Bitcoin Price Will Break $57,000 – Will It Wait?

On September 4, 2024, Bitcoin (BTC), the world's largest cryptocurrency, broke the critical support level of $57,000, the lowest at $55,670, according to CoinMarketCap data. However, the BTC price quickly recovered, returning to the $56,800 level.

100 million dollars in cash

This huge price swing has resulted in more than $100 million in longs and shorts in the last few hours. Most of the liquid comes from the long side. According to the chain analyst firm CoinGlass, out of the $100 million in liquidation, bulls picked up $91.35 million worth of long positions, while short sellers saw 8.57 million liquidations.

Despite the recent market recovery from $55,670 to $56,800, BTC currently appears to have entered a phase where short sellers dominate the assets and have the potential to liquidate many long positions.

Bitcoin technical analysis and upcoming levels

According to expert technical analysis, BTC has become extremely weak with a high probability of falling to the $54,000 level. The recent price decline not only breached a critical support level, but also broke a week-long consolidation near the support area, which is a bullish sign.

This is the first time BTC has fallen below $56,000 since August 8, 2024. Despite this steep decline and critical breakout, technical indicators such as the Relative Strength Index (RSI) and Stochastic remain neutral, according to CryptoQuant data.

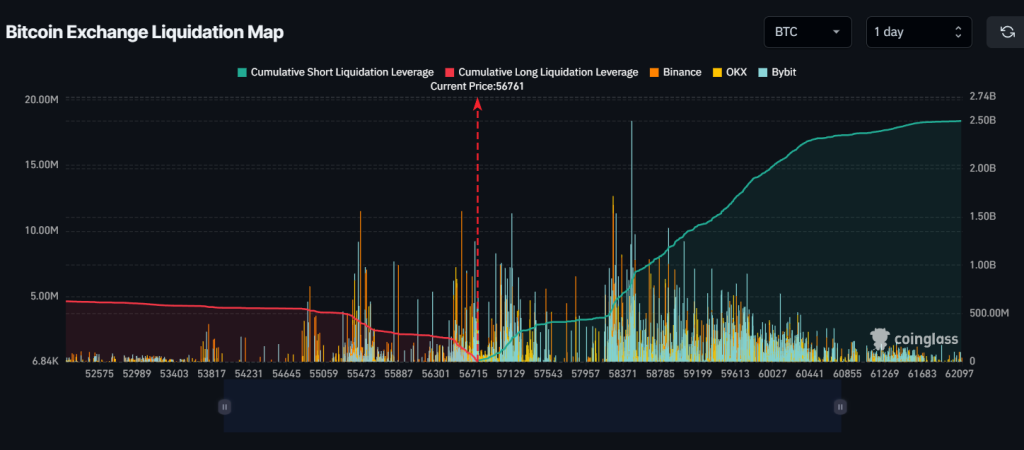

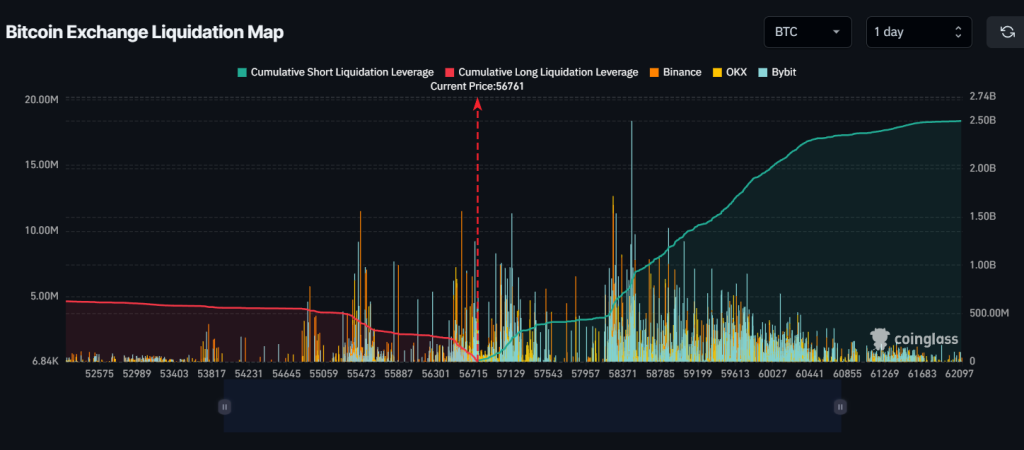

Key fluid areas

Currently, the main liquidity areas are $56,270 on the lower side and $57,130 on the upper side, as day traders are overextended at these levels, according to the CoinGlass Bitcoin exchange liquidity map.

If the market sentiment is weak and BTC falls to the $56,270 level, about $260 million long positions will be eliminated. Conversely, if sentiment reverses and the price rises to $57,130, nearly $215 million in short position value will be lost.

At press time, BTC is trading near $56,650 and has lost more than 5% in the last 24 hours. Meanwhile, open interest has declined by 4% over the past four hours, indicating significant liquidity following the recent breakdown of critical support levels.