Bitcoin Rellls Acly Macro economic needs – Hype, Sodo, Rnder and KAS continuing?

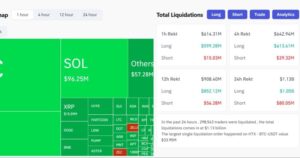

Bitcoin (BTC) More than 7% of more than 7% did this week, which refers to a strong purchase of a strong purchase. BitMEX With My Hospital Interpreter Interpreter US Bond Shop

COUNTCHANINIIN AND A BITCOIN has made a strong support in $ 79,000 in $ 79,000 for $ 76,000 for $ 76,000 for $ 76,000 for $ 76,000. Boling washing of a boling washing of the Creator, John Boeing also adjusts the same views. Balcont Brikon “Classic Bolbis band”, “the Classic Blubs Band”, “

The daily view of Crypto Market information. Source: coin 3360

Market participants are receiving closely watching the US $ 100 index. Any additional weakness in the US dollar may be more bullying for bitcoin.

If Bitcoin is administered to a high levels, it is more likely to increase the feeling in the Crypocaluancyment sector. That can cause recovery in the specified strategy. What are the applicts that can benefit from Bikko's strength?

Bitcoin Print Analysis

Bitcoin is closed above the line of April and the first indicator that the corrective level can be completed.

BTC / USDT daily chart. Source: Cocket of Trading

Bears are unable to leave you easily and they do not try to pull the price below 20 days of the current mobile supervisor ($ 82,885). As they do this, bears remain vigilant at high levels. BTC / USDT pair can be spent to $ 78,500.

Buyers may have other plans. Going down and try to prevent 20 days of EMA. The price of 20 days EAA The $ 89,000 dollars improves crime expectations and then, then, then, it will frighten $ 95,000.

BTC / USDT 4 hours. Source: Cocket of Trading

20-Ima is slippery, and relatively (RSI) indicates the importance of races in the positive region. A pair of re-re-re-re-re-re-re-re-re-re-re-re-re-rehabilitation can be $ 89,000, but they may be crossed. The pair of $ 92,000 to $ 95,000 can take $ 95,000 to $ 95,000.

The average support of moving, moving, are crucial support to prevent breads. When you make a pair, the shapes succeeded from 78,500 to $ 78,500.

Hyperliquid Analysis

Hi Perlink (HolPe) April 11 (15.14) More than 50 days (15.14) shuts up (15.14) and the April 12.35 dollars has reached over the resistance.

Hyp / USDT daily chart. Source: Cocket of Trading

Started 20 day EMA ($ 13.84), and ASAXNA has the edge of the rulers. Sellers are trying to prevent over $ 17.35 to prevent resistance.

If the price is less than $ 17.35 and less than 20 days of email, this optimist will be close. The pair of $ 12 can fall to $ 12 to $ 12 to attract buyers.

Hype / USDT 4 hours. Source: Cocket of Trading

A pair to 20 em, is an important verbal support to view. The price is from 20 EMA Then the bulls will try one more attempted to win the $ 17.35 of the $ 17.35 banks. If you succeed, you can get up to $ 21. There is a small resistance of $ 18, but may be crossed.

Sellers from 20 EMAA After that, pairs can be thrown into 50 seams.

Ondo's analysis

Besters, there is an ond line that indicated that the bears may lose their grave.

Odo / USDt daily chart. Source: Cocket of Trading

Recovery is selling near $ 0.96 near the $ 0.96 but it can get support within 20 days of EMA ($ 0.83) at 20 days. The price prices in the 20 days of email tries to drive the Oanden / USDee pair from $ 0.96. If you notice to do that, a pair of $ 1.20 USD to $ 1.20 dollars.

Sellers may have other plans. You try to pull the price below 20 days of EMA. If you could pull it out, pairs can be spent to $ 0.79 and after $ 0.68.

Oogg / USDT 4 hours. Source: Cocket of Trading

As the 4-hour chart shows, the pair of $ 0.96 is fleeting for $ 0.93 to $ 0.96. Buyers must wait for the value of 20-imma in order to protect the top hand. If the value is revenue with 20 emails, it increases the opportunity to hold over 5.96 vacation time. After that pair can then climb to $ 1.05 to $ 1.05 to $ 1.05 to $ 1.05 to $ 1.05.

Rather, if you are billing of 20 emissar, it suggests that it will dry high levels. Then the pair can be thrown into 50 SMA.

Related:

Price test

The $ 4.22 US $ 4.22 has reached the core of $ 4.22.

Daily chart Rodr / USDT. Source: Cocket of Trading

Moving advisors are on the Master of Chriscade, and ASA Raised to a positive zone to buy for buyers. If the price is more than $ 4.22, the RNDR / SDT pair will complete a double-down design. There is a minimum resistance in $ 5, but may be crossed. Then couples can climb the target for $ 5.94.

If it is contrary to this estimate, the price shows less regional level measures if the price changes below $ 4.22.

RNDR / USDT 4 hours. Source: Cocket of Trading

A pair of $ 4.06 is $ 4.06, but dragging is likely to have the support of 20 emi. After the price is revenue with 20 em, it indicates that his emotions are positive. That will improve the pros of rest than $ 4.22. The opposition between $ 4.60 and $ 5 may be established, but if the price is not returned below $ 4.22, a new activity shows the first move.

Alternatively, from 20 EAS Then you can slip up to 50 SMA when explaining a pair of combination nearby.

Kaspa Price Analysis

Compensation (KAS) more than 50 days over 50 days ($ 0.07) over 50 days of SMA ($ 0.07) Closed.

KAS / USDT daily chart. Source: Cocket of Trading

The 20-day EMA has started passing on the 360-day EMA ($ 0.07), and the ASAAs are entered into a positive territory. If buyers causing the price over $ 0.08, the number of compensation is two bottom-down design. This Customs Setup has a $ 0.12 purpose.

On the contrary, if the price is less than $ 0.08 and if less than 20 days of EMA, a subsequent complaint. A pair of a pair can be switched for a while in $ 0.08 and $ 0.05.

KAS / USDT 4 hours. Source: Cocket of Trading

A pair of $ 0.08 down is more likely to support 20 emisso. If the price is related to 20 em, a pair can be locked to the top of the region, which is a crucial resistance to view. If buyers won from the above defense, the pair of $ 0.09 can start a new TV.

This positive attitude is dyed if cuts down below $ 0.07 support and it is easier. The pair can cause it to stick in the region for a while.

This article does not contain investment advice or advice. Each investment and commercial activity includes vulnerability, and they must conduct their own study when making readers make decisions.