Bitcoin’s new all-time high sparks $400 million market cap

Bitcoin hit an all-time high of nearly $80,000 on Sunday, fueled by renewed optimism in the crypto community following the election of Donald Trump as US president.

This support sent Bitcoin higher, making the rally seem unstoppable for the time being.

Bitcoin's latest ATH moves $400 million in market liquidity

On November 10, Bitcoin hit an all-time high of $79,600, surpassing its previous all-time high (ATH) of $77,000, according to BeCrypto data. Although it has dipped slightly to $79,326 at press time, the leading digital asset's price is still up more than 3 percent in the past 24 hours.

“$79k bitcoin, new ATH calm folks, this is just the beginning. This is the time to be precise and firm. There's no need to rush, HODLing will do the work for you, says Bitcoin investor Tur Demeister.

Analysts attribute much of this development to Trump's optimism about his return to office. Many speculate that his administration may take a positive approach to crypto regulation, adding more momentum. Trump himself has shown support for crypto by attending several industry events, including the Bitcoin2024 conference, and has pledged to foster a pro-crypto environment.

Similarly, cuts in global interest rates have recently exacerbated Bitcoin's price action. The U.S. Federal Reserve and the Bank of England recently cut interest rates by 25 basis points, a move that will increase liquidity in softening the dollar. These factors have historically favored risk assets such as Bitcoin, making them an attractive option for investors amid relaxed monetary policy.

Meanwhile, Bitcoin's new record high has positively impacted the broader crypto market, with several leading assets riding the wave. In the last 24 hours, Ethereum gained 5.4%, Solana gained 3.2%, and Dogecoin gained 11%.

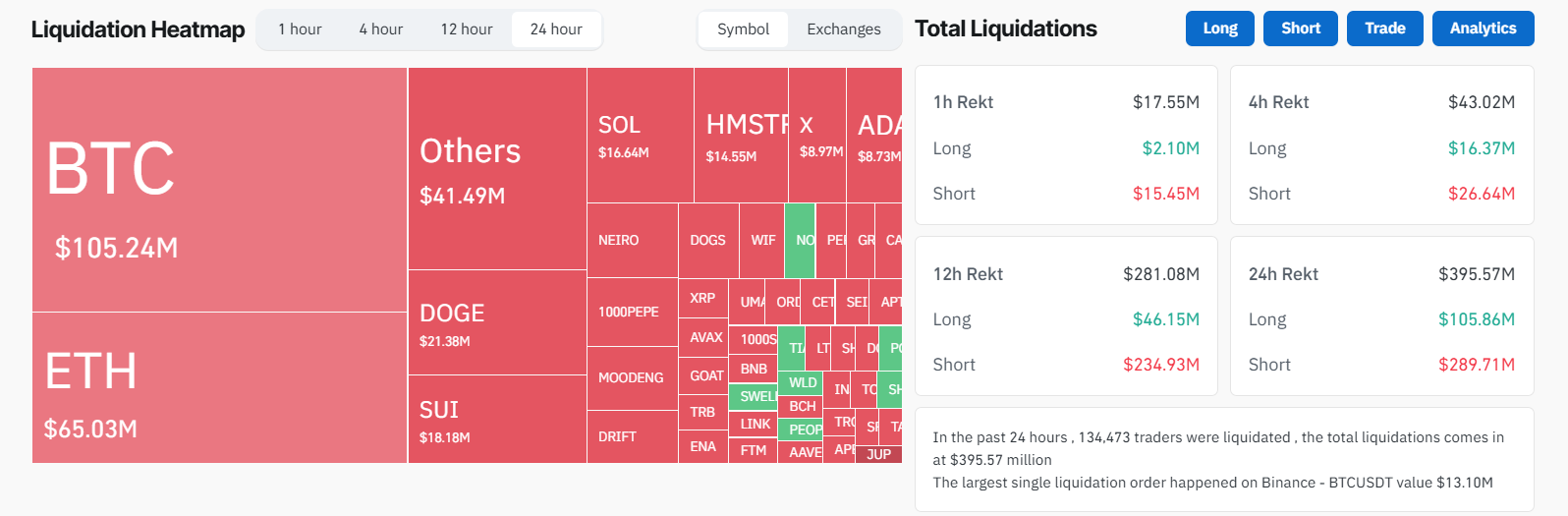

However, this massive market underperformance has resulted in significant losses for traders speculating on the value of these digital assets. According to Coinglass, more than 132,000 traders have withdrawn nearly $400 million during the market boom.

Short sellers — who were playing on the market's decline — saw the biggest losses, totaling $288.46 million. Long traders faced smaller setbacks, with total losses of about $105.6 million. Bitcoin traders account for about 30% of liquidity at $105 million, followed by Ethereum traders at $65 million.

Across exchanges, Binance experienced the highest volume of liquidity, representing 46.76% of the total or $180 million. Other exchanges such as OKX and Baybit also recorded significant losses, with $79.6 million and $65.4 million respectively.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.