Bitcoin Will Not Fall Below $60,000 Again: PlanB

Bitcoin stole the spotlight by rising to a new all-time high of $73,760 on March 14, 2024.

This figure is a major milestone in BTC's journey, especially as it approaches the expected halving. PlanB, popular in the crypto community, shared insights on this event, giving predictions about the future of Bitcoin.

$200,000 is a conservative target for Bitcoin.

At the heart of Bitcoin price forecasting by Planby is the Stock-to-Flow (S2F) model. Compare the current supply of Bitcoin with the flow of new BTC entering the market and expect significant price movements in conjunction with halving events. These are the times when the reward for mining Bitcoin transactions is halved, thus reducing the supply of new coins.

According to Planby, BTC's alignment with the S2F model's predictions, especially before the Bitcoin halving, is a critical indicator of its future performance. A transition from “blue to red” points in the Planby model indicates a transition to a new market cycle, while red indicates a bull market.

This change is predicted to continue based on historical patterns, signal development and ongoing bullish activity.

Planby suggests that while the market faces volatility, with a potential increase of 20-30%, the overall trend remains upward.

“We're going to have a huge price increase from here. [potentially] 100,000 dollars this year. [But] Note that this model jumped to about $500,000 in April, which is the average price level for this half of the time. He [may] It takes about two months or a year to get to that point, so the next peak will be next year, 2025, not this year,” Planby explained.

As for the next market peak, some predict that Bitcoin will reach $200,000. However, according to Planby, such a figure may fall short of expectations. In terms of S2F, he's looking at a higher than average target, perhaps more than $500,000 with the model's projections.

Read more: Bitcoin price prediction for 2024/2025/2030

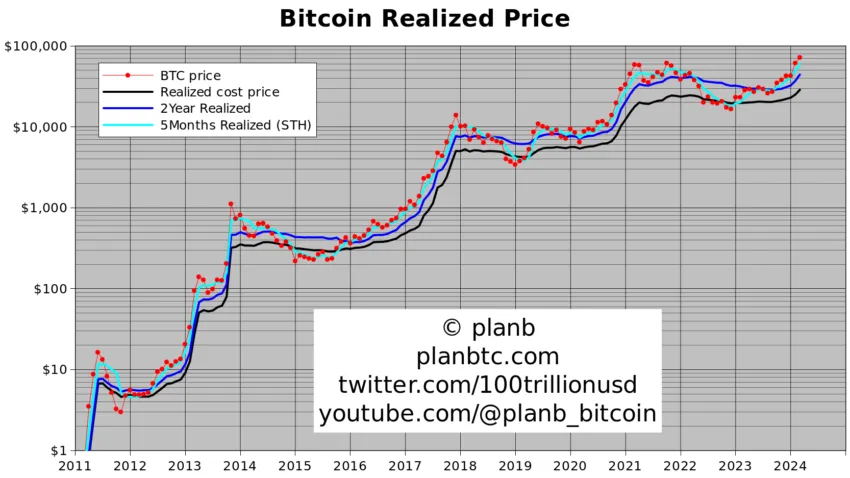

A key factor reinforcing this optimism is the behavior of indicators on the chain, such as the confirmed price and the two-year confirmed price, which show impressive growth during bull markets. The five-month confirmed price, in particular, forms a new strong support level at $60,000.

“The five-month guaranteed rate, that short-term mortgage rate, is now at $60,000. That is a very powerful floor because if we look at previous bull markets, then you will see that the price of Bitcoin will not go below that. [the five-month realized price]. So that's my personal aggressiveness floor that I think we're not going to go down any further,” Plan added.

In addition, the relative strength indicator (RSI) provides an interesting narrative. Currently, at the highs before the halving, the RSI suggests that Bitcoin is entering this level with unprecedented strength. This may indicate a shift away from the contractionary conditions of previous cycles to exponential growth.

In conclusion, Bitcoin stands at a critical juncture, supported by a confluence of indicators that suggest the rally is far from over.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.