BTC reaches a new milestone: $71,000 is an all-time high.

The price of Bitcoin crossed the $71,000 zone and established a new all-time high. However, the rally continued till the time of writing this report.

In six days, the world's largest cryptocurrency has gained more than 40% to trade at $71,000 at the time of writing. BTC is now close to breaching the $72,000 level.

Bitcoin is against losing

Bitcoin price indicated a pullback a week ago, but BTC holders' optimism about their cryptocurrency prevented any major declines. The price of BTC peaked at $69,000 in March and corrected back to $63,724 the next day.

This sent shockwaves through the investors, who immediately jumped to sell their assets to make a profit. This caused the critical mass of investors – the whales – to sell BTC.

In one day, more than 115,000 BTC worth more than $8.13 billion were sold by retail investors from 100,000 to 1 million BTC.

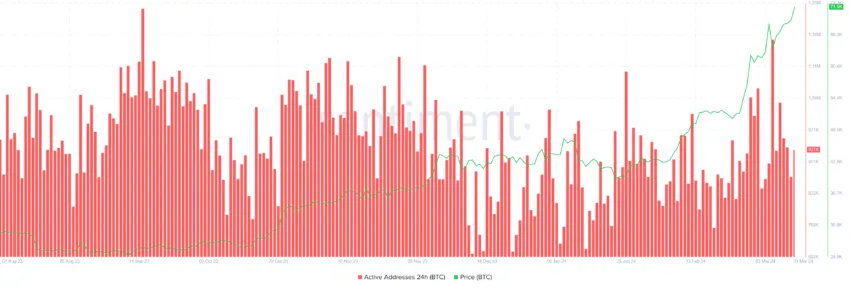

However, this support from investors was short-lived as the optimism of these investors soon faded. A decline in active addresses can see a similar situation. Transaction addresses range from 953,000 to 921,000.

However, Bitcoin has rallied over the past few days to reclaim a critical price level as a support floor. However, the cryptocurrency may witness some correction soon as it makes a significant increase.

BTC Price Prediction: A market-wide sell-off could wipe out gains.

The price of Bitcoin is currently on an optimistic note, but once a sell-off occurs, this will signal a correction for the cryptocurrency. The high MVRV ratio confirms this.

The market value to real value (MVRV) ratio indicates the average profit or loss of the investors who acquired the property. Specifically, the 30-day MVRV ratio evaluates the average profit or loss of investors who acquired a property in the previous month.

In the case of Bitcoin, the 30-day MVRV is currently at 16.26%, which indicates that investors who bought BTC in the last month are making a profit of 16.26%. This situation often prompts these investors to consider selling their assets to take advantage of their gains, which can lead to a sell-off.

Historical data shows that when MVRV is in the range of 11% to 21%, Bitcoin tends to undergo significant corrections. Therefore, this region is often referred to as the “danger zone”.

So selling is highly unlikely at the moment, which can naturally affect the price of Bitcoin. Testing the $72,000 resistance level, BTC is trying to break at the time of writing. But a failed breach combined with a sell-off could cause BTC to fall back.

The cryptocurrency could slide to $70,000, losing, sending it to $63,724.

However, if the investors show resistance and the price level of $72,000 is successfully breached and turned into support, BTC may continue to rise, which will destroy the price of the bearish article.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information found on our website is at their own risk.