Bittensor (TAO) developments could not stop investors’ concerns

Since August 9, Bittensor's (TAO) price has experienced a steady decline every day. This downward trend is in stark contrast to the altcoin's bullish performance from August 5th to 8th.

Holders were hoping the TAO would build on the uptrend and test last week's high. However, it seems that the same investors are also responsible for this failure.

Project development is not enough to drive the Bittensor stock

At press time, TAO is trading at $278.93, representing a 15% decline over the past four days. According to the daily chart, the Money Flow Index (MFI) and On Balance Volume (OBV) have remained in the same position since the beginning of the downturn.

MFI fluctuates between 0 and 100, using price and volume to measure buying and selling pressure around a cryptocurrency. It shows an increase in buying pressure when it rises. However, a drop indicates increasing sales.

But since the indicator is stagnant, it means that TAO investors are not actively buying or selling tokens, but sitting on the sidelines. According to MFI, OBV is a measure of buying and selling pressure. However, this indicator only looks at the sound and has the same meaning as the previous one.

Read More: How to Invest in Artificial Intelligence (AI) Cryptocurrencies?

As seen above, the OBV on the Bittensor chart remains stable, indicating that investors are not expecting price increases. This sentiment is in contrast to last week's gains after TAO added Grayscale to their investments.

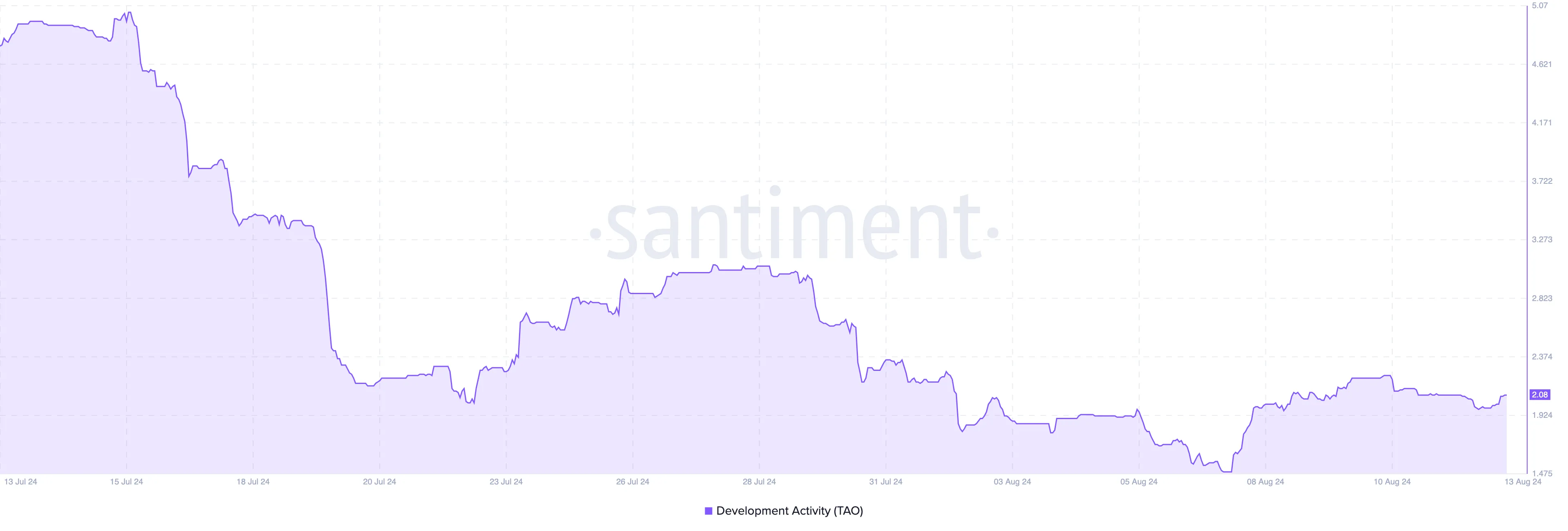

Meanwhile, on-chain data shows that Bittensor's development activity has improved, suggesting that work is being done behind the scenes to fix issues and add new features to the blockchain.

TAO Price Prediction: Bulls fall as price eye $241

Another look at the chart shows that the bulls are trying to push the TAO higher, but they are facing roadblocks. This can be seen from the relative strength index (RSI) signal.

The RSI, which measures momentum, crossed above the neutral 50.00 line on August 8, indicating a possible bullish trend for TAO. However, this is no longer the case, as the RSI has since fallen, indicating that the momentum is weakening and lacking the strength to sustain further price increases.

The Exponential Moving Average (EMA) also adds more context to this position. EMA measures the direction of a trend over a period of time. As of this writing, the 20-day (blue) and 50-day (yellow) are above the TAO price, indicating that the trend is weak.

Called a death cross, whenever the EMA is higher than its short, it indicates price weakness, suggesting that the signal may continue to fall. If it is the other way around, it will be a golden cross.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrency in 2024

From the image above, the TAO price can drop to $241.19, where it is the 0.236 Fibonacci retracement indicator. For context, the fib indicator shows price levels that can be used as support or resistance.

However, if investors start buying TAO again, the price forecast may change. If this is the case, TAO could rise to $288.91 or close to $327.48.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.