Blackrock to upgrade Coinbase prime broker agreement

BlackRock, the world's largest asset manager, is looking to improve its top-performing bitcoin ETF (IBIT) among its peers since its January 11 launch.

Bitcoin ETFs continue to attract institutional interest, bringing Bitcoin exposure to Wall Street and expanding its reach beyond retail investors.

BlackRock files Bitcoin ETF update

In a September 16 filing with the US Securities and Exchange Commission (SEC), BlackRock requested that Bitcoin withdrawals from Coinbase, which acts as a custodian for its asset manager IBIT, be processed within 12 hours.

“Subject to the above required minimum balance verification, Coinbase Custody will process the transfer of digital assets from the custodian account to the public blockchain address within 12 hours of receiving instructions from the customer or the customer's authorized representatives.” .

The question comes as investors raise concerns about Coinbase's bitcoin ETF custody practices. Specifically, investors want Coinbase, as a custodian, to provide on-chain verification of Bitcoin purchases to EFAs to ensure transparency.

The concern was raised by the underperformance of Bitcoin's price over the past three months, despite large inflows into Bitcoin ETFs. Some speculate that Coinbase may be using “paper BTC” or Bitcoin IOUs for ETF issuers.

Read more: How to trade Bitcoin ETF: A step-by-step approach

Amidst the concerns, Coinbase CEO Brian Armstrong boldly pushed back against fear, doubt, and doubt (FUD).

“All ETF minutes and burns we do are ultimately verified on-chain. Institutional clients have trade finance and OTC options available before trades are completed on-chain. This is standard for all our institutional clients. All funds will be deposited into the Prime Vault (onchain) within one business day, Armstrong wrote.

In a preview, Tron founder Justin Sun first raised concerns about Coinbase's Bitcoin wrapper, cbBTC, and criticized the exchange for its lack of proof-of-reserve, warning that it could be a sign of “dark days for Bitcoin.”

BlackRock's recently launched Bitcoin ETF aims to address these concerns. The reforms signal the asset manager's efforts to improve its operating framework and improve liquidity. ETF analyst Eric Balchunas downgraded the estimate.

“I understand why these concepts exist and why people want to devalue ETFs. Because native HODLers are unlikely to be sellers. But what they…ETFs and BlackRock have done is regularly save the price of BTC from the cliff,” Balchunas said.

Coinbase as a single point of attack

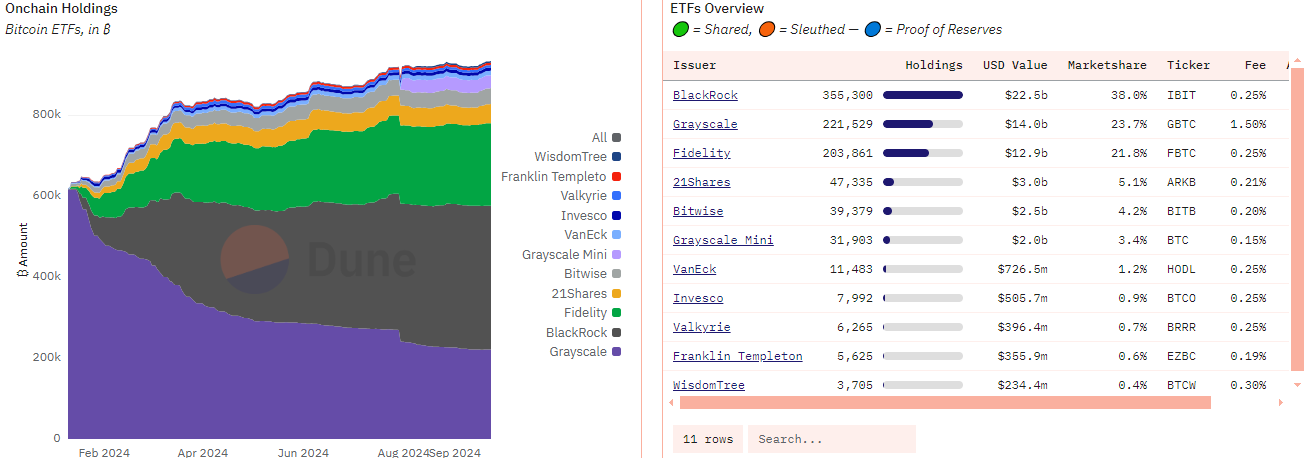

Since the financial instrument's launch on January 11, the Bitcoin ETF's earnings have been huge. BlackRock's IBIT dominates the sector, holding more than 38% market share and managing $22.5 billion in on-chain assets, according to Dunn data.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Coinbase plays a dominant role in the crypto spot ETFs market, providing brokerage services for eight out of 11 Bitcoin ETFs and eight out of nine Ethereum ETFs. It also provides trading execution and market monitoring services.

Coinbase manages 90% of the Bitcoin ETF assets of $37 billion, leading to concerns about its position as a potential single point of failure. Fox Business Correspondent Eleanor Terrett and others recently expressed concern about this position of influence.

“It's not good if almost all crypto ETF issuers have the same custodian for all BTC and ETH. This makes Coinbase a potential point of failure and it's scary,” Teret wrote.

Aside from recent concerns for investors about IOUs, the threat of North Korean hackers also puts Coinbase as a point of attack if bad actors target the custodian. Despite these concerns, the platform continues to play a vital role in institutional Bitcoin investment, driving the US-based BTC spot trading market.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.