Bitcoin price starts to reverse, will BTC break the $58 barrier?

Bitcoin (BTC), the world's largest cryptocurrency, appears to be recovering after hitting a monthly low of $55,500. In recent days, the price of BTC has fallen by more than 10%, but in the last three days, it has jumped by more than 5%, which can be considered a sign of a price reversal.

Bitcoin price reversal

With the recent price increase, BTC has experienced a breakout from the downtrend line and is now heading towards a strong resistance level of $58,000.

At the time of publication, BTC is trading near the $56,740 level and has seen a price increase of over 4.5% in the last 24 hours. Meanwhile, the volume of trade increased by 86 percent, and the interest of traders and investors increased significantly.

Bitcoin technical analysis

According to expert technical analysis, despite trading below the 200 exponential moving average (EMA) on both the four-hour and daily time frames, BTC looks bullish. Additionally, the price surge was triggered by a sharp divergence in the relative strength index (RSI) on the daily time frame.

Based on the historical price momentum, there is a high probability that the price of BTC will rise another 10% to $62,000 in the coming days.

Bullish gauges on the chain

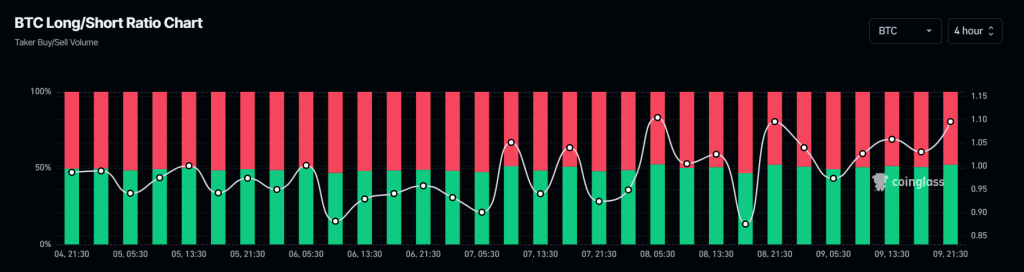

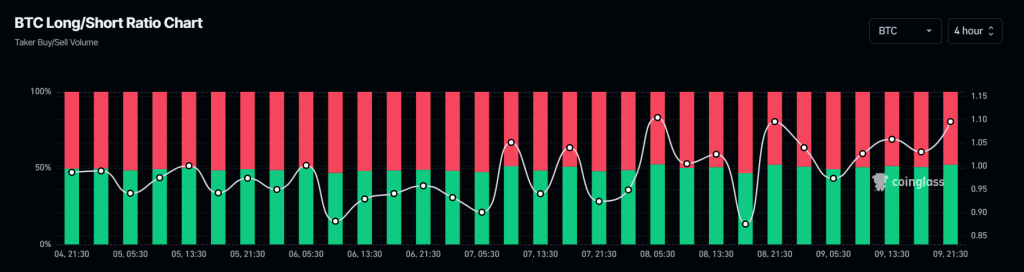

In addition to this technical analysis, benchmarks on the chain also support this current bullish view. The Coinglass BTC Long/Short ratio currently stands at 1.095, which is a bullish sign (a value above 1 indicates bullishness among traders). Additionally, BTC futures open demand increased by 6% in the last 24 hours and continues to grow.

Often, traders and investors use this combination to build long/short positions.

Key fluid areas

Currently, the main liquidity points are $55,900 on the lower side and $57,000 on the upper side, as traders at these levels are overleveraged, according to Coinglass.

If the current bullish market continues unchanged and the price of BTC reaches the level of $57,000, about $71 million long-term positions will be defended. Conversely, if the sentiment changes and the price drops to the $55,900 level, about $91.2 million of long positions will be lost.

This data indicates that the bulls are currently dominant and have the potential to remove more short positions in the coming days.