Bitcoin price drops 1.8% as ‘schizophenic’ new US jobs data is released

Bitcoin (BTC) saw flash-low volatility on Wall Street on June 7 as US payroll data surprised markets.

Bitcoin wobbles on mostly mixed US jobs data.

Data from Cointelegraph Markets Pro and TradingView showed a price drop of 1,300 BTC in one hourly candle before entering a reset.

Bitcoin joined a knee-jerk reaction to U.S. nonfarm payrolls data, which largely beat expectations that the labor market was adjusting to tighter fiscal policy better than forecast.

This also pushed back the chances of the Federal Reserve cutting interest rates – a key prerequisite for liquidity flows into risk assets and crypto.

According to Bloomberg, economist Mohamed El-Erian said, “It closes the door on a July rate cut.”

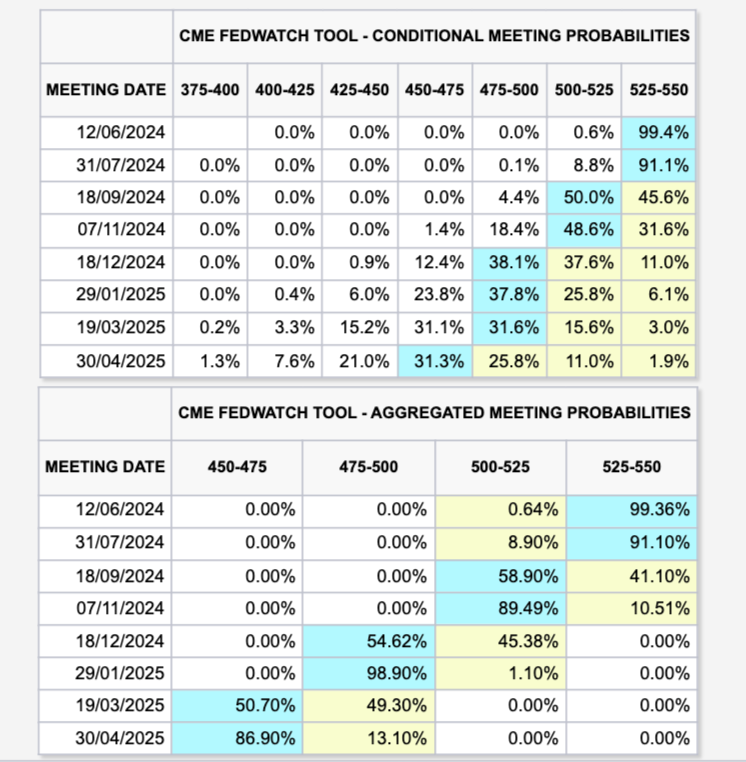

With the Federal Open Market Committee (FOMC) due to meet on June 12 to discuss rates, markets now see little prospect of a cut due to the next three meetings.

According to data from CME Group's FedWatch Tool, at the time of writing, the odds of a slight 0.25% cut for the June, July and September FOMC meetings stood at 0.6%, 8.8% and 50.8%, respectively.

Other comments pointed to a curious contrast between strong wage growth and unemployment, which rose to 4% – 0.1% above the forecast level.

“The US labor market looks completely schizophrenic,” analyst Holger Zeschapitz wrote in a post on X (formerly Twitter).

“While the BLS survey reported 272k new jobs for May, the household survey showed a big drop in people employed and 408k jobs lost. That's why the U.S. unemployment rate rose from 3.9 to 4% despite lower labor force participation.”

The price of BTC remains in a “tight spot”.

Turning to the BTC price action itself, market participants chose to take a back seat as volatility resolved itself.

Related: Bitcoin hash ribbs lights first buy signal starting at $25K BTC price.

Prominent trader Daan CryptoTrades noted that BTC/USD stayed below key resistance ahead of the data releases, while another trader Skew said spot bids were needed to fuel the uptrend.

In one of X's various posts, he added, “Tight position here overall with previous highs and resistance ($71.6k).”

Asset tracker CoinGlass showed thick liquidity above and below the spot price, with $72,600 now the focus of resistance – up from $71,900 earlier in the day.

“It's still consolidating between the two major support and resistance levels between $67K & $72K,” reports Daan CryptoTrades.

“As price consolidates below this resistance, it becomes more likely to break out in my opinion. We are waiting patiently :)” …

The accompanying chart shows the recent high highs, low highs, low lows and high lows for BTC/USD, highlighting the overall sideways trading environment.

This article does not contain investment advice or recommendations. Every investment and business activity involves risk, and readers should do their own research when making a decision.