Bitcoin was difficult in September. Here are the key parameters to look at next.

Key receivers

In September, the market value of Bitcoin fell by 14%. Market sentiment has turned pessimistic due to poor price performance of major cryptos. The data on the chain shows no significant signs of convergence yet.

Share this article

Bitcoin is set to close out September with double-digit losses relative to August. As the market sentiment declines, the top cryptocurrency must hold a critical support level to avoid a major correction.

Bitcoin at risk

Bitcoin is consolidating around the $19,000 support level. Market participants have noticed the weak price action of the top crypto in recent weeks.

Market sentiment for Bitcoin remains negative. Social data from Santiment shows a weighted sentiment of -0.69, while talk about Bitcoin on social media sits below 20%, indicating a decline in demand.

Brian Quinlivan, director of marketing at Sentiment, pointed to the trend in a Sept. 30 report, noting that “the world is in a very weak place and traders don't have much faith that it will recover anytime soon.” This year, crypto has suffered along with other riskier assets amid high inflation, rising interest rates, the global energy crisis and the 2021 bull market.

The decline in interest in Bitcoin can also be seen from a chain perspective. According to Glassnode data, the number of addresses holding at least 1,000 BTC has remained stable at 2,117 addresses over the past three days, following a significant drop of 26.75%. This market behavior has made famous investors lose their desire to accumulate more coins.

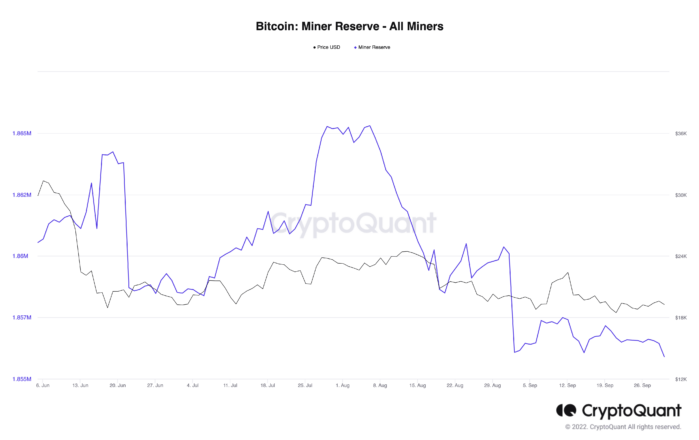

A similar trend is playing out with miners. According to CryptoQuant data, Bitcoin miners' reserves have risen by 1.86 million tokens, which has been at this level for almost a month. The inactivity among miners follows a strong sell-off in August.

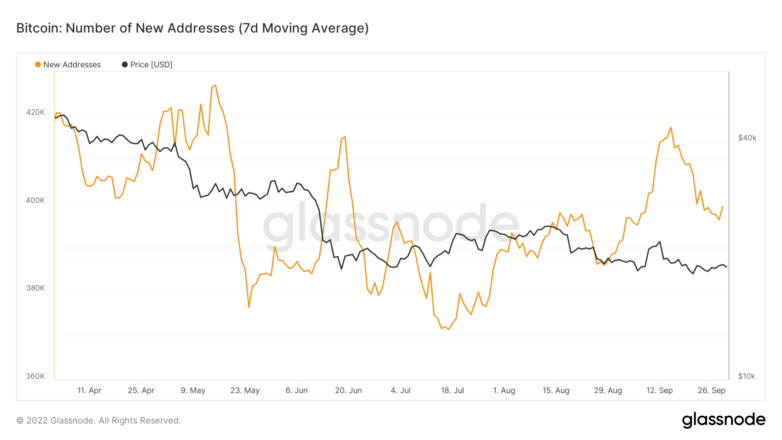

Although the data shows a bleak outlook for the number one crypto, the number of new daily addresses created on the network hints that the top crypto may post a turnaround. The Bitcoin network has been expanding since mid-July with a sharp increase in retail interest. The mass difference between the growth of the network and the value of the property indicates future improvements.

If network growth peaks at more than 417,000 addresses on a seven-day average, the crash narrative can be confirmed.

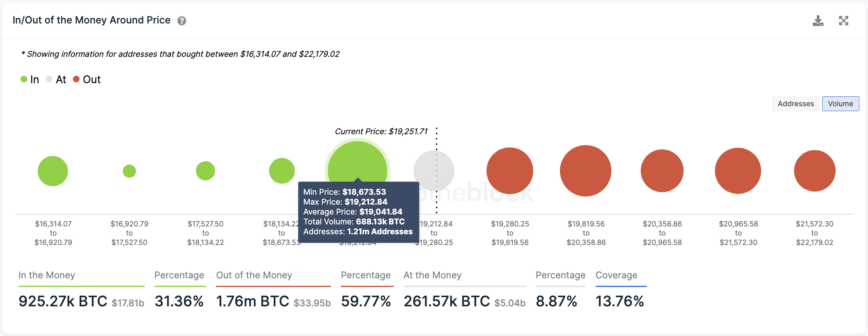

Trading history shows that BTC established a critical support level at $19,000 where 1.21 million addresses bought over 688,000 BTC. This wall of interest must be contained to prevent a steep correction. If it fails to hold this level, a sell-off may occur, sending BTC to $16,000 or below.

IntoTheBlock's IOMAP model shows that Bitcoin faces several areas of resistance ahead. The most valuable is set at $20,000, with 895,000 addresses worth about 470,000 BTC.

It's been a rough year for markets, and crypto hasn't been spared in the downturn. With Bitcoin now almost a year into its brutal bear market, several signs suggest the pain may not be over. Although newcomers are joining the top crypto's network, the global macro picture, sentiment and demand for mining is declining, and recent price action suggests there is no clear reason for the Bitcoin narrative to reverse anytime soon.

Disclosure: At the time of writing, the author of this article owned BTC and ETH. The information in this article is for educational purposes only and is not investment advice.

For more key market trends, subscribe to our YouTube channel and get weekly updates from leading Bitcoin analyst Nathan Batchelor.

Share this article

The information on or included in this website is obtained from independent sources that we believe to be accurate and reliable, but we make no representations or warranties as to the timeliness, completeness or accuracy of any information on or accessible from this website. . Decentralized Media, Inc. Not an investment advisor. We do not provide personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may be out of date, or may be incomplete or incorrect. We may, but are not obligated to, update any outdated, incomplete or inaccurate information.

You should not make an investment decision in an ICO, IEO or other investment based on the information on this website and you should never interpret or rely on any information on this website as investment advice. If you are seeking investment advice on an ICO, IEO or other investment, we strongly recommend that you consult a licensed investment advisor or other qualified financial professional. We do not receive compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities or commodities.

See full terms and conditions.