Bitfinex Launches Perpetual Futures for Bitcoin and Ether with ‘Indirect Volatility’

Share this article

Bitfinex Derivatives, the derivatives platform operated by iFinex Financial Technologies Limited (Bitfinex), has launched two new sustainable futures contracts designed to track the implied volatility of Bitcoin (BTC) and Ether (ETH) options.

The announcement comes as Bitfinex looks to expand its suite of trading tools in response to an increase in the volatility of the crypto market. Implied volatility in this offering, according to Bitfinex, “measures the ongoing and expected volatility in the options market.

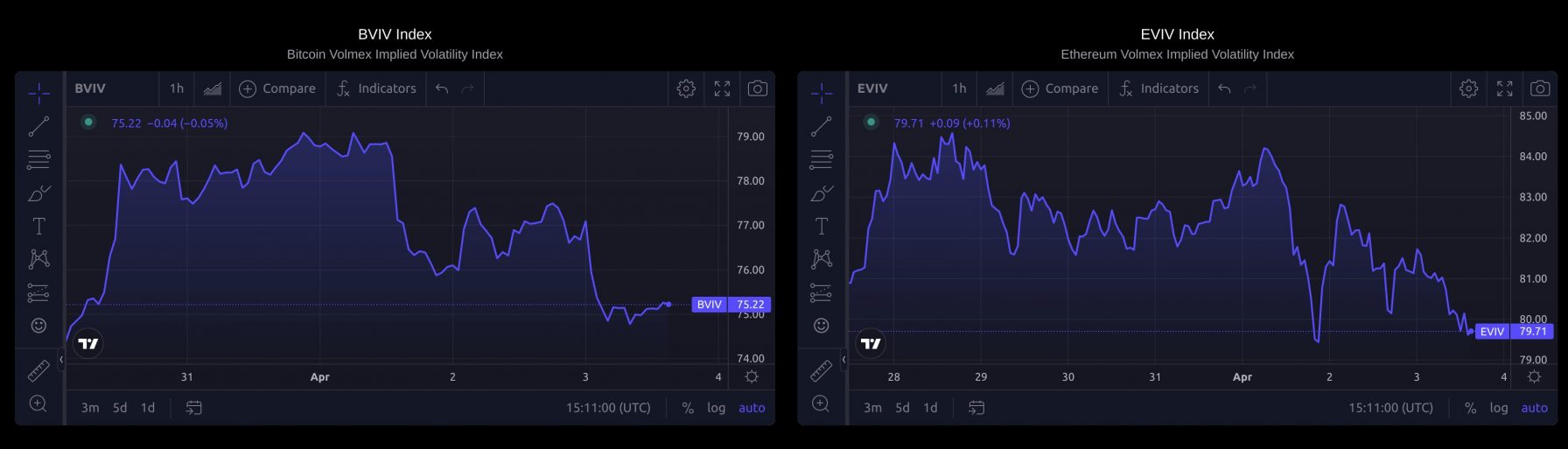

The new contracts are based on the Volmex Implied Volatility Index: Bitcoin Implied Volatility Index (BVIV) and Ethereum Implied Volatility Index (EVIV). These indices track the expected 30-day volatility of BTC and ETH options contracts. Volmex Labs licensed the Bitfinex indices, allowing Bitfinex to use them for the new perpetual futures offering. BVIV and EVIV are the first crypto volatility indices in the industry.

These new perpetual futures contracts track the expected 30-day volatility of Bitcoin and Ether based on an index method developed by Volmax Labs, and are said to be able to trade at leverage of up to 20 times.

“Measuring the future price volatility of the market, BVIV and EVIV contracts are tracking ‘fear' in the market of expected price movements in Bitcoin and Ether when the market is fearful and the price of the relevant options contracts in general,” Bitfinex said in a press release.

Bitfinex Head of Derivatives Jag Conner emphasized the importance of these new offerings. Conner said the indices allow Bitfinex Derivatives users to “not only track but also trade the implied volatility of Bitcoin and Ether in a simple perpetual format.”

Perpetual futures, also known as perpetual swaps, are derivative contracts that allow traders to predict the future price of an asset without an expiration date. Conner explained that perpetual futures are “the best-selling format in the crypto space” because they don't rely on a set structure like other contracts.

A funding mechanism in such a format helps to keep prices in perpetuity in sync with the underlying asset or index (BTC and ETH, in this case). With the new dynamic futures, Bitfinex users can now bet on expected bullish or bullish price movements.

In this format, betting with long volatility matches the price movement of the asset based on how strongly it changes over a period of time. When investors anticipate high price volatility, volatility increases; Conversely, when the expectation is muted price action, volatility contracts.

Cryptocurrency volatility reached an all-time high in March 2024, with the “Market Violent Index” (CVI) for the crypto market reaching 85 points on March 11. This surge in momentum comes two days before Bitcoin arrives. It is an all-time high above $73,000 on March 13. Currently, CVI indicators indicate crypto volatility at around 76 points.

Share this article

The information on or included in this website is obtained from independent sources that we believe to be accurate and reliable, but we make no representations or warranties as to the timeliness, completeness or accuracy of any information on or accessible from this website. . Decentralized Media, Inc. Not an investment advisor. We do not provide personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may be out of date, or may be incomplete or incorrect. We may, but are not obligated to, update any outdated, incomplete or inaccurate information.

Crypto Briefing may include articles with AI-generated content created by Crypto Briefing's own proprietary AI platform. We use AI as a tool to deliver fast, useful and actionable information without losing the insight – and control – of experienced crypto natives. All AI-added content is carefully reviewed, for accuracy, by our editors and writers, and we always draw from multiple primary and secondary sources to create our stories and articles.

You should not make an investment decision in an ICO, IEO or other investment based on the information on this website and you should never interpret or rely on any information on this website as investment advice. If you are seeking investment advice on an ICO, IEO or other investment, we strongly recommend that you consult a licensed investment advisor or other qualified financial professional. We do not receive compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities or commodities.

See full terms and conditions.