Bitcoin’s new ATH marks the biggest advance since January 2023

Bitcoin has been on a remarkable rise recently, with the cryptocurrency reaching new all-time highs almost every day this week. Unlike previous highs, this rally appears to be sustainable, driven by strong market fundamentals.

Bitcoin's continued growth has attracted significant attention, positioning the asset for further potential growth.

The strength of Bitcoin gains

According to Glassnode's analysis, Bitcoin's realized cap has increased by 3.8% over the past 30 days, marking one of the most significant flows since January 2023.

“The Realized Cap is currently trading at an ATH value of $656 billion, backed by a net 30-day capitalization of $2.5 billion,” Glassnode explained.

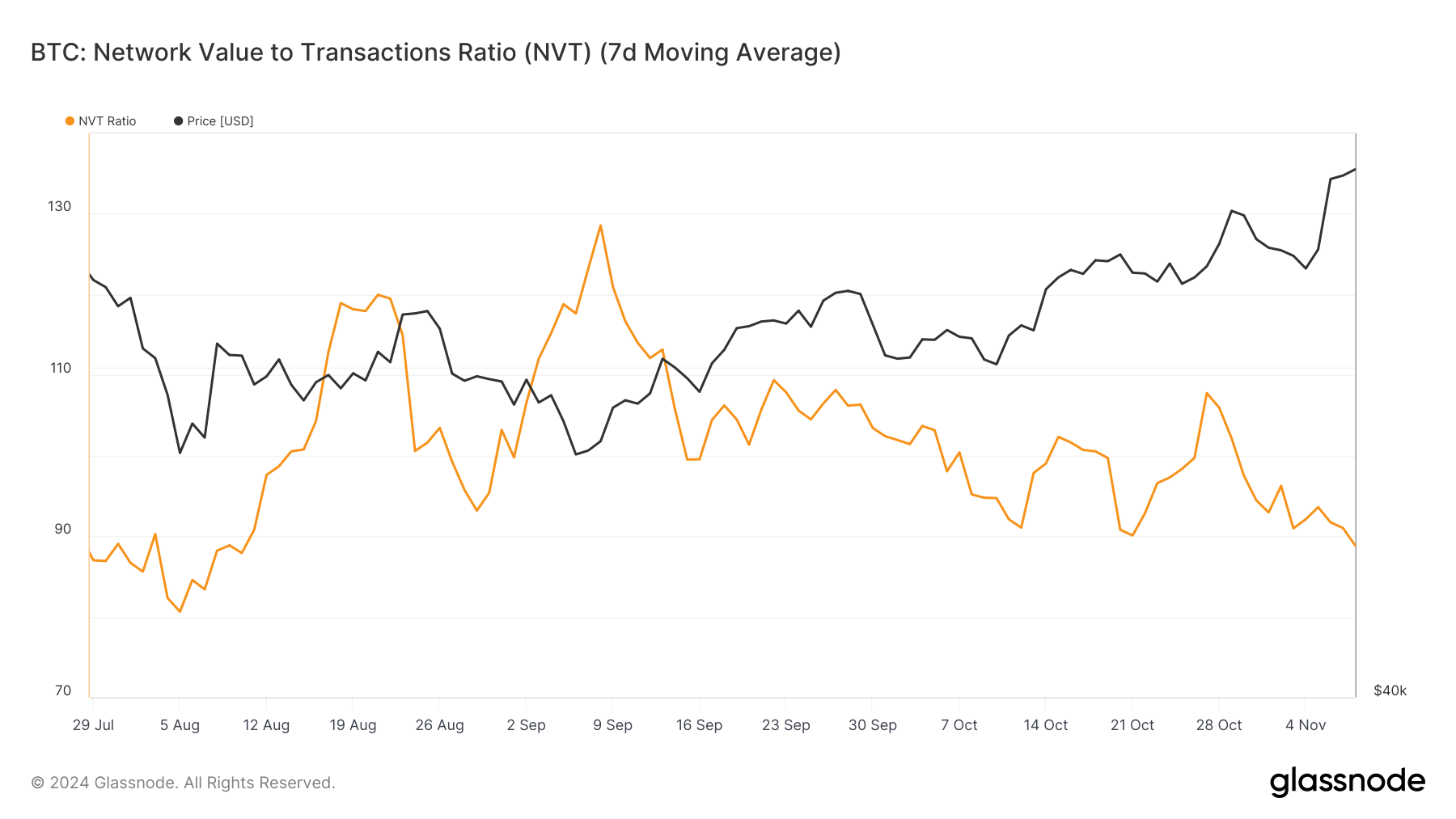

Bitcoin's macro momentum is strong, supported by the NVT (Network Value to Transactions) ratio, which is currently at a three-month low. A low NVT ratio indicates that Bitcoin is not overvalued, which reduces the chance of a quick correction.

This underestimation, as seen by NVT, suggests that Bitcoin's growth is not driven by speculative gains, as in previous rallies. With its value based on trading strength, Bitcoin seems well-positioned to continue its upward trajectory, drawing confidence from investors who see this as a stable growth phase.

ETH Price Prediction: ATHs Continue

At the time of writing, Bitcoin is trading at $76,443 during intraday trading on Friday. This continued growth reflects Bitcoin's resilience in the face of broader economic shifts and confirms strong buyer demand.

While Bitcoin is on the verge of crossing $80,000, it may see a small dip to test support around $73,773. This pullback allows BTC to consolidate before launch, maintaining healthy growth without triggering overbought conditions.

However, if Bitcoin fails to bounce back from this level and investors start taking profits, its price may drop further. A break below $73,773 could lead to a decline to $71,367, which would challenge the current bearish outlook and promote caution for short-term traders.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.