BlackRock records the largest one-day outflow, but Bitcoin ETFs still register a $622 million gain.

Key receivers

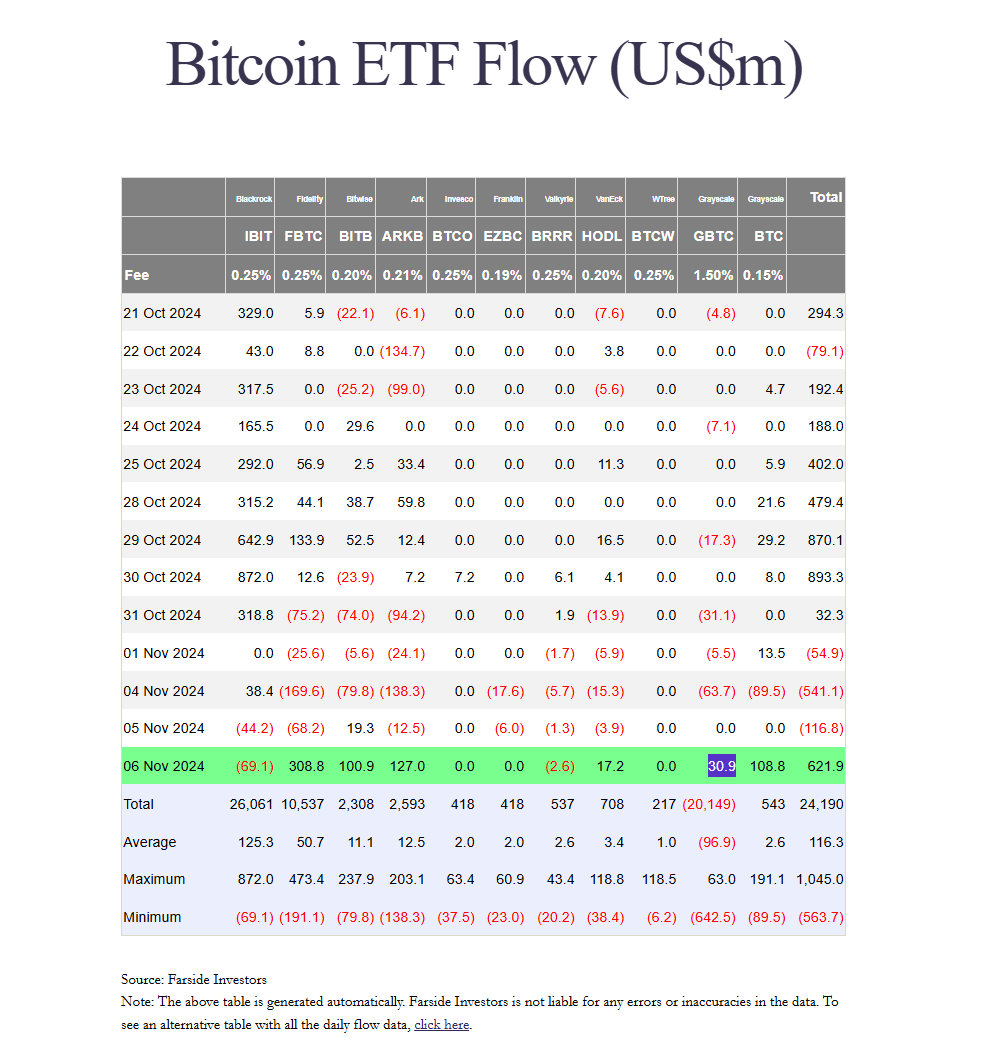

US spot Bitcoin ETFs broke a three-day losing streak on November 6 with net inflows of $622 million. While BlackRock's IBIT was its biggest outflow day, several ETFs, including Fidelity and ARK, saw it with higher returns.

Share this article

US spot Bitcoin ETFs attracted net inflows of nearly $622 million on Nov. 6, ending a three-day losing streak, although BlackRock's IBIT experienced its biggest one-day inflow since its launch.

According to data from Farside Investors, the world's largest Bitcoin ETF recorded a net inflow of about $69 million yesterday, while Valkyrie's BRRR saw inflows of more than $2 million.

IBIT's loss came as a surprise as the fund traded more than $1 billion in shares in the first 20 minutes of the market opening. According to Bloomberg ETF analyst Eric Balchunas, IBIT achieved the highest trading volume, reaching $4.1 billion.

“For context, that's more volume than stocks like Berkshire, Netflix or Visa,” the analyst said. “It's also up 10%, which is the second best day since launch. Some of that will translate into earnings that could hit Tuesday, Wednesday night.”

However, he noted, high buying and selling activity doesn't necessarily translate into new investments or capital flows into ETFs, meaning high volumes can occur through both buying and selling.

Most ETFs were trading at double their average size, marking one of their best trading days since their January launch, Balchunas said in a follow-up post.

On Wednesday, Fidelity's FBTC led the pack with net buying of around $309 million, followed by ARK Invest's ARKB, which took in around $127 million.

Big gains were also seen in Greyscale's BTC and Bitwise's BITB. The low-cost version of GBTC raised nearly $109 million in new capital, the second-highest daily revenue since its launch.

Meanwhile, the BITB fund brought in around $101 million, its best one-day performance since mid-February.

Greyscale's GBTC reported a net inflow of around $31 million yesterday, while VanEck's HODL saw around $17 million.

Share this article