Bitcoin Price Forecast $10 Billion Sends BTC Above $30,000 Resistance – Is A New Bull Market Officially Beginning?

Bitcoin, the pioneering digital asset, has once again caught the world's attention as it broke through the dreaded $30,000 resistance level. A massive $10 billion inflow fueled this rally, reflecting renewed confidence from institutional and retail investors.

With this significant resistance, market analysis is heralding the start of a new bull market cycle. As the world watches Bitcoin's direction closely, the main question remains: How high will it go this time?

Screenshot of current metrics

Bitcoin is currently trading at $29,623. Digital gold saw a 24-hour trading volume of nearly $21 billion, up more than 3% over this time frame.

Bitcoin sits at the proud peak and dominates the crypto market, holding the #1 ranking on CoinMarketCap. The live market capitalization has reached an astonishing $578 billion.

Going into the supply metric, there are currently 19.52 million BTC coins in circulation, which is close to the maximum supply cap of 21 million coins.

Bitcoin price prediction

Examining the current technical landscape for Bitcoin, we find a number of critical metrics that give insight into its potential direction. A pivot point, an important technical level, currently sits at $29,350.

When we look at the price landscape, Bitcoin immediately faces resistance at $30,285. Additional resistances are lined up at $31,075 and $31,820 respectively.

On the downside, the cryptocurrency established immediate support at $28,200. Deeper, ongoing support levels are seen at $27,285 and $26,555.

Turning our attention to technical indicators, the Relative Strength Index (RSI) stands out. Currently, Bitcoin's RSI value is at 68.

This is important as an RSI value above 70 typically indicates that the asset may be in overbought territory, indicating the possibility of a correction on the downside.

At the other end of the spectrum, an RSI below 30 indicates an oversold condition. In Bitcoin's case, the RSI, just shy of 70, indicates strong bullish sentiment.

But traders should be careful because this also indicates the possibility of a price correction.

Further complementing our technical analysis is the 50-day Exponential Moving Average (EMA), another critical indicator. For Bitcoin, this EMA is currently estimated at $28,700.

This indicator, along with the aforementioned parameters, provides an overview of Bitcoin's current market position and future movements.

Top 15 cryptocurrencies to watch in 2023

In the year Stay up-to-date with the world of digital assets by exploring our hand-picked top 15 alternative cryptocurrencies and ICO projects to watch in 2023.

Our list is compiled by experts from Industry Talk and CryptoNews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take this opportunity to discover the potential of these digital assets and educate yourself.

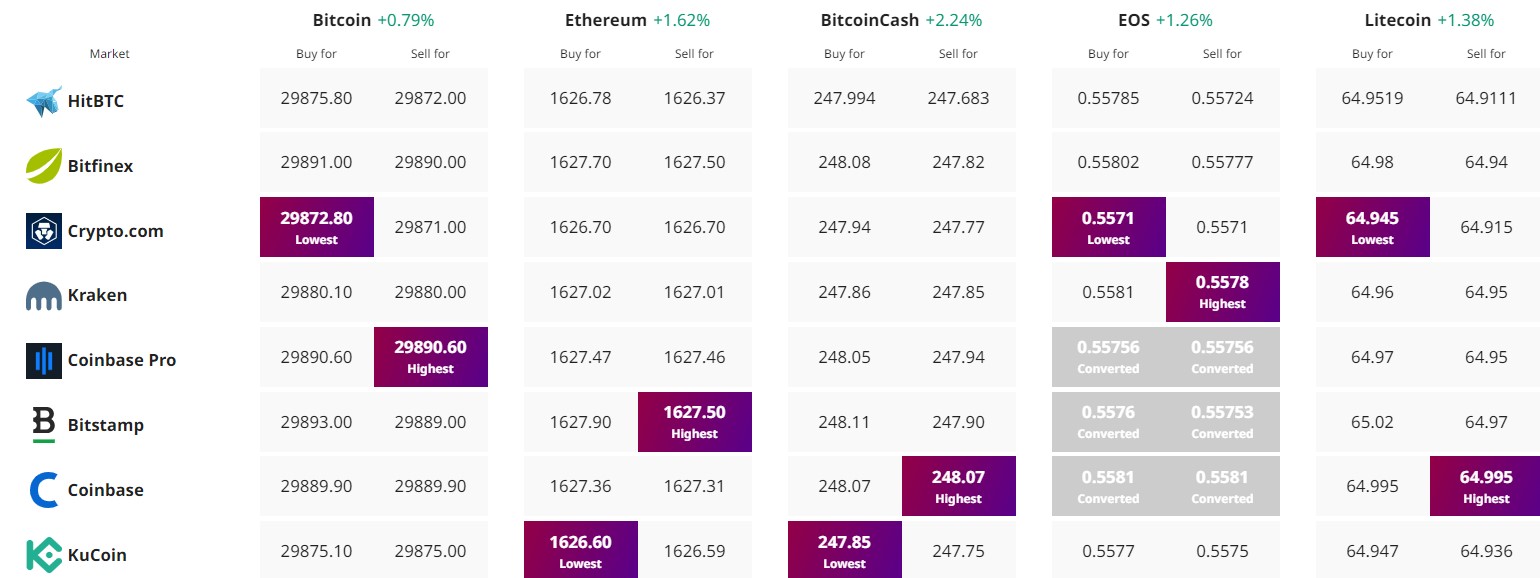

Find the best price to buy/sell cryptocurrencies

Disclaimer: Cryptocurrency projects endorsed in this article are not financial advice of the publisher or publication – cryptocurrencies are high-risk investments, always do your own research.