Bitcoin trades above $50k – but this time it’s very different.

Bitcoin (BTC)'s rise to $50,000 on Monday comes on the back of strong institutional demand, likely interest rates, and a lack of Bitcoin revenue in stark contrast to two years ago.

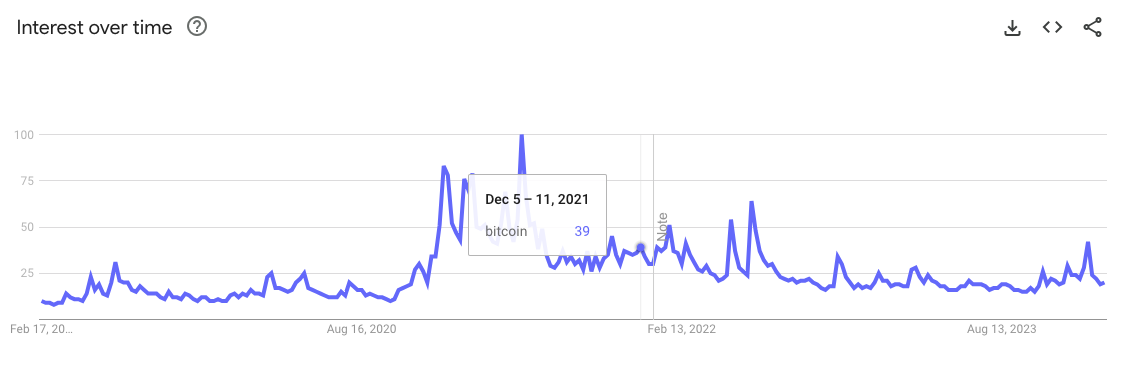

The data shows that the last time Bitcoin hit the $50,000 mark was in December 2021, a period when – unbeknownst to most investors – the crypto was about to collapse into a sustained bear market that was marked by 11 consecutive US interest rate hikes. The collapse of several high-profile crypto institutions and the withdrawal of retail investors from crypto has seen Bitcoin crash.

Last time #BTC was at $50,000.

->50% supply held by lettuce – Terra/Luna run Ponzi – FTX selling paper BTC- GBTC premium buyers get again – Fastest price increase in history – Super Bowl “crypto” ads #BTC at $50,000 today: – 70 supply % held by… pic.twitter.com/yL4ZdiFyzJ

— Mitchell (@MitchellHODL) February 12, 2024

Speaking to Cointelegraph, however, eToro market analyst Josh Gilbert said macro conditions are currently very favorable for risky assets like Bitcoin.

“We have four or five cuts lined up by the Federal Reserve in 2024, after seeing a fourth bitcoin halving increase the asset shortage and billions of dollars flowing into bitcoin ETFs.

The first big boost many investors are looking for is the upcoming Bitcoin halving, Gilbert explained. The halving is scheduled for April and is the time when mining rewards for Bitcoin miners are cut in half. It is widely seen as a bullish boost for the BTC price in the long term.

RELATED: As Crypto Takes Off, Bitcoin Looks Like It Will Surpass Meta in Total Value

Gilbert said there was a positive sentiment around the performance of Bitcoin ETFs, which gives the market more confidence that institutions are buying bitcoin at a faster pace.

In the year A Feb. 12 report from CoinShares found that bitcoin ETFs attracted a total of $1.1 billion in inflows over the past week, the largest seven-day inflow since the ETF went live on Jan. 11.

Meanwhile, retail interest remained low, with crypto market analyst Will Clemente suggesting that this could indicate a more sustained basis for growth in the broader market.

In December 2021, interest in the search term “Bitcoin” was hovering at 39 points, according to Google Trends data. At the time of publication, Bitcoin interest was sitting at just 19, which suggests a relatively low level of retail interest in the asset.

In the year On February 11, analyst platform CryptoQuant CEO Ki Young Ju predicted that Bitcoin could hit $112,000 per coin by 2024, driven by the performance of spot Bitcoin ETFs.

Magazine: At 18, the real-life Doge-to-Moon mm