Bitcoin will recover as Trump prepares pro-crypto executive orders

Bitcoin bounced back to $94,000 as Donald Trump prepares to sign pro-crypto executive orders on his first day in office.

These orders may override key regulatory actions, including the SEC's Staff Accounting Book 121 (SAB 121).

Trump is reportedly preparing to overhaul Crypto regulations from day one.

According to The Washington Post, the orders are expected to address major challenges facing the crypto industry, including banking restrictions and the controversial SAB 121.

This SEC announcement requires companies whose clients hold cryptocurrencies to record those assets as liabilities on their balance sheets.

“SEC lifts SAB 121 on issue for big banks, but not widely enough Zach Guzman wrote.

SAB 121 has been a focal point of industry criticism. Lawmakers tried to repeal the directive last year.

However, President Joe Biden vetoed the measure despite bipartisan support in Congress. The Trump administration is expected to urgently revisit the issue.

Currently, the SAB 121 policy makes holding crypto more expensive and risky for banks. Therefore, they are less likely to offer crypto protection or other services to their customers.

“Congress passed repeal last year, but Biden vetoed it. At $5m BTC, it is the third of Saylor's three incentives: ✅ Spot ETFs ✅ Fair value accounting ✅ Banks can hold Bitcoin (SAB 121 repeal),” wrote crypto entrepreneur Julian Fahrer.

Bitcoin and crypto markets will be green again

After the news, the crypto market showed a strong recovery after the initial dips earlier in the day. Bitcoin fell to $89,000, its lowest in two months. Since the news, BTC has returned to $94,500 at the time of reporting.

Also, Ethereum followed the same trend by recovering from the dip below $3,000 to $3,100. AAVE, an altcoin linked to Trump-backed World Freedom Financial (WLFI), saw a 5% jump in one hour.

Additionally, additional reports suggest that Trump's executive orders could provide better banking services for crypto businesses. His orders contradict the practices of industry leaders as “banking”.

FDIC Vice Chairman Travis Hill recently condemned past banking restrictions on crypto companies. He asked for clear guidelines to support the industry.

Similarly, Trump's team has reportedly proposed restructuring the FDIC and consolidating bank regulators to improve efficiency.

Apart from these developments, there are other pro-Cryto developments expected on the inauguration day. David Sachs will take on the role of the first crypto czar, and crypto-friendly former regulator Paul Atkins will lead the SEC.

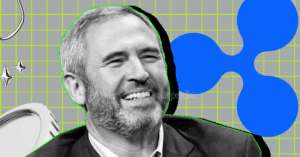

Meanwhile, major crypto firms such as Ripple, MoonPay and Kraken have contributed heavily to Trump's inauguration events. These donations may help them discuss future crypto policies with the administration early.

In general, Trump's inauguration scheduled for next week is expected to bring about a change in US crypto policy. The market, still reeling from earlier volatility, took the news as a sign of potential growth and stability under a more crypto-friendly presidency.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.