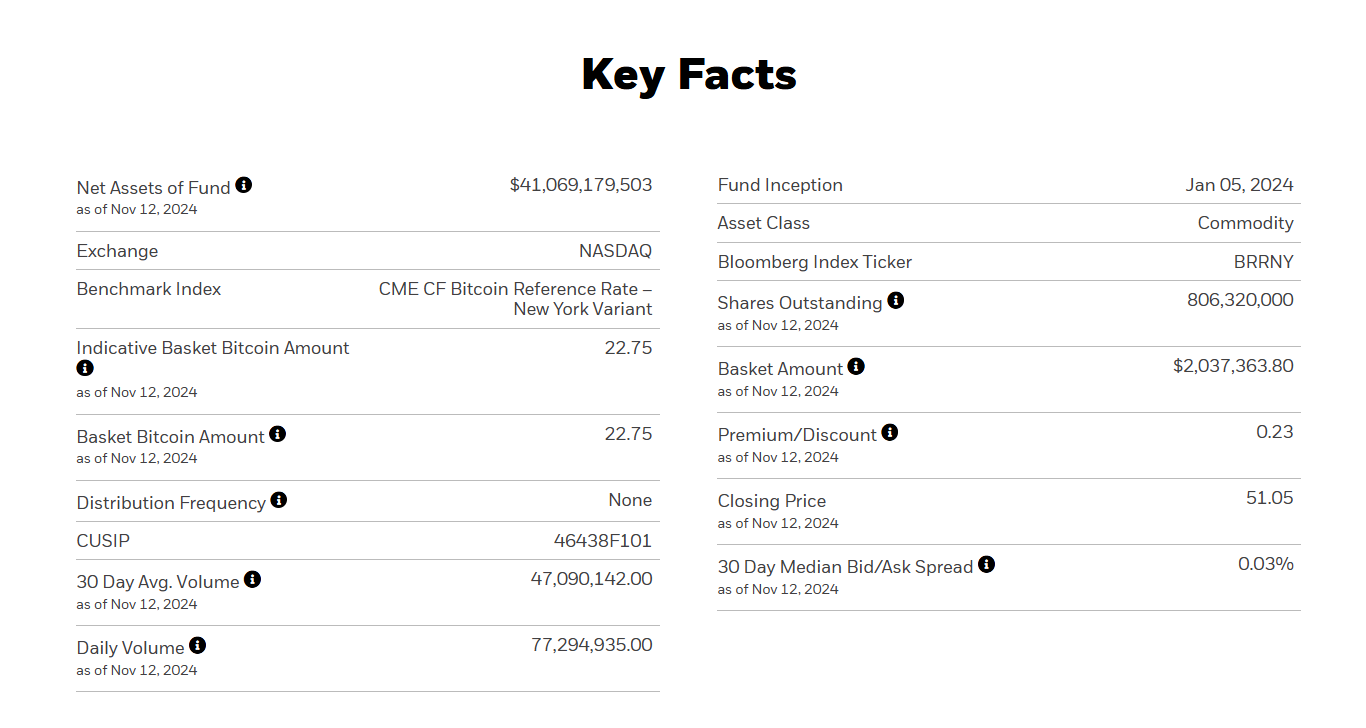

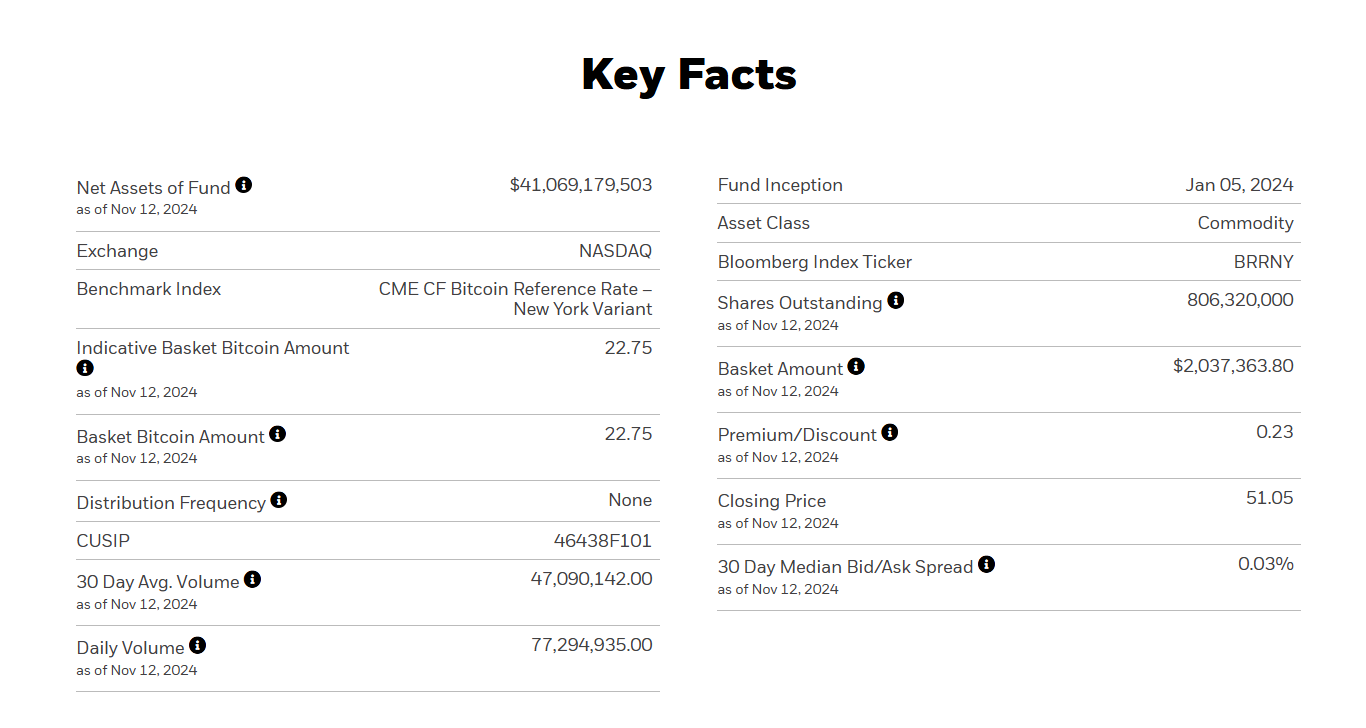

BlackRock’s Bitcoin ETF has topped ETFs by 1% in size, reaching a record $40 billion.

Key receivers

The BlackRock Bitcoin ETF reached $40 billion in assets in 211 days, setting a new speed record. IBIT is now larger than all ETFs launched in the past decade, ranking in the top 1% by volume.

Share this article

BlackRock's iShares Bitcoin Trust (IBIT) has amassed $40 billion in assets under management 211 days after its launch. According to Bloomberg ETF analyst Eric Balchunas, the fund has outperformed the 2,800 ETFs launched in the past decade and is up 1% of all ETFs in terms of assets.

The achievement broke the previous record of 1,253 days held by the iShares Core MSCI Emerging Markets ETF, a fund managed by BlackRock that tracks the investment performance of large-, mid- and small-cap companies in emerging markets.

At just 10 months old, IBIT has outgrown its gold ETF counterpart, the iShares Gold Trust (IAU), which currently has nearly $32.3 billion in assets.

As of January, IBIT had net income of nearly $29 billion, according to data from Farside Investors.

The rise in Bitcoin prices due to factors such as Trump's election victory and potential regulatory changes has fueled demand for IBIT and other Bitcoin ETFs.

Bitcoin hit a new record high of $93,000 as reported by CoinGecko. The leading crypto asset has overtaken Saudi Aramcon to become the world's 7th largest asset, according to Companies Market Cap. The new breakthrough comes just days after Bitcoin replaced silver.

US bitcoin ETFs are on track to surpass Satoshi Nakamoto's estimated bitcoin holdings.

Bitcoin ETF stock gains momentum following Trump's re-election. A group of US spot Bitcoin ETFs has attracted more than $4 billion in net inflows.

In a statement on Tuesday, Balchunas said these funds are approaching Satoshi Nakamoto's estimated bitcoin holdings, which could surpass the credited bitcoin creator.

Market analysts expect an inflow into Bitcoin ETFs, aided by the positive sentiment surrounding crypto markets and potential future developments.

Share this article