Bitcoin price rises to three-week high.

Bitcoin rose 5.6%, hitting a three-week high of $61.1 thousand on Tuesday morning. Altcoins such as Celestia, Immutable X and Near have seen double-digit percentage gains. Crypto stocks rose slightly ahead of the Fed's expected rate cut announcement.

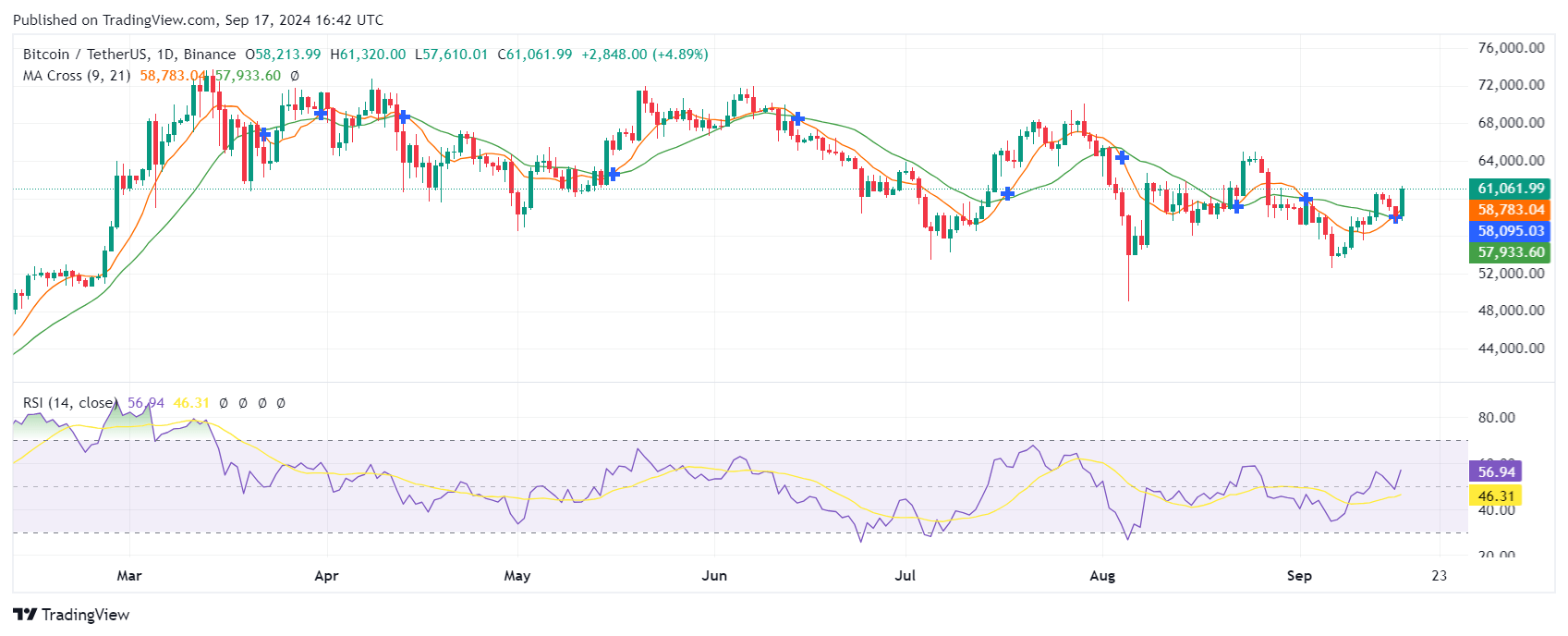

Bitcoin prices rose to their highest level in three weeks, fueling gains in the cryptocurrency sector and related stocks. It rose 5.6%, reaching 61.1K at 11:55 am ET, before settling back to around $61k.

The increase marks a sharp turnaround from a quiet start to the week, indicating renewed interest in digital assets.

Altcoins and Bitcoin Prices Rise Ahead of Fed Cuts

In addition to Bitcoin, other major cryptocurrencies also made significant gains, with Ethereum (ETH) up 4.2% to $2.38k.

In particular, some altcoins outperformed the larger tokens. For example, Celestia (TIA) gained 15.7%, Immutable X (IMX) gained 14.8%, Near Protocol (NEAR) gained 9%, Uniswap (UNI) gained 8.9%, and Sui (SUI) gained 8.1%.

The rally comes ahead of a possible decision by the Federal Reserve on interest rates.

Market analysts widely expect the central bank to cut rates for the first time in four years. With inflation largely under control and the labor market showing signs of cooling, many believe the Fed will take a more accommodative stance.

Low interest rates are typically a boon for cryptocurrencies, as lower borrowing costs make traditional savings and investment vehicles less attractive. As a result, investors often turn to riskier assets like cryptocurrencies for higher returns.

Crypto-focused stocks are also on the rise.

Crypto-focused stocks have also benefited from Bitcoin's rally, although their gains have generally been modest compared to digital tokens.

MicroStrategy (MSTR) is a well-known company with 0.6% of the largest Bitcoin holdings.

Crypto exchange platform Coinbase Global (COIN) increased by 3%, crypto investment company Galaxy Digital (OTCPK) gained 5.4%.

In the crypto mining sector, Riot Platforms ( RIOT ) rose 2.4%, MARA Holdings ( MARA ) rose 1.9%, and HIV Digital Technologies ( HIV ) rose 4.3%. Bit Digital ( BTBT ) had the biggest jump of 13%, Hut 8 ( HUT ) was up 6.6% and CleanSpark ( CLSK ) was up 3.1%.

While the broader stock market also faces buying pressure ahead of a key Federal Reserve decision, the crypto sector continues to ride a wave of optimism about lower rates and increased investment in digital assets.