Bitcoin volatility rises, geopolitical tension rises

Bitcoin (BTC) volatility is at multi-month highs, with price action hitting futures traders on both the long and short side. It comes amid geopolitical tensions, fueling increased demand for safe havens.

As the world watches developments in the geopolitical landscape, TradFi and crypto market participants must scramble for influence.

Bitcoin bow to geopolitical tension

Bitcoin price volatility has been increasing, anticipating a steady uptrend since June 24. Data dashboard BiTBO shows that the last volatility levels were in early May. This metric shows how quickly the price of BTC fluctuates over a period of time.

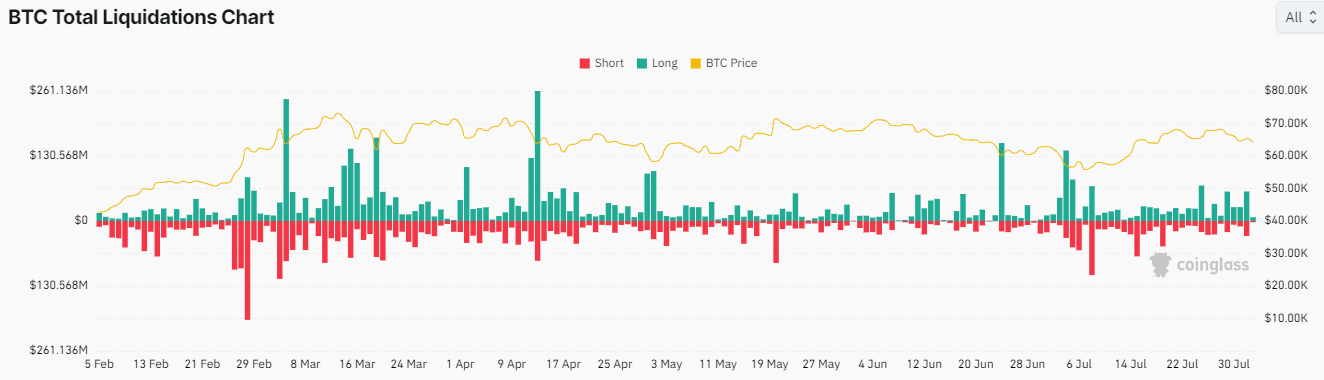

According to data from Coinglass, the volatility caused the loss of more than 90,000 traders, with total crypto market liquidity reaching $267.95 million. In the Bitcoin market, about $60 million long positions were released, compared to about $30 million short positions.

Read more: How to buy Bitcoin (BTC) and everything you need to know

This is in the context of the ongoing conflict between Israel and Hezbollah, which creates an out-of-whack situation. Recent reports indicate that Hezbollah fired a barrage of rockets into Israel's Western Galilee late Thursday.

With a major war and the threat of a major war, markets are experiencing ever-increasing levels of uncertainty and risk. The same attitude occurred during the Russia-Ukraine conflict and the Iran-Israel saga. This shows that financial markets, including crypto, are influenced by fear and risk aversion over geopolitical tensions and conflicts.

“The extent of Iran's attack on Israel will tell us how far the fall will go on Bitcoin and the markets,” said one analyst.

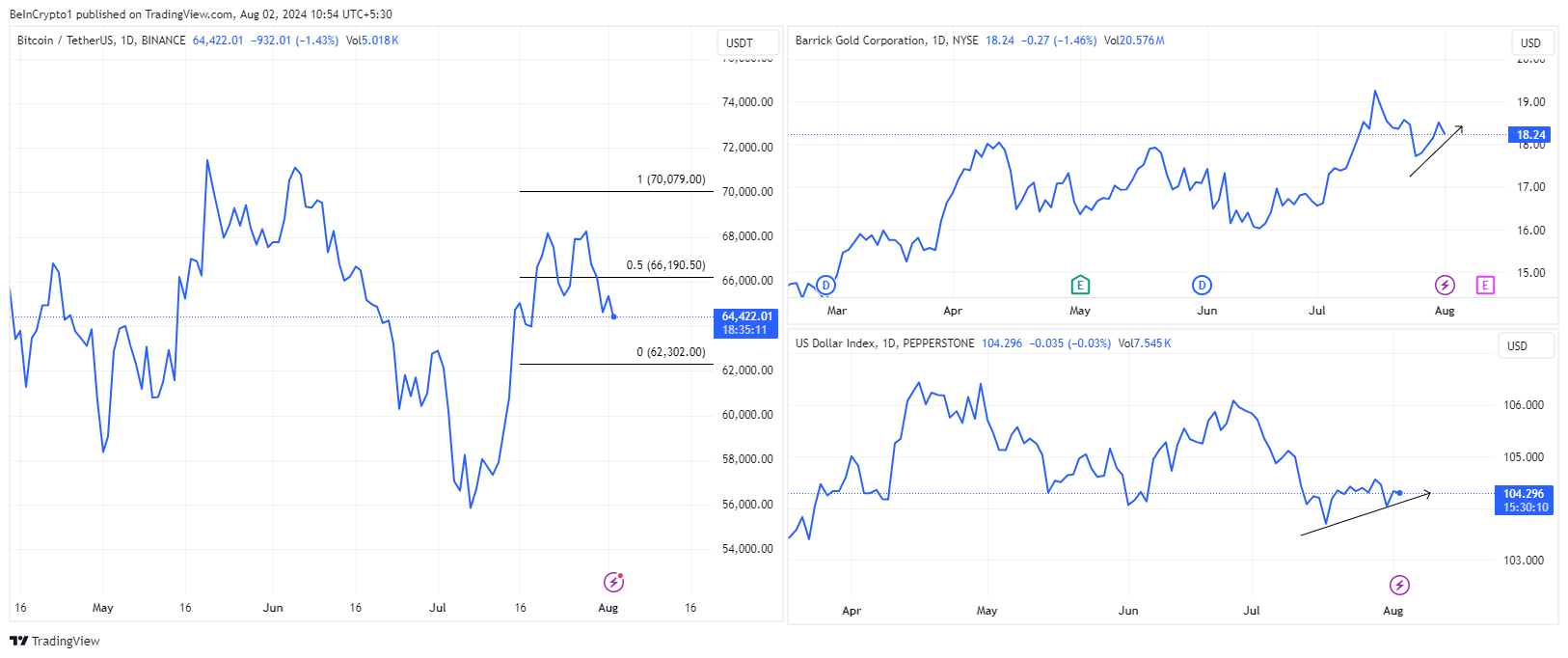

Meanwhile, the US dollar index and precious metals such as gold are rising. The U.S. dollar index, which measures the value of the U.S. dollar against six foreign currencies, rose 0.54 percent last week. This caused Bitcoin to crash by 5% due to its inverse relationship with the USD. A general atmosphere of fear and risk aversion is affecting Bitcoin as investors look to reduce risk and move into traditionally safe-haven assets like gold.

So it is important to monitor the severity of the conflict in the next few days. Global reaction, market sentiment and investor behavior also influence price action.

However, geopolitical instability or conflict can benefit alternative assets such as Bitcoin. It could also drive adoption, as happened in the first months of the conflict between Russia and Ukraine.

Read more: Top 9 Crypto-Friendly Countries for Digital Asset Investors

Investors can turn to alternative assets like Bitcoin to protect their wealth from traditional market volatility. This can increase the demand for Bitcoin and crypto in general, which will effectively increase their value.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.