BlackRock’s Bitcoin ETF has set a record $1.1 billion in one-day revenue

Key receivers

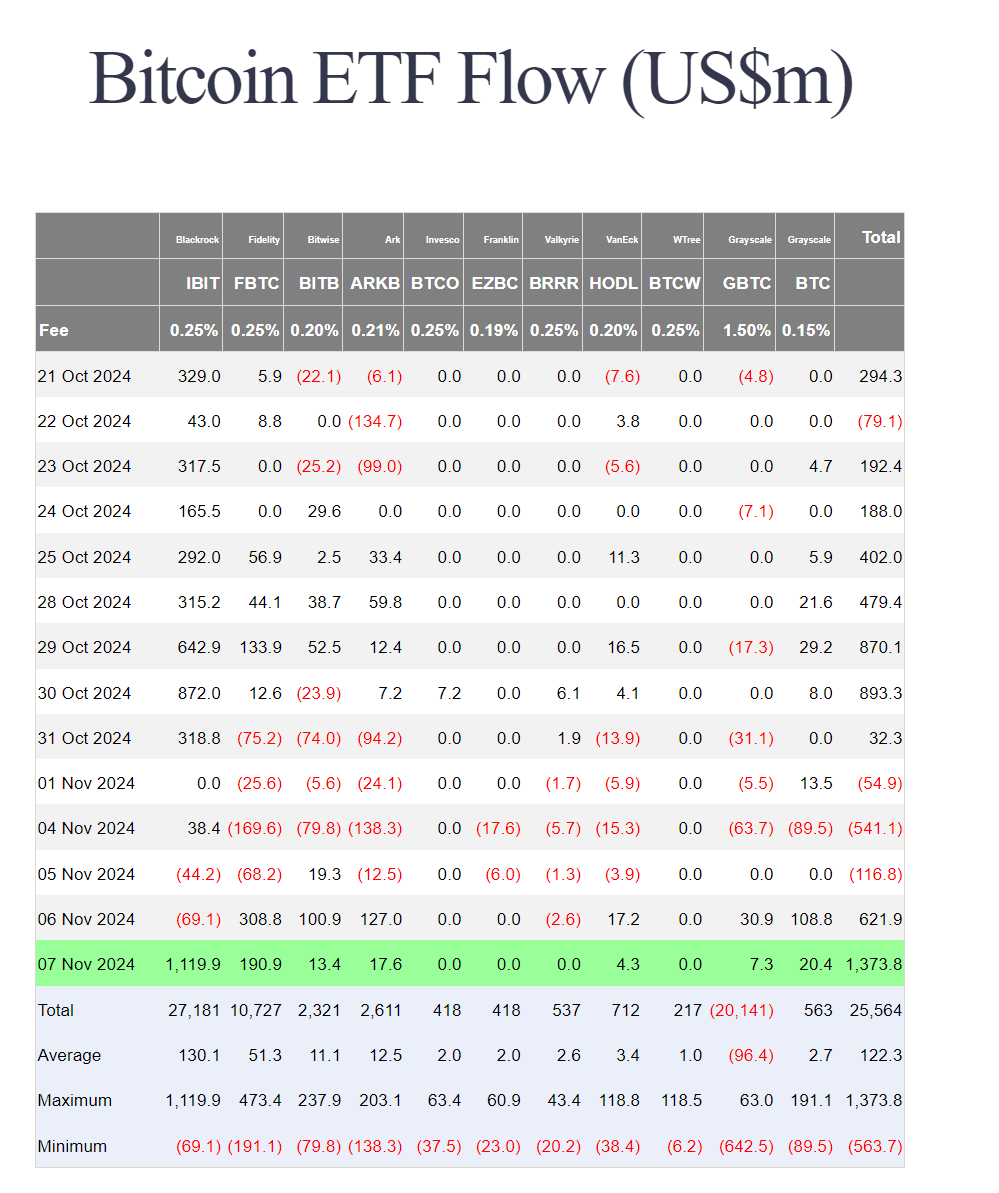

BlackRock's Bitcoin ETF saw a one-day gain of $1.1 billion. Total inflows for US spot Bitcoin ETFs during the period reached $1.37 billion.

Share this article

BlackRock's iShares Bitcoin Trust (IBIT) recorded an inflow of $1.1 billion in one trading session, marking the largest one-day inflow among US spot Bitcoin ETFs. Total inflows across all Bitcoin ETFs during the period reached $1.37 billion.

BlackRock's ETF led the day's activity with $1.12 billion in revenue, while Fidelity's Wise Origin Bitcoin Fund ( FBTC ) attracted $190.9 million during the same period.

Significant ETF gains coincided with Bitcoin's price action, which briefly touched $76,500 before settling around $75,700. The reported flows may reflect activity from the previous trading day due to the T+1 report, which explains why BlackRock ETFs posted negative flows in the previous session while other funds saw strong inflows.

Since their launch in January 2024, US spot Bitcoin ETFs have amassed billions in assets under management, with BlackRock's IBIT emerging as the market leader.

U.S. spot Bitcoin ETFs reached a record asset value of more than $66.1 billion last month, thanks to six days of inflows and rising Bitcoin prices.

Share this article