Bluefin Wales’ View: War, Gold and Crypto

The increase in global instability is one of the main reasons for the rapid continuous improvement of the crypto market and also an important reason for BTC's recent strong performance.

Due to the lack of safe-haven assets, the performance of non-BTC cryptos is more dependent on macro liquidity changes and the state of play of the currencies on the spot.

Altcoins have gained some advantage in the liquidity competition with ETH, which has further negative effects on ETH's performance.

A bull market in a geopolitical crisis

After last week's release of non-farm payrolls and employment data, the “lower-than-expected interest rate cut” appears to be slowly being accepted and priced in by investors.

This week, several central banks led by the ECB will announce their latest interest rate decisions. Although Europe has fared better than the US in terms of inflation and the ECB has signaled expectations of significant interest rate cuts, given that the ECB's influence is relatively weak compared to that of the Fed, the pace of global money flows is predictable. The return to the risky property market will decrease in the future. For the crypto market, the bull market may be more “soft and long”.

However, this does not seem to be the case. Since the beginning of April, the rate of return of transactions in the crypto market has increased significantly. Last week, the entire crypto market received an inflow of almost $3 billion, and the total liquidity balance also returned to the level of the same period in Q3 2022. The prices of BTC, ETH, and altcoins affected by the above situation have all found strong support, and market sentiment has recovered significantly. What causes unusual changes in cash flow?

Let's look at the performance of other assets together. As BTC hits a new all-time high, gold prices rise more than 25% in 6 months, hitting historic highs. At the same time, the price of silver and copper reached its highest level in a year. Rising gold prices are usually associated with safe haven sentiment. As a long-standing “hard currency,” gold is an important hedge when macro uncertainty increases, especially during periods of geopolitical tensions.

However, things get interesting when we look at the price trends of silver and copper. Silver and copper are military and strategic materials closely linked to the production of weapons and the defense industry. Therefore, to some extent, the rapid rise in silver and copper prices is a further reflection of the risks of geopolitical conflict and macro instability.

So, are there more similar clues? of course! Crude oil prices have risen more than 20 percent since the start of 2024, as demand and supply chain tensions caused by geopolitical crises have boosted the price of strategically important commodities such as coffee.

The feeling of a safe place is never reflected in a property; In times of uncertainty, people turn their money into “safe haven hard currencies,” or commodities, which are a critical factor in the rise in prices of commodities such as gold, crude oil, and coffee, and indeed one of the reasons for this. Increasing value of cryptos like BTC.

BTC: Will they continue to rise?

Given the escalating geopolitical tensions in the Middle East and Eastern Europe, global investors' need for a safe haven is difficult to effectively address in the short term. Therefore, the safe feeling strongly supports the demand for BTC. At the same time, although the rate of liquidity return is expected to slow, the likelihood of a recurrence of the liquidity buffer is low. Therefore, the liquidity balance in spot BTC ETFs will be “locked” relatively stable. In the long run, future liquidity returns will steadily increase BTC prices.

Traders in the options market share a similar view. Although investors' daily bullishness has been weakened by short-term fluctuations, investors' bullishness towards BTC remains stable and dominant in the near and far months. However, investors' expectations of BTC's mid- and long-term performance have fallen somewhat compared to the same period in March, and weakening expectations of interest rate cuts may be one reason.

Based on the latest gamma exposure distribution, at the end of the “asset allocation period”, the price of BTC seems to have shown some signs of stabilization. BTC price may receive some support around $63k to $65k. However, if the price of BTC rises further, it will face some resistance around $74k, which will increase significantly as the price rises.

It's worth noting that traders still have a relatively cautious view on BTC's price performance, as recent implied volatility data shows. On the upcoming BTC halving, although the level of macro uncertainty is relatively low and the risk level for the tail has fallen, traders still expect the 7-day price movement of BTC price to be 9.27% and the 30-day price. The range of activity can reach 20.74%.

Considering that investors' bullishness is still high, the price of BTC still has the potential to cross $80k in a favorable situation. However, flexibility is never one way; We cannot ignore the possibility of BTC falling below $65k.

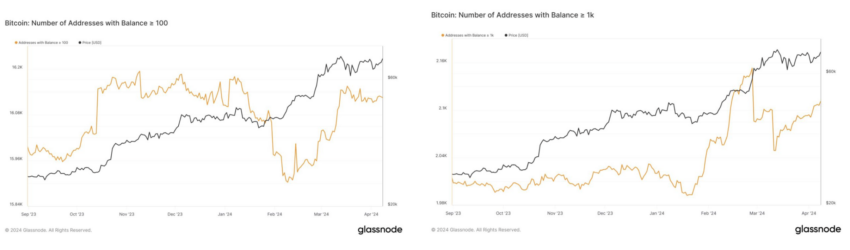

Traders' caution seems warranted. In the spot market, although the number of whales holding more than 1k BTC is still increasing, in general, the growth of whales holding more than 100 BTC is declining, which means that the buying power is weakening. In general, although holding BTC is still a better choice in the medium and long term, at the end of the temporary “asset allocation period”, the increase in the price of BTC may gradually stabilize.

Non-BTC Coins: The Inside Game

Compared to BTC, ETH is not very lucky. The chance of the Spot ETH ETF passing is slowly narrowing. Even the most optimistic ETH investors are slowly accepting that the deals and plays around spot ETFs are long-term. The performance of ETH depends more on the location of liquidity in the crypto market and changes in the level of macro liquidity in the crypto market.

From a macro perspective, traders are still bullish on ETH's long-term performance, benefiting from expected interest rate cuts. However, similar to BTC, weakening expectations of interest rate cuts negatively impacted ETH futures performance expectations, which was reflected in ETH futures annual premium changes.

Although investors have seen relatively high price volatility for ETH (9.94%/7 days, 21.5%/30 days), given the recent gamma spread, investors are more concerned about bearish swings than bearish volatility. Getting up. If the price of ETH shows a downward trend, it may find some support after falling to $3,300.

At the same time, compared to the resistance in the upward region, the support on the downward path seems “not easy”. The hedging behavior of market makers will cause the ETH price to break above $3,700 and stabilize until there are enough positive events based on “liquidity reallocation” in the current market conditions.

Fortunately, ETH whales seem to have slowed down the selling of spot items. Under the influence of projects such as Etena, holding positions for profit has become a relatively more profitable business, and the traditional covered call strategy has regained favor as the price increase has decreased. However, this means that whales are temporarily “neutral” in the price game.

For analysts, when the price of ETH is weak, it seems more appropriate to invest in other coins with more growth potential, which has additional negative effects on the performance of ETH. ETH's market share once fell below 16%; Although it has recently recovered, compared to last month, the market share of ETH is still significantly reduced. Considering that the market share of BTC has not changed significantly in the last month, it is clear that altcoins have gained some advantage in the liquidity competition with ETH.

In general, holding ETH is not a “bad strategy”; For whales, rich ETH interest-bearing channels are still relatively stable and can bring many returns. However, for fighters looking for winning returns, keeping in mind the current level of leverage and the relatively low speculative sentiment of altcoins reflected in funding rates, following the pace of liquidity in the crypto market seems a more appropriate choice.

Disclaimer

This article is sponsored content and does not represent the views or opinions of BeInCrypto. While we adhere to The Integrity Project's guidelines for impartial and transparent reporting, this content was created by a third party and is intended for advertising purposes. Readers are advised to independently verify information and consult with experts before making decisions based on this sponsored content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.