in short

Writing in the Economist, Cory Maker of the Bill, Called by Clock Coly Fink and COR Drose “the next major evolution in the infrastructure of the market” according to the executives, it will enable quick settlements and will expand the world of investment collections by inserting marital property records into digital researchers. Exprets Tiat said that they use “one multi-cycle transition” for the decryption “multi-cycle transition” they use the expression “the owner is not one-cycle revolution”.

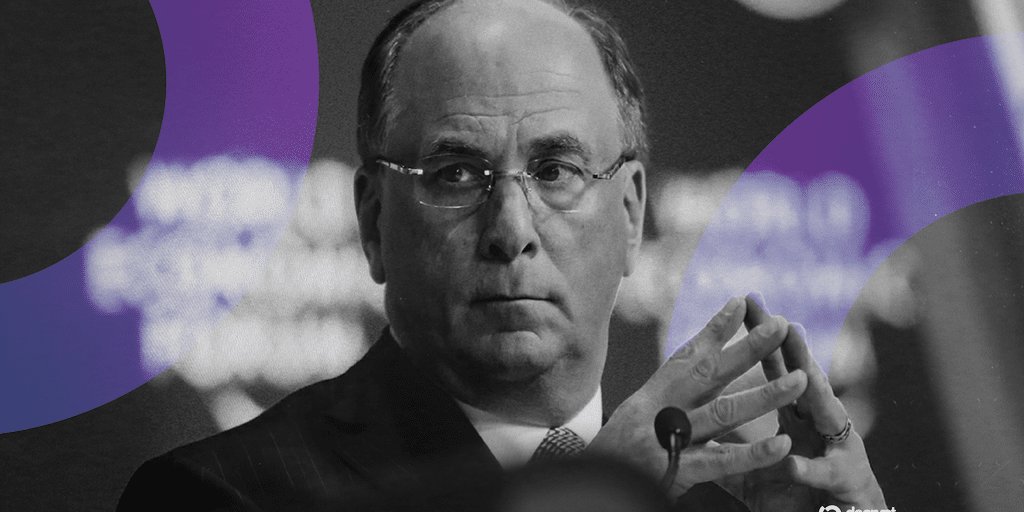

BlackRock's operations were conducted in the 1970s, when electronic mail was introduced in the 1970s.

In a new column b EconomistBlackrock COO GAIL FIRIND and COR RARENE “in the infrastructure of the market” in the next major evolution in the market infrastructure “in the next major evolution” that will be released “in the managers” is “punished”.

Popularity Delays in ownership of property rights among digital workers have revealed that stocks, bonds, real estate and other holdings can be sold and cannot exist without traditional intermediaries.

The vision of the executives fits into the agenda set by Black Rock in adults, Back to the Finks 2022 statement That “next generation, the next generation will create a sense of security for the evil generation.”

“In the beginning, it was very difficult for the financial world to see a big idea, which often seems speculative,” wrote Duo.

But below that noise, “insertion” can significantly expand the world of non-investing investments “and” if it replaces the current transactions, it will provide the ability to solve the existing and records that are not stopped with the rest of the finances. “

The world's largest asset managers associate traditional institutional institutions with DND-ZIG-first innovations, saying that technology is “built on both sides of the river” and that technology will not replace it now.

Multi cycle transition

Joshua Wei is a lawyer and co-chairman of the Hong Kong Web3 Association Decrypt This Blackrock “Maybe it will be part of the next generation of the direction to the markets, but in my opinion it became a master.”

“This is a narrow, well-built system of service issues that later one-cycle arguments are later accused of one-cycle participation. One-cycle one cycle is a one-cycle revolution that is destroyed in the next year,” he said. “That's not how innovation works.”

“Introduction modern money has its place in them, but it was worried,” he said, but the crowded Vavilla structure “is only a real problem in reducing the risk of settlement, reducing the risk of resistance, or reducing access to rare assets.

Growing but still nshich

Regulated financial assets are international equity and bond markets. Still, expanding by more than 300 percent in the last 20 months, today Brains sold 16 million dollars to users “in 1996.

The world's largest asset manager is already building towards that future with Blorrock's USD Digital Liquidation (BUIDL) Discuss last year And it has grown to 2.3 billion dollars, which is the highest in the world Rwa.xyz data.

“We must defund all assets of the ‘middle class'.” Alternative investors The technology will help lower costs and eliminate middle-of-the-road coverages during Blocrock's third-quarter earnings call for real estate.

Daily claim news newspaper

Start every day with all the news stories, plus original features, podcasts, videos and more.