Blackrock Bitcoin Holdings Up After Grayscale Selloff?

BlackRock, the world's largest asset manager, significantly increased its holdings of Bitcoin (BTC) on Friday, December 6. This growth came shortly after another asset manager, Greyscale, sold $150 million worth of BTC.

Gaining Courage signifies BlackRock's growing confidence in the flagship cryptocurrency. With institutional players buying Bitcoin after its $100,000 triumph, what could be next for the coin?

Bitcoin continues to receive support from BlackRock.

On Thursday, December 5, the price of Bitcoin rose to $100,000 for the first time. Arkham Intelligence reported.

In contrast, BlackRock, which is said to hold 500,000 BTC, took a different approach. The investment giant added $750 million to its Bitcoin holdings a day later, showing confidence in the asset's long-term prospects despite recent price swings.

According to BeinCrypto findings, this surge in BlackRock's bitcoin holdings was crucial in helping the cryptocurrency retest after briefly dropping $100,000 to $97,000. But now the question is will BTC continue to rise?

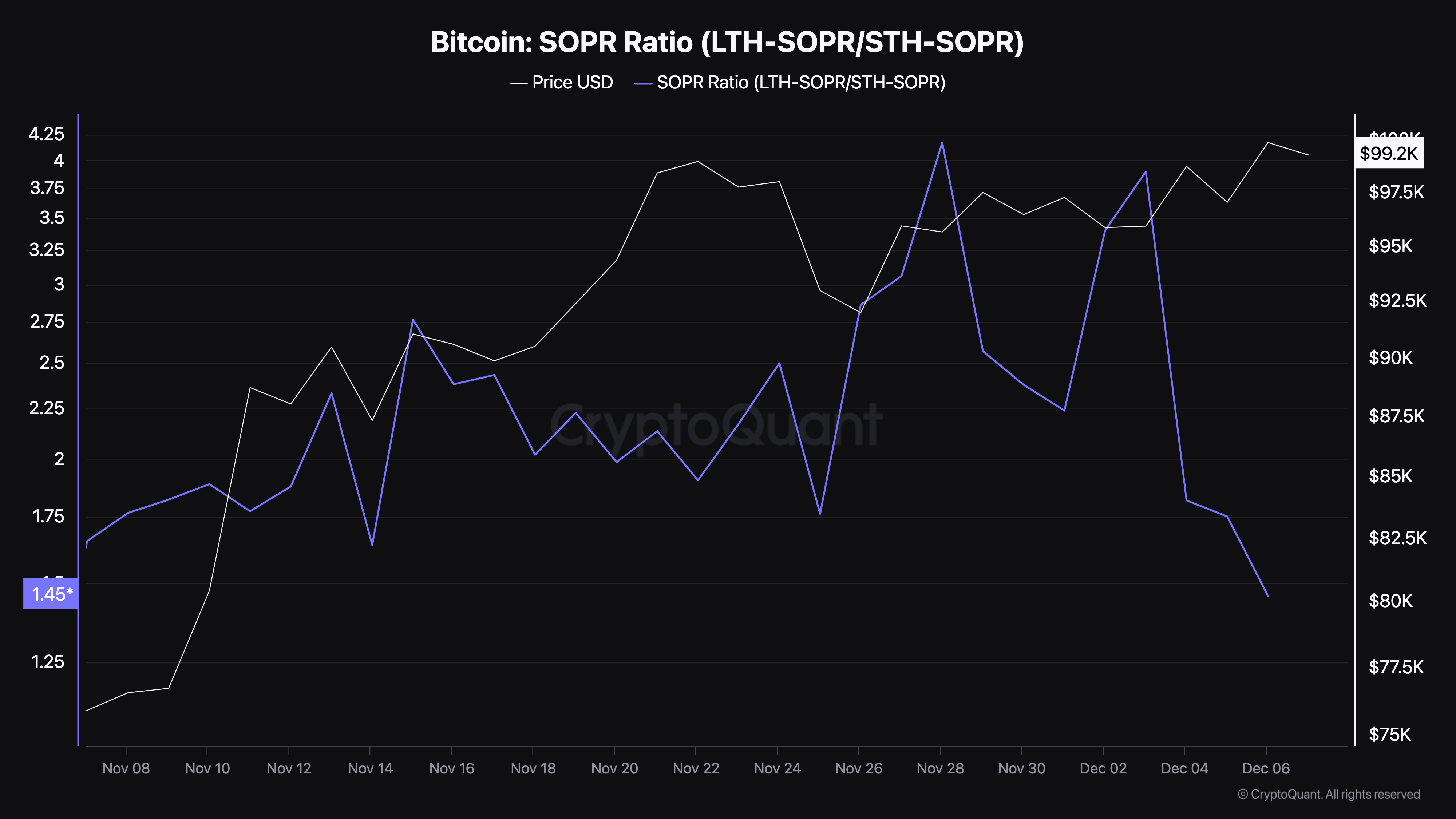

One way to tell if the price of Bitcoin will continue to jump is to look at the SOPR. SOPR stands for Cost Output Profit Ratio. It is calculated by dividing the profits held by long-term holders (LTH) by those held by short-term holders (STH).

When the ratio is higher, it means that LTHs have more leverage than STHs. In this example, it means that the price is close to the area or the top of the market. However, according to CryptoQuant, Bitcoin SOPR has dropped to 1.45, which shows that STHs are dominant, and the price is close to the bottom.

If this trend continues, Bitcoin price could trade above $100,000 in the coming weeks.

BTC Price Prediction: Could $100,000 be Just the Beginning?

From a technical perspective, Bitcoin price is trading in a symmetrical triangle on the 4-hour time frame. A symmetrical triangle pattern shows a period of consolidation, where the value narrows between converging trend lines before a breakout or breakdown occurs.

A break below the lower trendline usually indicates the start of a bearish trend, while a break above the upper trendline usually indicates the start of a bullish trend.

Additionally, Chaikin's Cash Flow (CMF) is in positive territory, indicating obvious buying pressure. If this remains the same and BlackRock's Bitcoin holdings increase, BTC price could rise to $103,649.

In an extremely extreme scenario, the price of Bitcoin could rise to $110,000. However, if institutions like Greyscale continue to sell at high volumes, this may not be the case. Instead, the price of Bitcoin could drop to $93,378.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.