Bitcoin prices are trading at all-time highs in these nations.

The value of Bitcoin has risen in several regions, some of which have faced a more terrifying fiat currency crash. Turkey, whose BTC price was 1.3% higher than the international price in July, saw its inflation rise almost 70% in January, Bitcoin price in South Korea a surprising 10.23%.

On March 6, fiat currencies fell in Egypt and Turkey as central banks tried to contain inflation, while South Korean crypto traders benefited from tighter forex controls.

How the collapse of the lira led to crypto adoption

Turkey's inflation rate rose to 67.07 percent in January, dashing hopes of a rate hike. At the same time, the Turkish lira continued to depreciate by more than 40 percent against the US dollar last year.

Turkish Finance Minister Mehmet Simsek has predicted that inflation will remain stagnant in the coming months. Eight months ago, the decline of the lira led to a Bitcoin premium of around 1.3%. SimSec said in January that the government is close to finalizing crypto regulations.

Meanwhile, crypto exchange OKX recently launched a platform to specifically serve Turkish customers. The startup includes Turkish Lira trading pairs for Bitcoin and Ethereum. Ray Youssef, CEO of Nones App, sees this as a positive development because peer-to-peer trading can address Egypt and other regions facing the Global South.

“Egypt has become twice as poor in one day! And crypt is 100% illegal there. To the central bankers of the world and to all the people of the Global South, listen up: the central banks of your countries are not the only cause of your pain, they are being attacked by the colonial West! Crypto is not the enemy but our only solution when used in p2p markets! Yusuf said.

Read more: How to protect yourself from inflation using cryptocurrency

Given Turkey's history of cryptocurrencies, authorities may want to limit foreign investments in domestic crypto exchanges. This could help traders offset the lira's weakness as more bitcoin circulates domestically at a price premium.

South Korean kimchi maintains local currency.

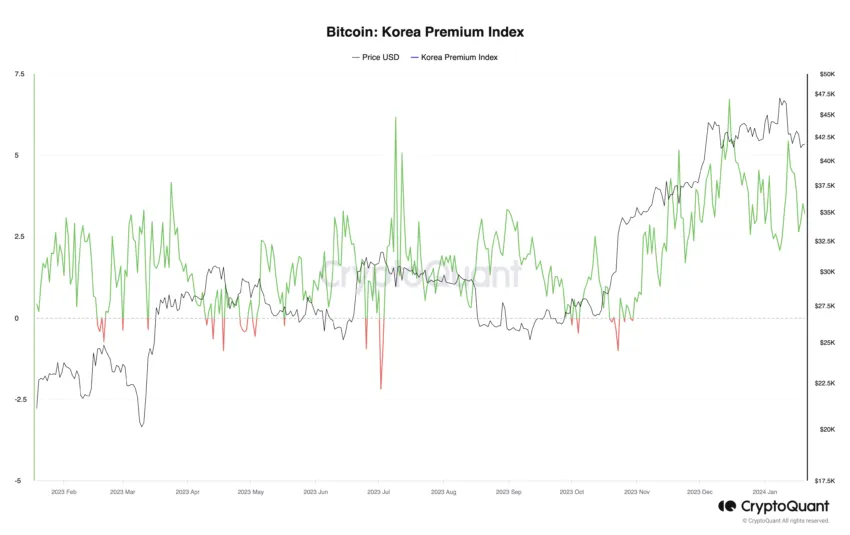

Another incident occurred in South Korea, where the government restricts the flow of foreign currency into the crypto market. The region's so-called kimchi premium is up 10% following the recent bitcoin rally, which has pushed asset prices higher than global prices.

The South Korean government prohibits foreigners from investing in local crypto exchanges. In addition, local people are not allowed to participate in crypto arbitrage business to benefit from the local premium by keeping all the crypto in the country. As a result, an asset like Bitcoin trading at a premium indicates buying pressure in the local market.

Kimchi premiums have regularly occurred at high points in the Bitcoin market. Earlier this week, the price of bitcoin briefly rose above $69,000 before falling more than 3%, which was linked to a rise in the kimchi premium. Eight months ago, Bitcoin on Bithumb, Korea's largest exchange, was trading at 3%, the same price as the 2021 Bitcoin high 14-day moving average of the Korea Premium Index.

Read more: What is Fiat Currency? How is it different from Cryptocurrency?

Looking at the latest news, BeinCrypto contacted Bithumb for comment on Kimchi's rise but did not hear back at press time. The exchange is the largest crypto trading space in South Korea.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action taken by the reader on the information found on our website is at their own risk.