Bitwise files for XRP ETF via Delaware Trust

Key receivers

Bitwise Establishes Delaware Trust as Prerequisite for XRP ETF. The SEC's caution on crypto ETFs reflects a lengthy approval process.

Share this article

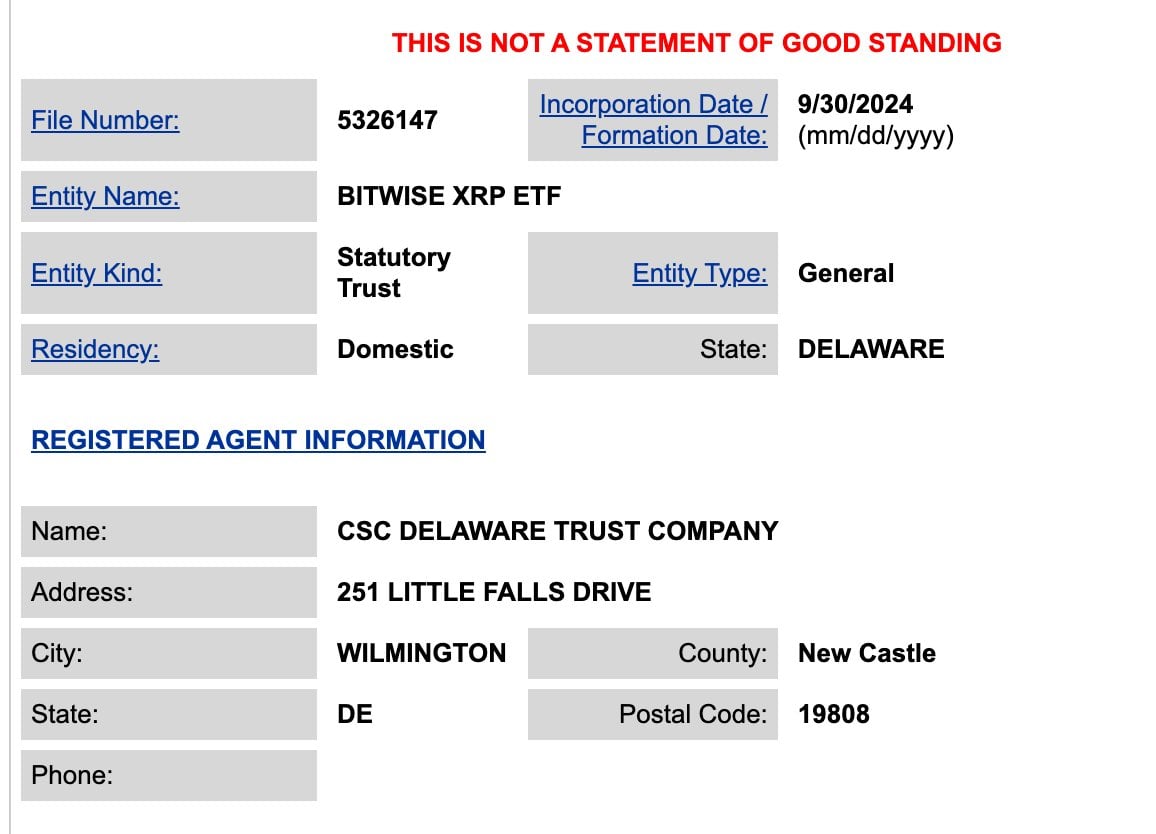

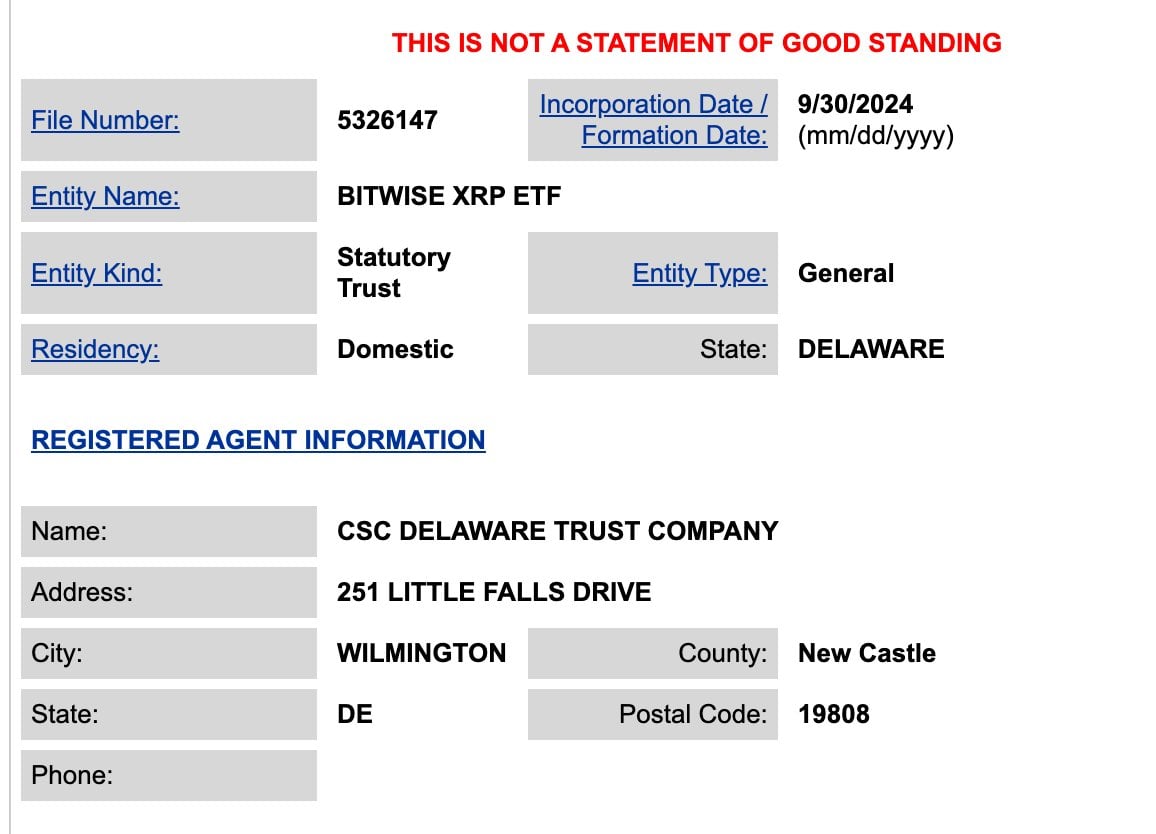

Crypto asset manager Bitwise has taken a step forward to launch the XRP ETF. According to a filing with the Delaware Division of Corporations, the company has set up a trust that could serve as the basis for the XRP ETF.

As of this writing, no related documents have appeared in the SEC's EDGAR database, which is the official repository for ETF proposals.

The move follows a pattern seen in the crypto ETF sector, where asset managers create trusts before seeking approval from the SEC for an exchange-traded product.

The filing drew attention in the crypto community, particularly among those interested in XRP, the digital asset associated with Ripple. XRP has been the subject of regulatory scrutiny in recent years.

The road to an accepted XRP ETF may face challenges. The SEC has taken a cautious approach to crypto-based ETFs, approving Bitcoin and Ethereum ETFs after a lengthy application process and regulatory discussions.

Bitwise's move follows the launch of Bitcoin ETFs by companies such as BlackRock and Fidelity earlier this year. These approvals marked a change in the regulatory landscape of crypto investment products.

The potential XRP ETF represents another advance in the integration of digital assets into traditional finance. However, regulatory approval is not guaranteed, and the process can be lengthy.

As the crypto market continues to evolve, Bitwise's filing of the XRP trust through Delaware is a development that market participants are watching. The subject of ongoing regulatory and market debate, the crypto could bring new investment vehicles for XRP.

Last month, Grayscale introduced an XRP trust in the US targeting accredited investors, potentially paving the way for an ETF conversion amid Ripple's ongoing legal battles with the SEC.

Share this article