Bitcoin Price Support at $54,450: Four Reasons to Watch

The price of Bitcoin (BTC) is down 24% since ending at $71,758 in early June. As the sentiment grows, the future direction of the pioneering cryptocurrency bias hinges on four critical narratives.

Retailers adjust their trading strategies based on market sentiment, which explains the highly volatile nature of crypto.

Now the important factors that affect the price of Bitcoin

The $54,450 level provided possible support for Bitcoin's price. Two failed breakouts after the Relative Strength Index (RSI) tested the critical level of 30 suggest that BTC may be headed lower.

However, whether a recovery is sustainable will depend on four macro market drivers.

The launch of Ethereum ETFs can trigger positive market sentiment.

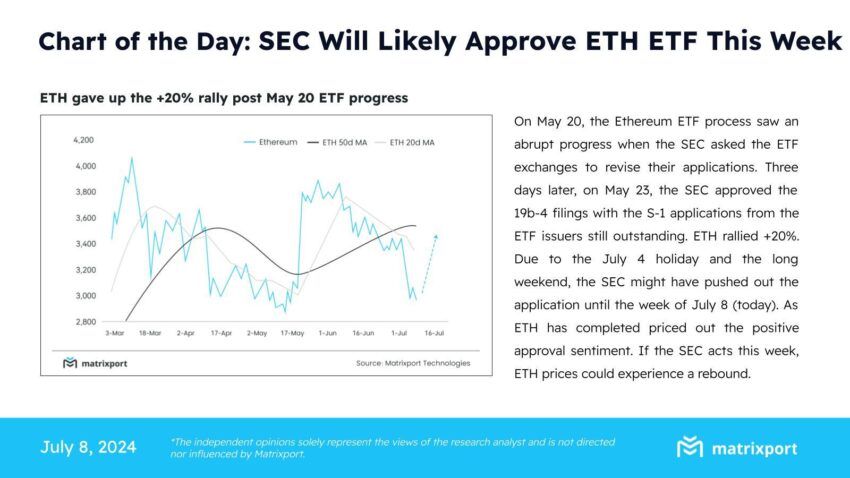

Crypto fans will join Ethereum token holders in watching Spot Ethereum ETFs (exchange-traded funds) begin trading this week. The US Securities and Exchange Commission (SEC) collected the final S-1 forms from the issuers of the upcoming ETH ETF on Monday. This indicates progress in the approval process for these financial documents.

Crypto financial services platform Matrixport shares optimism. The firm expects issuers to start filing updated S-1 filings this week when the deadline approaches.

According to the report, progress could be as fast as May, three days after the regulator green-lighted 19b-4.

With the expected launch, the Matrixport report expects a 12% recovery in the price of Ethereum to $3,400. This estimate comes as ETH jumped 20% after the approval of the 19-b filings in May. Bullishness in favor of approval is expected to flow into Bitcoin.

Also read: Ethereum ETF explained: what it is and how it works

2. Mt. Gox influence can already be valued

Gox fees will continue to fade as the market has already factored in or priced in the impact. The Mt. Gox recovery trustee started payments in Bitcoin and Bitcoin Cash (BCH) last week.

Bitstamp exchange, in agreement with Mt Gox, indicated that it will ensure compensation to investors as soon as possible. Some lenders have already confirmed receipts, highlighted a 60-day timeline for token distribution. Kraken, one of five exchanges the trustee uses to return the money, has a 90-day timeline.

Japan's Bitbank and SBI VC have reportedly received and distributed the funds allocated to them. They effectively beat their 14-day timeline. As creditor payments continue through the defunct exchange trustee, optimism continues to return to the market.

This could be especially good for the value of Bitcoin if lenders don't give money when they receive it.

“Many of these lenders are tech-savvy and long-time Bitcoiners who have previously turned down aggressive offers to ease their cash demands,” said Alex Tor, head of research at Galaxy.

3. German government selling Bitcoin

As of June 19, the German government has moved more than 10,000 BTC. This is almost the price of $1 Bitcoin moved in various crypto wallets and exchanges. This has fueled the recent sell-off in Bitcoin as investors get a head start on supply shocks.

However, based on Arkham's data, token balances are decreasing in government reserves.

There is speculation that the German government will eventually slow down Bitcoin transactions, favoring the mainstream crypto asset. One of the country's members of parliament, Joanna Kotar, a prominent crypto activist, expressed outrage as local German media picked up the call.

“The German press picked it up,” Kotar wrote.

Read more: Who will have the most Bitcoins in 2024?

4. Testimony of the Federal Reserve Chairman this week

Inflation in the US has been declining steadily, and the country's economy is showing strength, but still far from satisfactory levels. With these, it looks like a soft landing, especially after the positive payroll data on July 5. The Federal Reserve's long-awaited pivot to monetary policy now seems possible.

“The Fed's latest forecasts are making investors cautious. Fewer-than-expected rate cuts are putting pressure on riskier assets. Political instability in Europe and a strong US dollar are pushing BTC down,” wrote a popular account on X.

Crypto markets continue to feel the heat of these macro events. This week is crucial as Fed Chairman Jerome Powell prepares to address Congress on July 9 and 10.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.