Bitcoin Set To Break $50K: Are You Ready For The Crash?

The post Bitcoin Set To Break $50K: Are You Ready For The Crash? It first appeared on Coinpedia Fintech News

Bitcoin is caught in a downtrend after touching the $73,000 mark. He has been struggling to break through for nearly six months now. There were many factors that fueled the Bitcoin uprising, including the German government selling seized BTC, Matt Gox's payment of creditors, wars in the Middle East, and many other events. Even if we exclude these factors, August and September have been the best months for Bitcoin for more than a decade. I've already explained why the September crash will help bring bullishness to Bitcoin in the coming months. Let's break down some of the reasons why Bitcoin is likely to drop to $50,000.

Profit Vs Loss

Bitcoin is trading at $56,685 at the time of writing. There are 1.51 million Bitcoin addresses with 618,430 BTC holdings who bought the asset between $55,852 and $58,305. These wallets are at breaking point.

However, above this mark, there are over 4.50 million addresses holding 1.81m bitcoins. There is a high probability that most of these addresses will make a profit as soon as the price reaches there. Why take profit? Because the general market sentiment is weak and traders may believe that the price will fall further. Data from IntoTheBlock shows that 78% of BTC investors are sitting on profits. There are 19% of people who bought bitcoins above the current price level and are thus at a loss. 3% investors bought BTC at current price.

Bitcoin liquidity and position trends

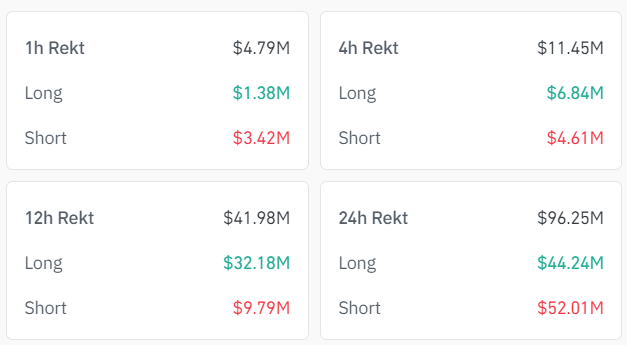

Bitcoin has moved between the bound zone of $56,388 to $58,315 in the last 24 hours. A total of $96.25 million worth of trades were canceled during this activity.

If we look at the 24 hour data, btc looks bullish but the 12 and 4 hour data says otherwise. In the last 12 hours, a total of $41.98 million worth of Bitcoin transactions were offset by $32.18 million worth of long transactions.

market sentiment

More than 88% of those who invest in bitcoin are retail, meaning they are only short-term investors or traders. On the other hand, 10.48% of investors are long holders and 1.26% are whales. The retail investor fears red on the chart, the long-term investor knows it's a correction, while the whale sees it as an opportunity.

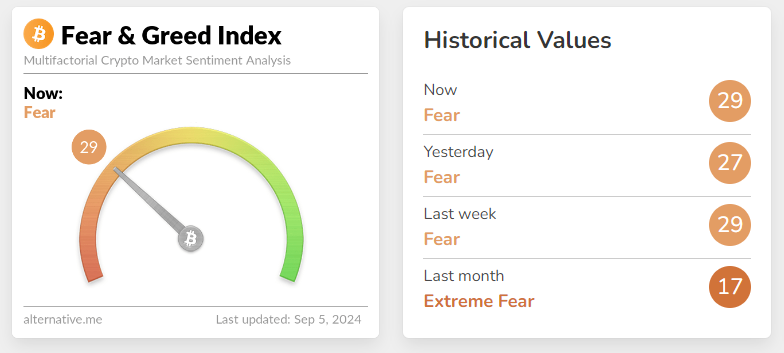

A common strategy that makes whales unusual is that they start buying when others are selling at a loss. Recent on-chain data suggests that several whales have sold some bitcoin at a loss. They do this because they know the market is in a panic and they will have an opportunity to buy soon. The index of fear and greed is on the side of fear for more than a month. In the past few weeks we have seen Bitcoin fall as much as 15% in a single day. The closest strong support for BTC is at $50,520. Bitcoin confirmed this support last month.

look forward

Analyzing all the data from various sources and market sentiment, Bitcoin seems to be down to $50k. Bitcoin has a full month of historic lows to contend with. This is an open opportunity for everyone who understands the price and movement of BTC, but most investors will remain fearful until BTC reaches at least $65,000. This is not financial advice, you should take decisions based on your own due diligence. What do you do, buy, sell or HODL?