Bitcoin sinks below $100,000, altcoins fall following Fed hawkish signals.

Key receivers

Bitcoin price has fallen below $100,000 due to hawkish Federal Reserve stance. Meme Tokens experienced a steep decline amid the market selloff.

Share this article

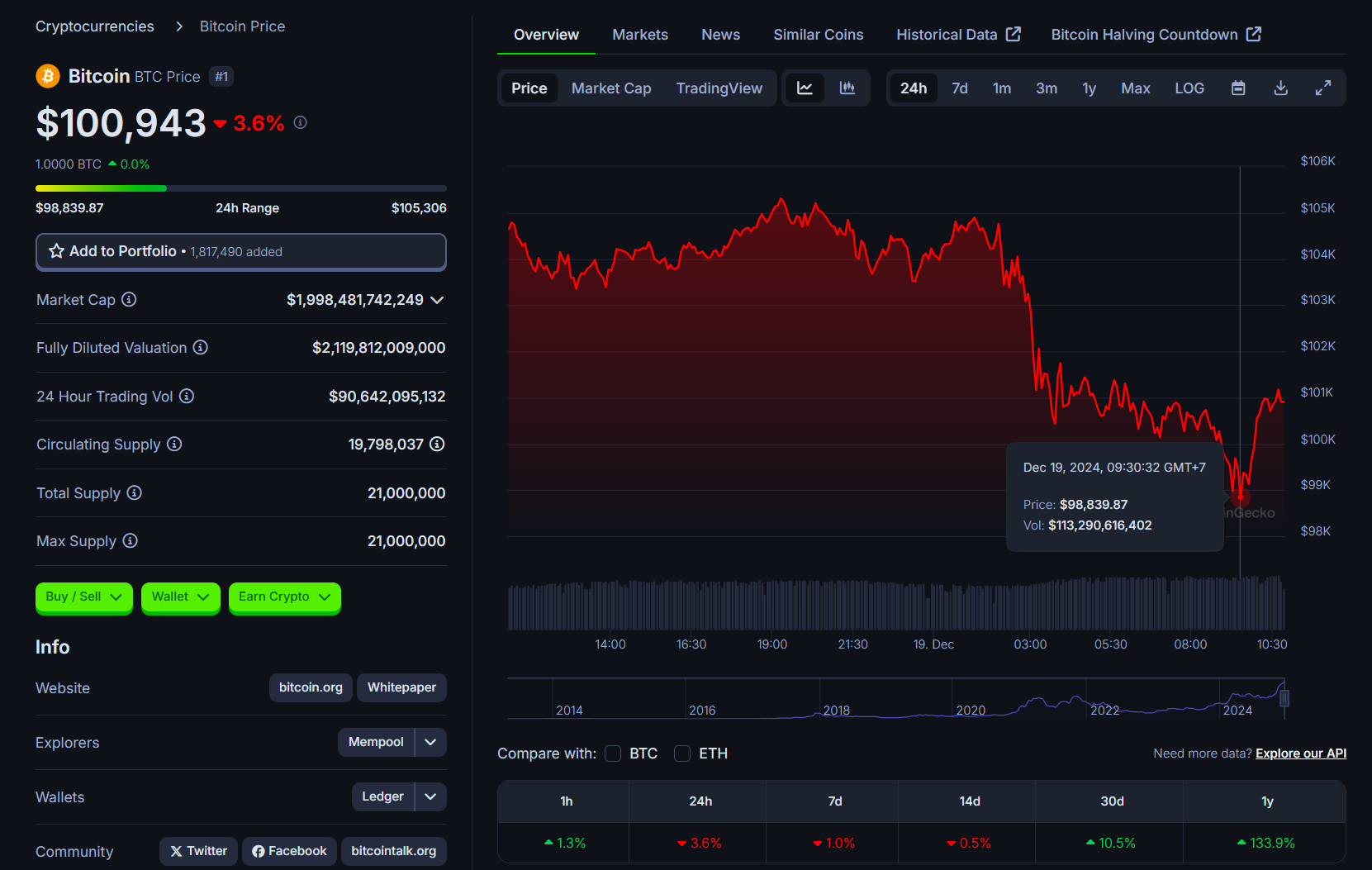

Bitcoin fell 6%, trading below $100,000 amid a market-wide sell-off after the Fed adopted a hawkish tone at Wednesday's FOMC meeting, according to data from CoinGecko.

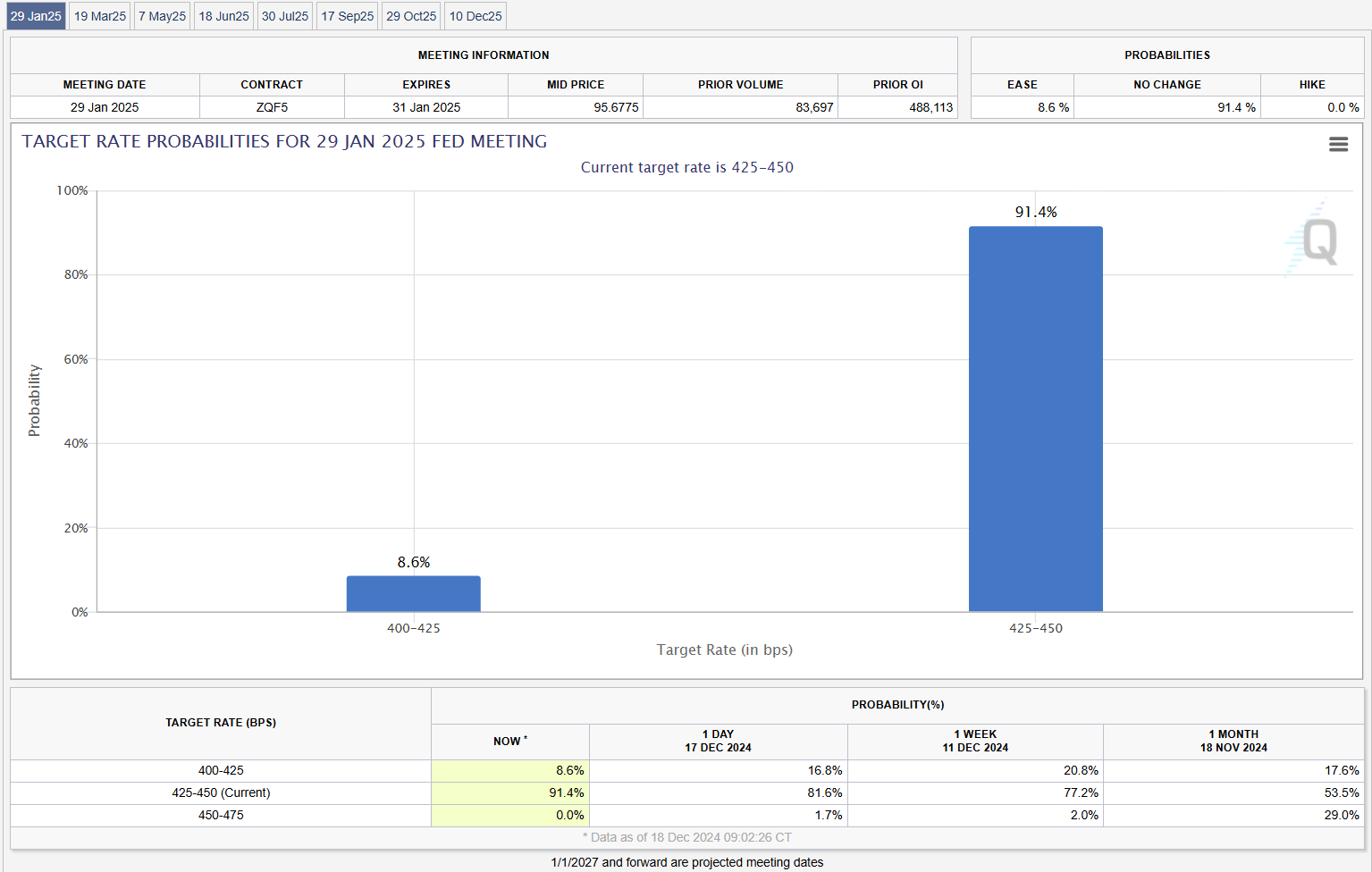

The Fed cut its benchmark interest rate by 25 basis points as expected, but forecast just two rate cuts in 2025, down from previous forecasts of four cuts. Fed Chairman Jerome Powell indicated that the central bank will be more cautious when making further adjustments to the policy rate.

Analysts at Morgan Stanley said they do not expect a rate cut in January 2025 due to the Fed's more hawkish outlook.

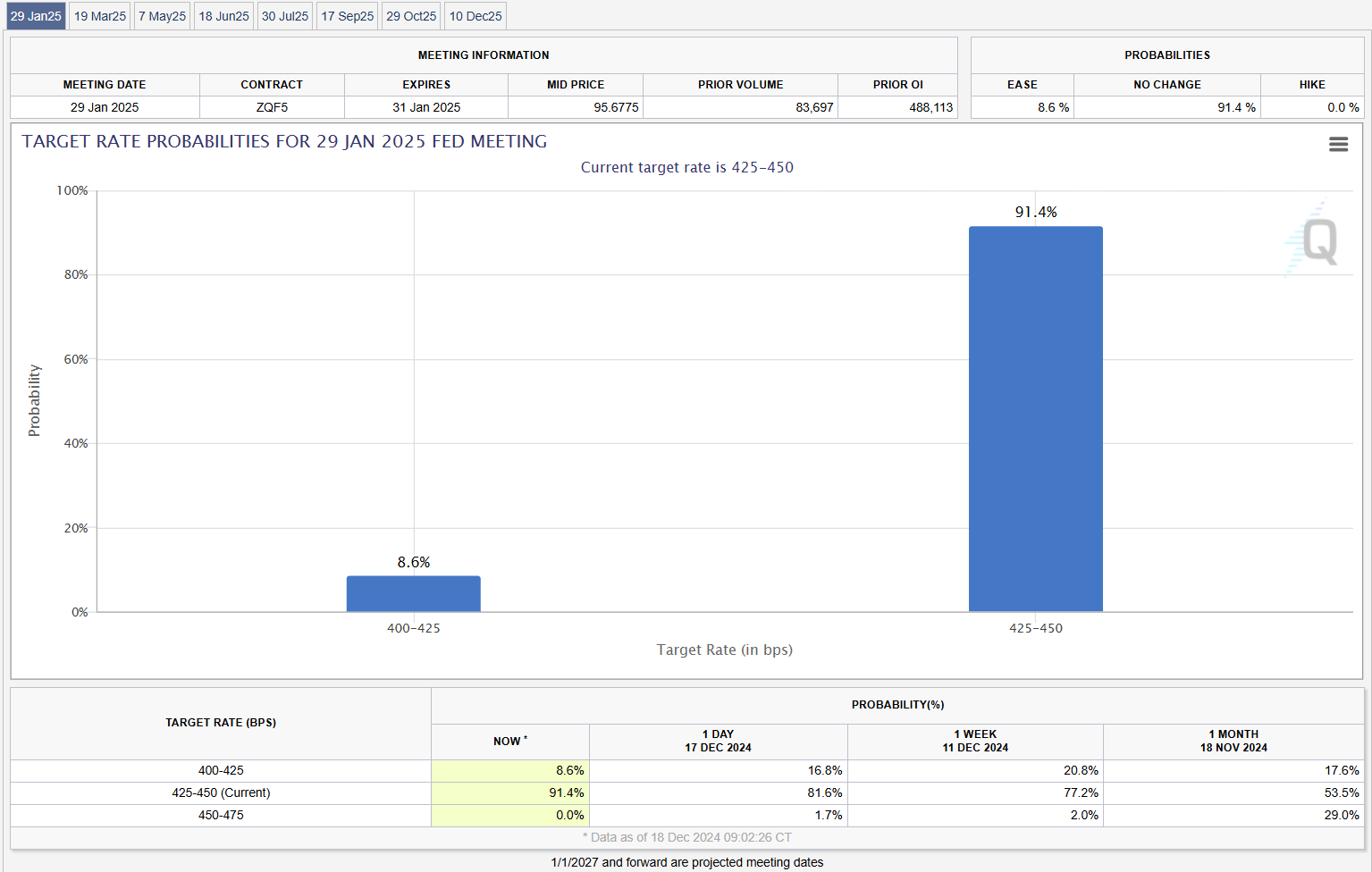

Following the Fed's hawkishness, the odds of a rate cut at the Fed's January meeting fell to 8.6%, based on data from the CME FedWatch Tool, while the odds of keeping rates on hold rose to 91% from 81% a day earlier.

Stock and crypto markets reacted strongly to Powell's hawkish signals. The Nasdaq fell more than 3%, and the Dow posted its longest losing streak in 50 years. The dollar hit a two-year high as bond yields rose across the board.

Bitcoin briefly lost $5,000 on Powell's speech before recovering more than $100,000 to $98,900 on Wednesday evening. Other crypto assets also declined, with Ethereum down 5% to $3,600, Ripple down 9%, and Dogecoin down 8%, according to CoinGecko data.

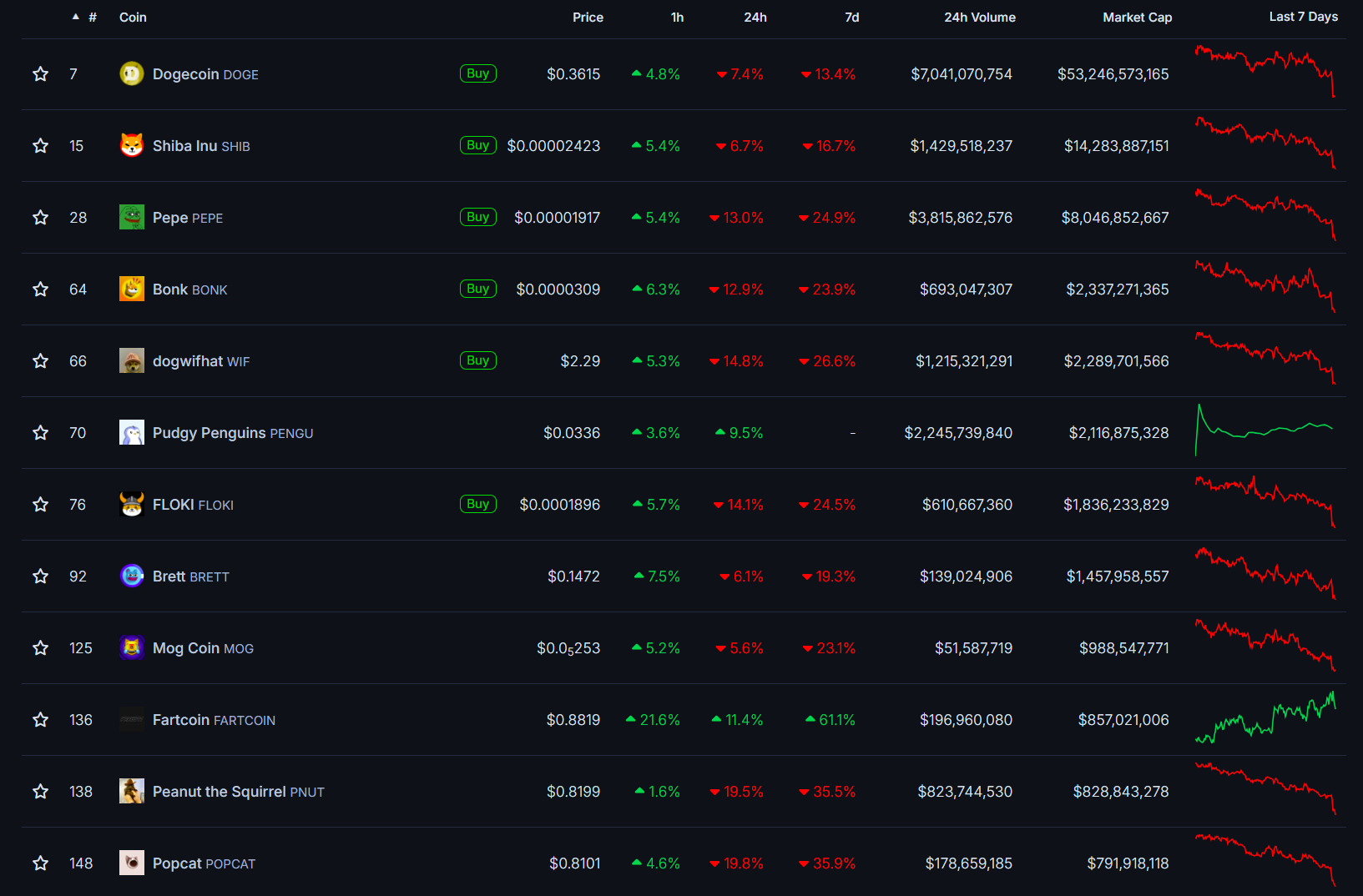

Meme tokens experienced the biggest drop in 24 hours, with PopCat (POPCAT) down 20% and Peanut Squirrel (PNUT) down 19%. Other tokens including Pepe (PEPE), dogwifhat (WIF), Bonk (BONK) and Floki (FLOKI) recorded double-digit losses.

Share this article