Bitcoin Tempers ETF Frenzy, But Can It Reignite 8-Year Bull Market?

Ever since the US Securities and Exchange Commission (SEC) approved Bitcoin exchange-traded funds (ETFs) on January 11, 2024, the crypto market has recovered significantly. This ended on March 14, 2024, when Bitcoin (BTC) reached a new all-time high (ATH) at $73,737.

This progress is not limited to America. Hong Kong has just launched spot Bitcoin and Ethereum ETFs, while Australia is preparing to launch its own versions of spot Bitcoin ETFs.

The global enthusiasm community is not only about the Bitcoin currency, but also the digital vision that can be compared to gold.

Can Bitcoin ETFs Help Continue an 8-Year Bull Rally?

Bitcoin's status as a store of value and inflation hedge brings it to the gold market, a comparison that now extends to their respective ETFs. Historical precedents provide a compelling storyline.

In the year The launch of gold ETFs in 2004 sparked a nearly 8-year bull market. The first gold ETF, SDPR Gold Shares, was listed on the New York Stock Exchange (NYSE) on November 1, 2004, at a gold price of $450.80 per ounce. It then rose steadily, reaching $1,825 on August 1, 2011. In 2024, gold reached a price of $2,392 on April 19.

However, according to a post by crypto YouTuber Altcoin Daily via X (formerly Twitter), the BlackRock Bitcoin ETF has achieved in 70 days what the gold ETF took in assets under management (AUM) over 800 days. It highlights the unprecedented demand for Bitcoin compared to gold's early days in the ETF sphere.

“This is just the beginning…” Altcoin Daily reported.

Read more: Crypto ETN vs. Crypto ETF: What's the Difference?

In support of this view, Bitcoin analyst Willie Woo pointed to the current fiscal volatility.

“Now that Bitcoin's inflation has dropped below gold, it will be interesting to see the market price rise above gold as a share of the stock. [S2F] thesis,” Woo commented.

He expects Bitcoin to match his S2F valuation but with a 5-10 year lag. Wu notes the slow pace of the global financial system in adopting such innovations.

Bitcoin's technological architecture may give it another edge over gold. Events like the quadrennial halving are designed to reduce the number of new bitcoins entering the market, theoretically increasing its value over time.

Indeed, historically speaking, post-periods have resulted in significant price increases. In the year A halving was proposed in 2012, from $12 to $1,000 in late 2013. Similarly, the 2016 half-deductible price hike increased from $650 to nearly $20,000 by December 2017.

These patterns suggest a bearish outlook, though with the caveat that price increases are long-term, not immediate. The famous analyst Plan has confirmed this again. Despite the short-term fluctuations, they predict high growth in the future.

PlanB sees a bullish outlook, consistent with historical data and market analysis, despite current market divergence.

“BTC > $100,000 in 2024. BTC Max > $300,000 in 2025,” PlanB said.

Despite the success of the ETF, the price retreat

However, regardless of speculative optimism and historical trends, today's market activity paints a different picture. At the time of writing, Bitcoin is trading at $62,035, which is a slight decrease of 0.47% in the last 24 hours.

Similarly, spot gold is making modest moves, trading at $2,311. This number shows a decrease of approximately 1.02% from yesterday's price.

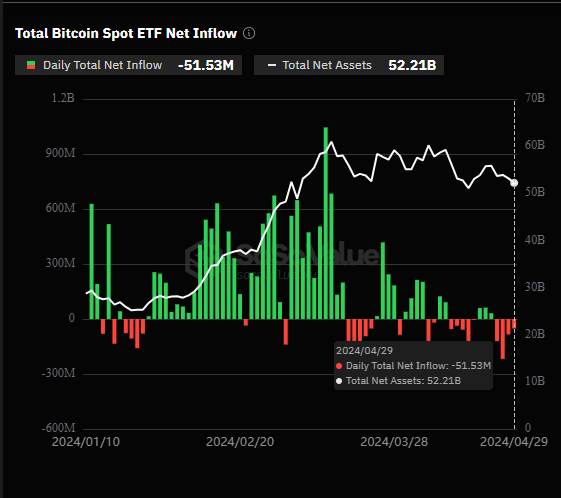

Additionally, according to data from Soso Value, the US spot Bitcoin ETF recorded daily outflows of $51.53 million since April 29, 2024. This marks the fourth consecutive day of negative flow. Even BlackRock's previously top-performing iShares Bitcoin Trust (IBIT) saw no new inflows during the period.

Read More: Bitcoin Price Prediction 2024/2025/2030

These indicators suggest a careful approach. While the excitement surrounding Bitcoin ETFs is palpable and challenging to compare to gold's ETF-led rally, the reality on trading floors of volatility and speculative uncertainty tells a story.

Due to the complex interplay between technology, economics and global regulations, Bitcoin offers a unique investment perspective that may or may not match gold's historic rise. Investors and observers alike would do well to keep a close eye on these developments, considering the potential and pitfalls of this digital asset class.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.