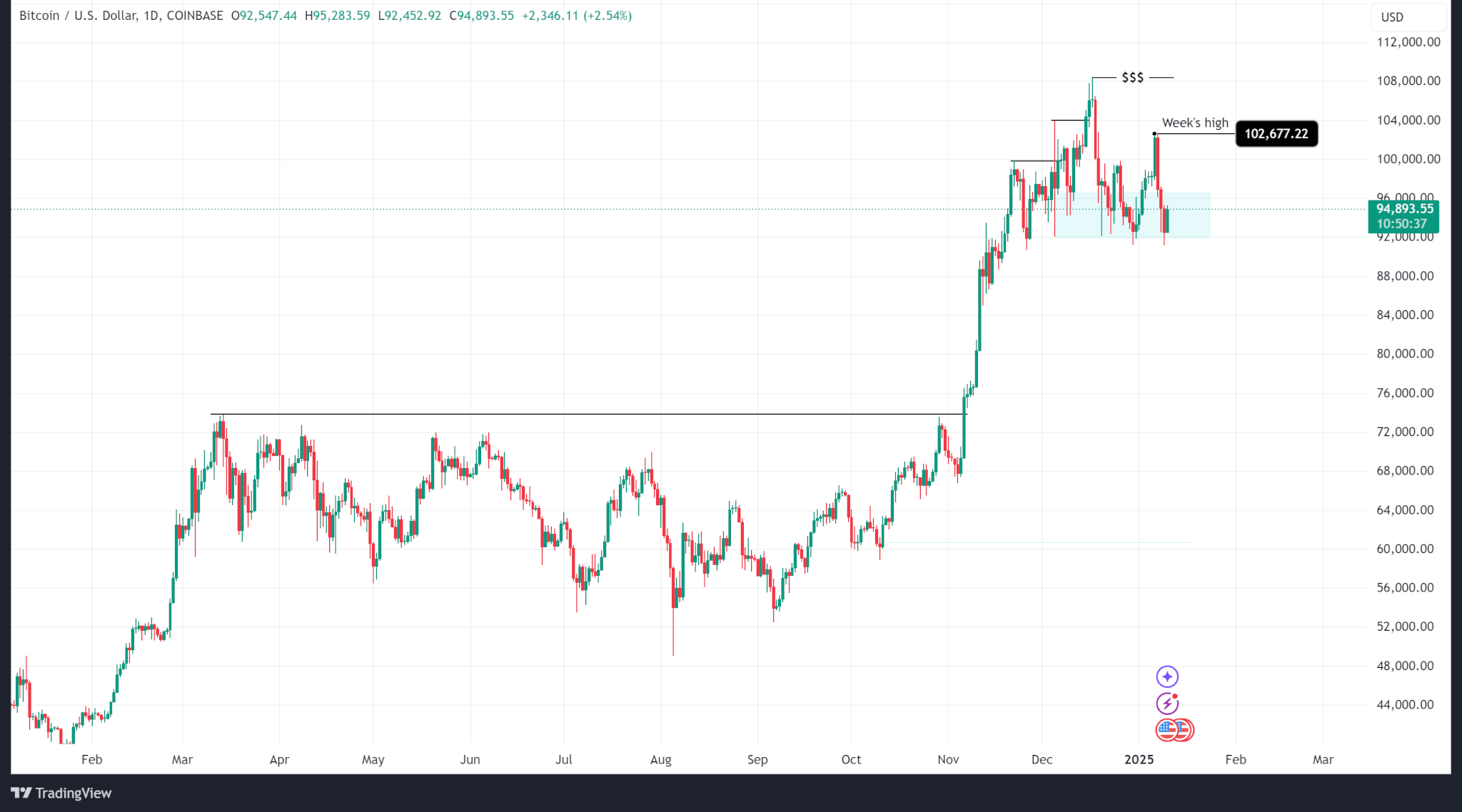

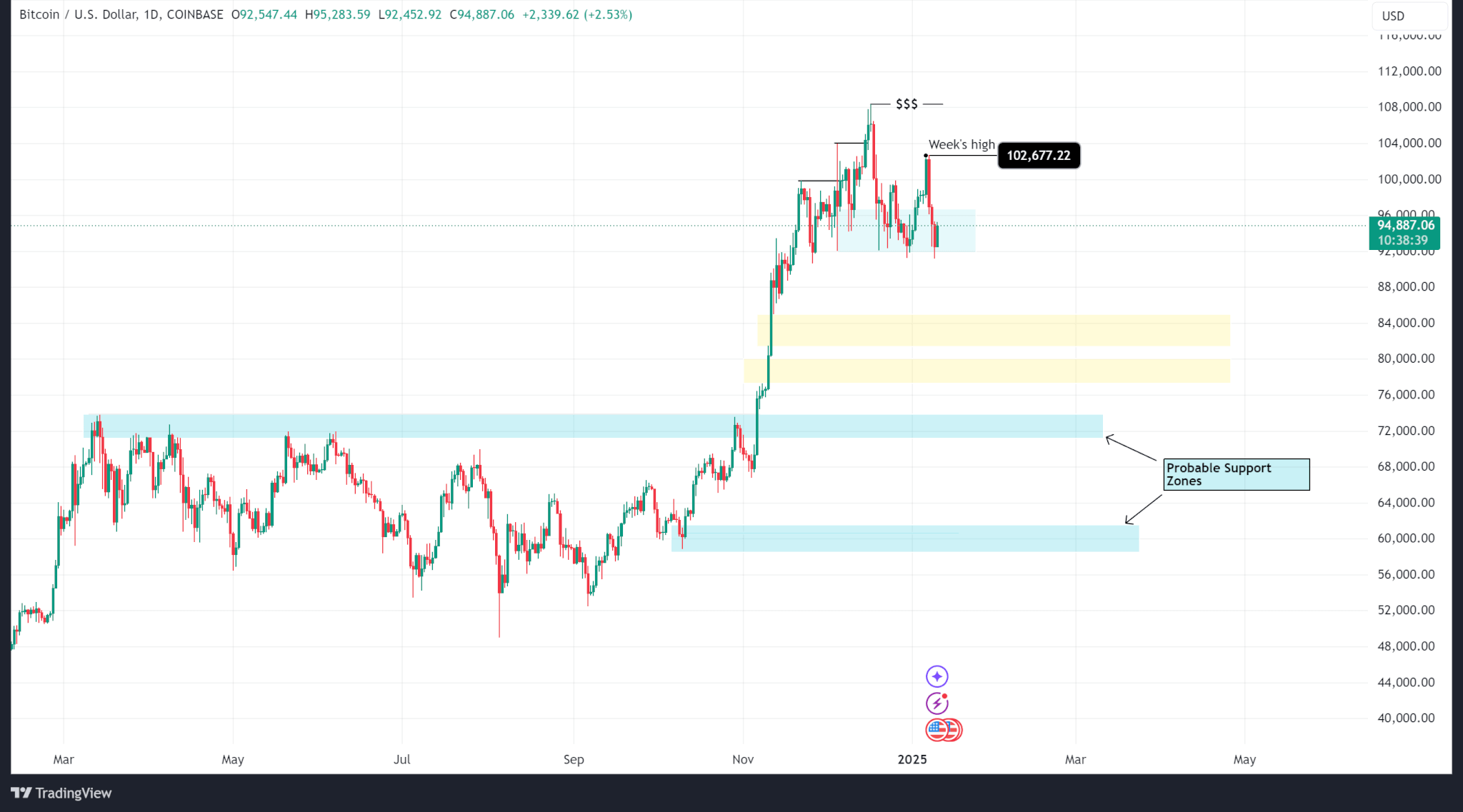

Bitcoin price has fallen from a high of $102,667 reached on Tuesday, January 7 to $94,890.00 as of press time, but remains in the latest H4 demand zone.

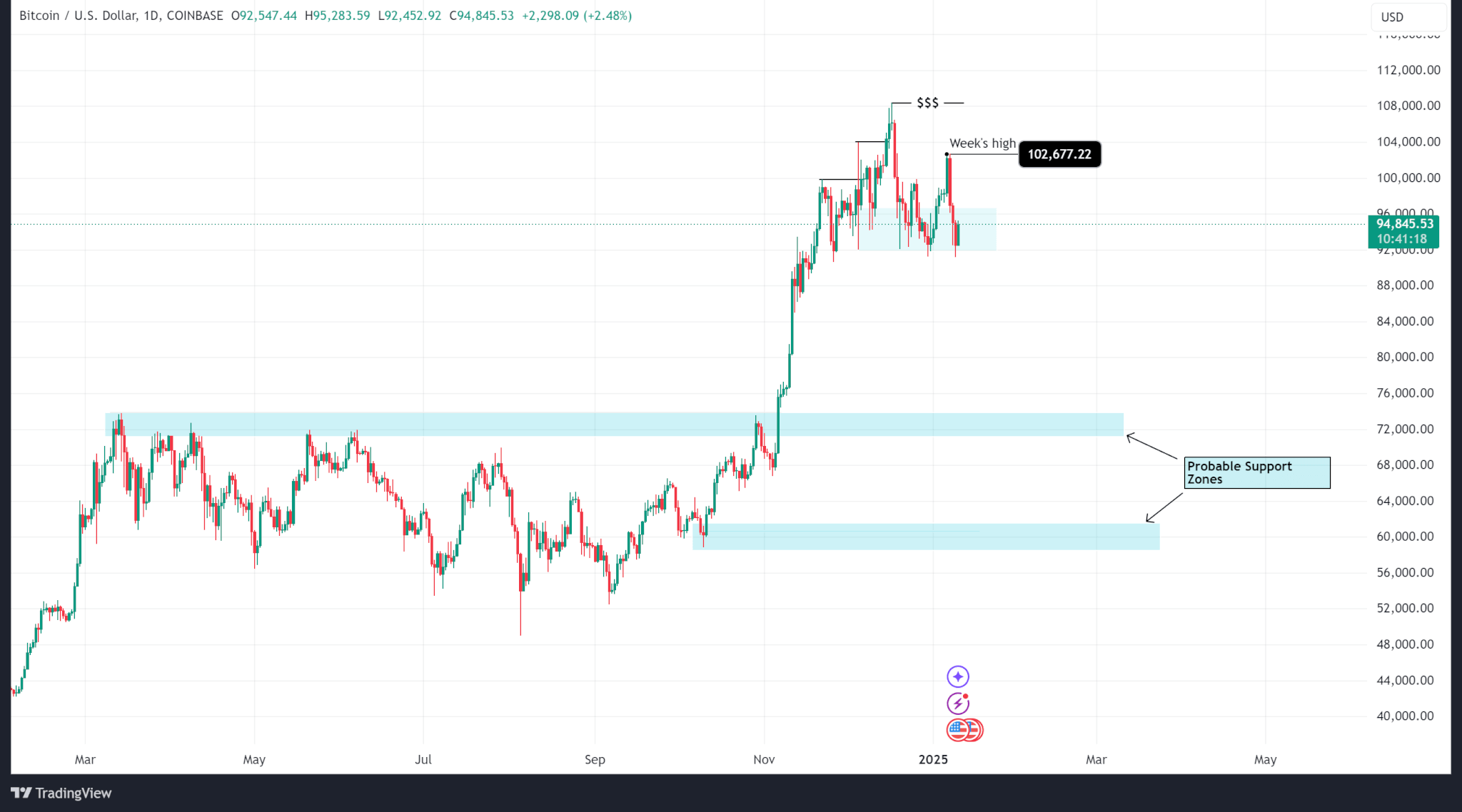

While the interest zone between $92,000 and $97,000 may be the last level of support in the H4 time frame, a broader market view shows that BTC is in a premium zone in the daily time frame, so a push below $92,000 will still keep the price in the entire territory. .

The best technical buying levels will be the last structure in the daily time frame or the 50% Fibonacci level from the lowest point to the break.

There are two real value gaps that the price can react to. While not major zones, they could support an outer high at $108,000 or a short-term support rally before continuing to sell off to the first support zone.

All this is predicated on Bitcoin breaking below the $91,000 level.

Meanwhile, spot crypto ETFs rallied on Wednesday, January 9, following the release of minutes from the Fed's meeting that showed the Fed was cautious about inflation and the effects of Trump's upcoming policies.

BTC ETFs bled $568.8M on Wednesday, while ETH ETFs lost $159.4M, with Fidelity's largest outlay (258.7Mn for BTC and $147.7Mn for ETH).