BlackRock’s IBIT Bitcoin ETF sees a record $330 million in spending

BlackRock's iShares Bitcoin Trust (IBIT) ETF has recorded the largest outflow since its launch a year ago, making it a dominant player in the Bitcoin ETF market.

The last outflow surpassed the record of $188.7 million that occurred on December 24, 2024.

Bitcoin EFF reached $242 million due to bleeding from IBT

According to data from SoSoValue, the fund's withdrawal of $330.8 million on January 2 is equivalent to 3,500 BTC. After IBIT's record breakout, the total daily net inflow of BTC ETFs reached $242 million.

January 2 also marks the third consecutive release date for IBIT, setting another new record. According to data from Farside Investors, BlackRock Bitcoin Trust experienced a total of $391 million in inflows last week alone.

At the same time, Fidelity, Ark, and Bitwise BTC ETFs recorded net income of $36.2 million, $16.54 million, and $48.31 million, respectively, on January 2.

IBIT's influx comes as Bloomberg ETF analyst Eric Balchunas noted in December that IBIT outperformed all ETFs launched. BlackRock said it shot up faster than any other ETF in global markets.

“The growth of IBIT is unprecedented. It is the fastest ETF to reach multiple levels faster than any other ETF in any asset class. At current asset levels and an expense ratio of 0.25%, IBIT can expect to earn about $112 million a year,” said James Seifert, another senior ETF analyst.

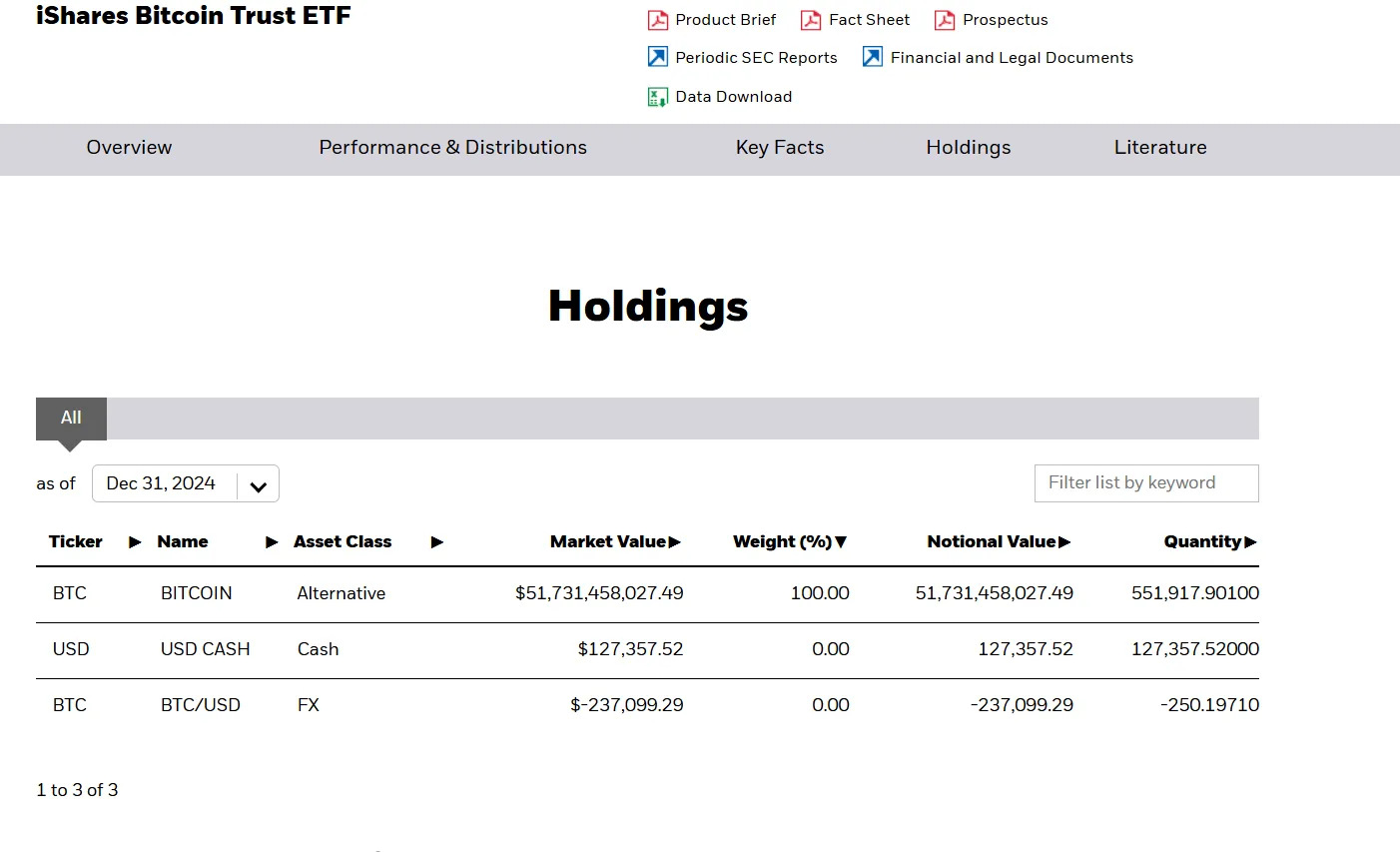

As of December 31st, IBIT holds 551,000 BTC. Since the launch of IBIT, BlackRock has acquired over 2.38% of all Bitcoin.

BlackRock's faith in Bitcoin was clear when the company said it has no plans to launch any new altcoin-focused ETFs, focusing only on BTC and ETH.

In December, Jay Jacobs, head of BlackRock's ETF department, emphasized the company's desire to expand the reach of its existing bitcoin and ethereum ETFs, which have been the best performers to date. Interestingly, BlackRock analysts also recently suggested that Bitcoin should comprise 1 to 2 percent of traditional 60/40 investment portfolios.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.