BlackRock holds $78 million in shares in IBIT across two investment funds, new filings show

Key receivers

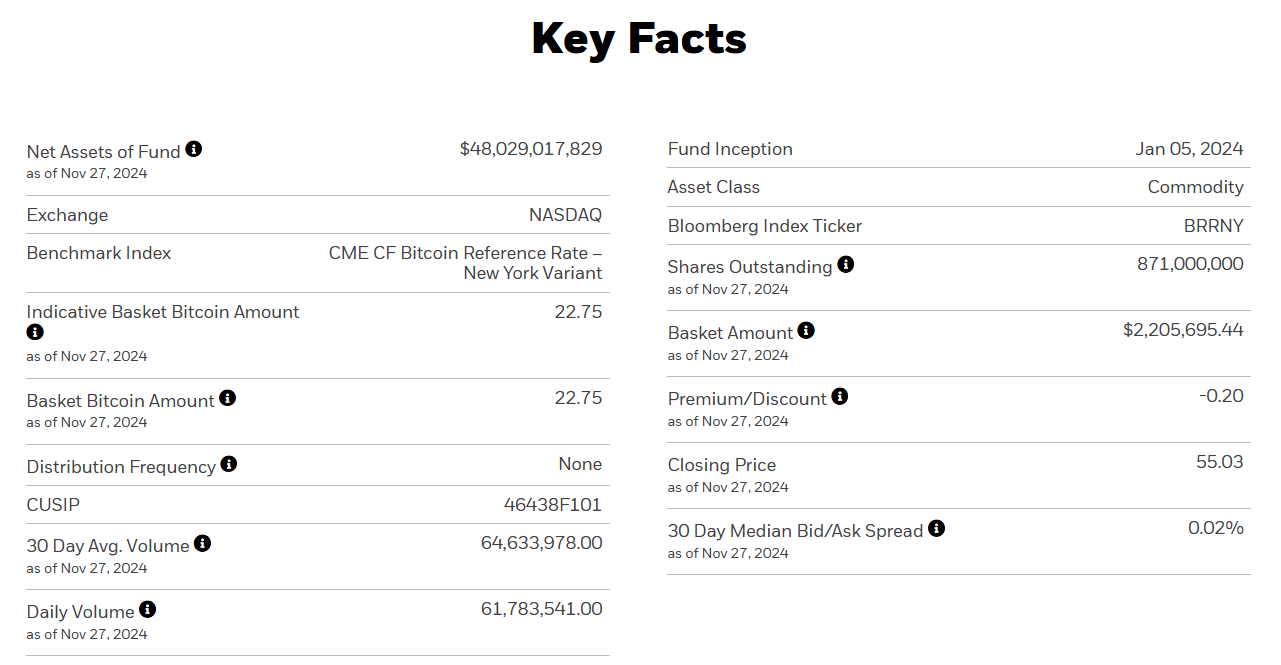

Two funds managed by BlackRock hold $78 million worth of IBIT shares. IBIT's assets under management grew to $48 billion as of January.

Share this article

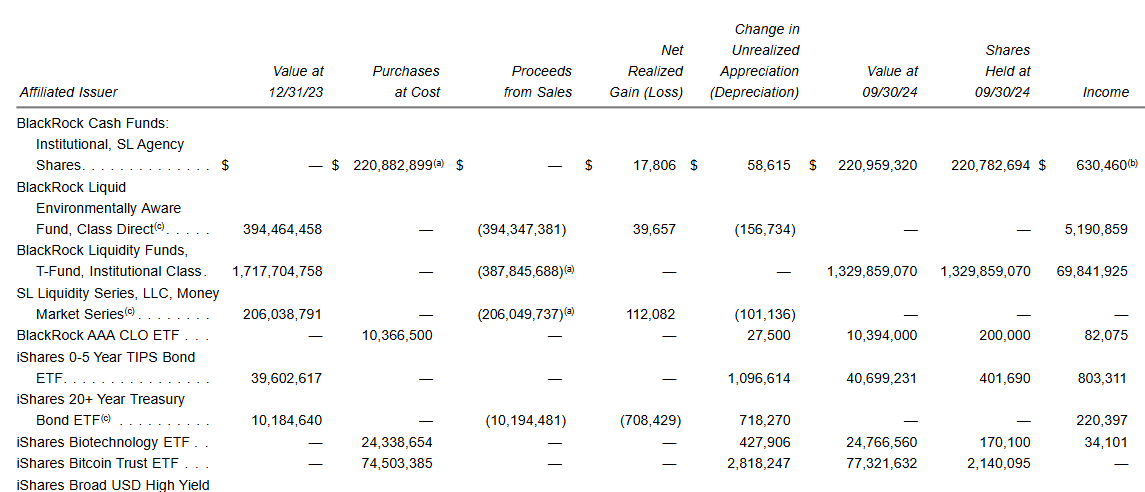

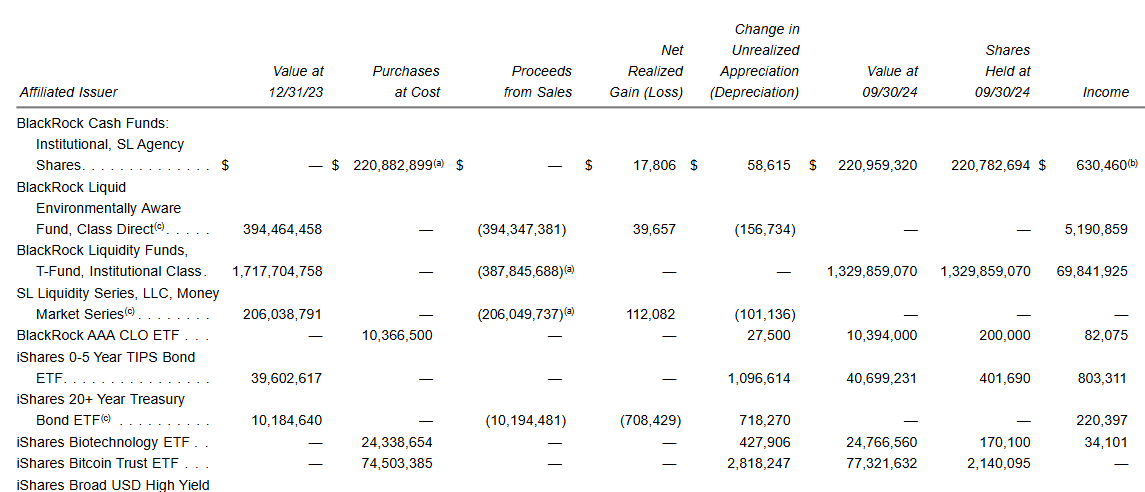

BlackRock added more shares of iShares Bitcoin Trust (IBIT) to the two funds, bringing it to a total of $78 million on Sept. 30, according to recent SEC filings shared for the first time by Macroscope.

BlackRock Strategic Income Opportunities (BSIIX), with $39 billion in assets under management, said it added more than 2 million shares of IBIT to its portfolio in the period ended September 30.

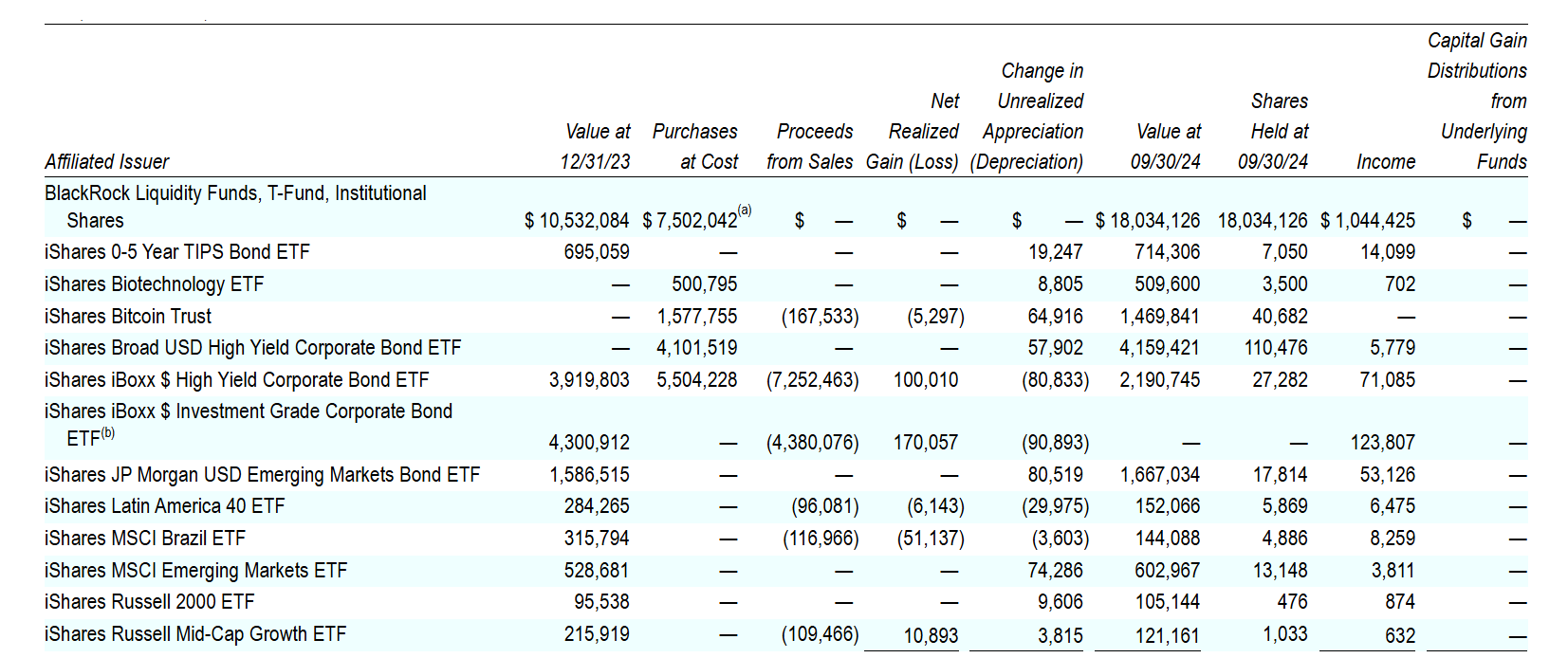

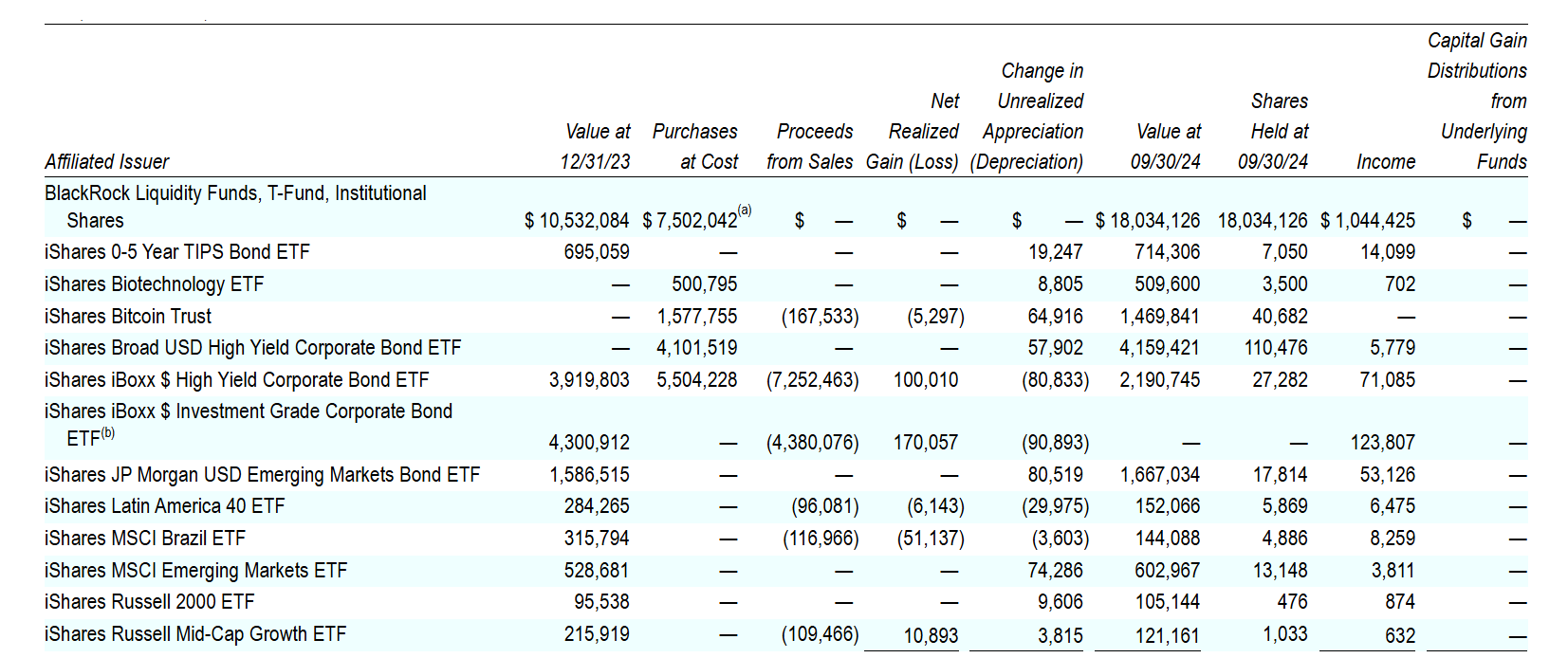

According to a separate filing, BlackRock Strategic Global Bonds (MAWIX), which controls $816 million in assets, bought more than 24,000 shares of IBIT, increasing its total holdings to 40,682, worth about $1.4 million.

Both funds are managed by Rick Reeder, BlackRock's Chief Investment Officer (CIO) Global Fixed Income.

IBIT has seen rapid growth since it began trading in January. As of November 27, it has approximately $48 billion in assets under management. The fund outperforms its gold-focused counterpart iShares Gold Trust (IAU), which holds about $33 billion.

IBIT has attracted investments from various groups of investors, including hedge funds, pension funds and institutional investors.

In the latest 13F filings, Millennium Management led the way in IBIT shares with about $848 million, followed by Goldman Sachs with $461 million and Capula Management with $308 million.

According to data from Farside Investors, the Bitcoin ETF has maintained daily performance metrics, including trading volumes and capital flows, with more than $30 million inflows.

Share this article