Bitcoin Stays Around $100k, Fed’s Waller Signs Multiple Rate Cuts in 2025

Key receivers

Federal Reserve Governor Waller has hinted at several interest rate cuts in 2025 due to promising inflation. Bitcoin rallied above $99k following better-than-expected inflation numbers, with traders seeing a breakout above $100k and altcoins rallying strongly.

Share this article

Federal Reserve Governor Christopher Waller has hinted at several rate cuts in 2025 if inflation continues at current rates.

Speaking on CNBC Thursday, Waller said, “The inflation we got yesterday was pretty good,” pointing to the latest figures showing a slowdown in inflation.

He added that if the same inflation data continues to be reported, it would be reasonable to expect a reduction in prices in the second half of the year, which may decrease by March.

Waller also noted that if inflation falls short of December's favorable data, future cuts could exceed current market expectations.

Two-year Treasury yields, which closely reflect changes in Federal Reserve policy, fell to 4.25% after Waller's comments. Markets expect 40 basis points by 2025, up from 34 points previously.

Waller cautioned that the pace of cuts is data-driven. “If the data doesn't work together, you're going to go back to two, maybe even one [cut] If we get a lot of sticky inflation,” he said.

The labor market continues to weigh on the Fed's outlook, with recent data showing steady job growth and low unemployment at the end of 2024. Waller described the job market as “firm, not booming.”

Bitcoin reacted positively to Wednesday's CPI release, aligning with Waller's upbeat inflation outlook.

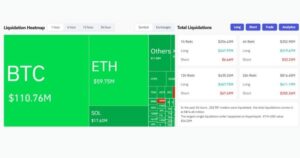

The asset briefly crossed the $100,000 resistance level and has been trading between $98,000 and $100,000 in the past 48 hours, with Bitcoin still struggling to break and hold above the $100,000 mark.

This level, a psychological barrier since Bitcoin first reached it in early December, has proved difficult to sustain. Earlier this week, Bitcoin fell below $90,000, but higher-than-expected inflation data pushed the price higher again, raising bullish sentiment.

As of Monday, Bitcoin's market dominance has dropped to 57%. Alternative digital assets posted gains, with Solana up 8% and XRP up 15% in the past 24 hours.

Meanwhile, the DXY remains in a downtrend, but is still higher than the levels it reached a month ago after Donald Trump's election victory.

As it rose after the 2016 election before declining in 2017 as seen during his first term in office, many expect the DXY to fall after Trump takes office.

Share this article