Bitcoin supply from water warning: warning sign or the new BCD?

The price of Bitcoin (BTC) will take a close to $103,000 after the $112,000 mark earlier in October, and the broader Crupto market is defined by the professional movement, which is the main part of the surprise movement, macro operations and ESF flow data showing limited movement. In addition, at the $100,000 psychological barrier signal. The price made investors more pessimistic.

Despite the cooling rate, the chain's metrics suggest a very different story beneath the surface of each historic Birkenau rally. Analysts say that Bitcoin's next step is to start the first leg of the first leg of the supply store, the consolidation of the supply, of $ 6 trillion.

Hidden sign: 29% of them in reservoir water

of

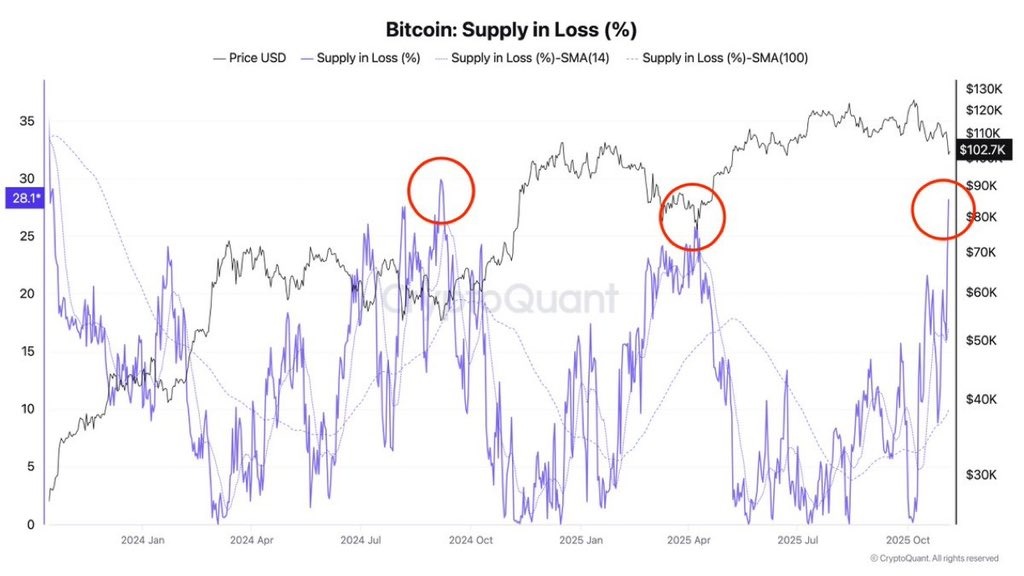

The chart above shows that approximately 29.2% of Bitcoin's distribution is currently a figure seen only in the past decade.

Each of the previous season's primary search mines

In the year May 2017 → $1,800 to $19,80000 2021 $69,000 to $694 → $40,000 to $73,000

In all cases, most market participants were calling for deep corrections and they were all wrong. This repeated pattern of “coin losses” is not a failure, as the intolerance of high “coin losses” breaking.

Loval Finawh: market structure researcher

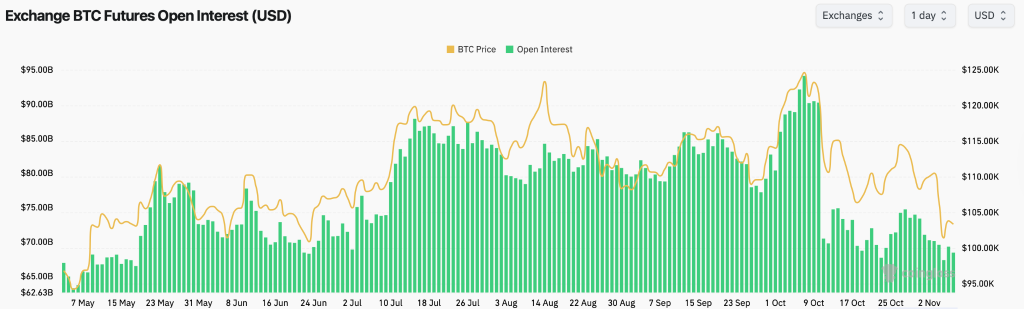

In the past few days, about 30 billion dollars have been destroyed in non-existent positions. From a peak of more than 90 billion dollars, from 92 billion dollars to 68.6 billion US dollars, from a fall of 68 billion US dollars to 68.6 billion US dollars, it decreased by 42%.

Funding rates are close to 0.01%, a marker of independent primary markets. That means no longer crowded, risk of COCCACE and forced sellers. Historically, the market doesn't fall when readings burn when initial demand builds – it reloads. The structure is now clean for headline activity, stopping at the lowest level in months.

Next: Bitcoin (BTC) Price to $110,000 USD?

At the beginning of the month, the price of Bitcoin is below $ 100,000 after selling strong selling pressure at the beginning of the month. Although the bulls have recovered above the range, the upward pressure will continue to prevail. Currently, the price is facing equal pressure on both sides, which raises concerns about the future price action.

Since the beginning of the last quarter, the liquidity is probably coming out of Crypto, causing it to go to other phones. Since its launch in October, the balance has been steadily increasing. The trend is from $ 106 to 77 kg. From $ 77 kg. From $ 77 kg. From February to March, it is seen that the top puller is rejected. On the other hand, the Chinese money flow, although in negative territory, shows the transportation of Chinese money. These indicators suggest that the price of bitcoin will soon lose ground and break above $100 per kg.

Currently, there are two important support levels at $100,618 and $98,139. The technicians are jumping and may continue to do so for some time. Therefore, the price is angry to drag the levels below 100 kg.

Trust with the agreement

In the year From 2017 To ensure accuracy, transparency and reliability, each article is known in fact. Our review guidelines ensure unedited reviews when indicated by exchanges, platforms or tools. We strive to provide up-to-date information on everything Crypto and Countchant, from origins to industries.

Investment responsibility

All opinions and insights shared represent the market conditions of the author. Please do your own research before making any investment decisions. However, the author or publication is not responsible for your financial choices.

Sponsored and advertisements

Sponsored content and affiliate links may appear on our site. Ads are clearly marked, and our editorial content is completely independent from our advertising partners.