BTC Slips 3% As Cryptocurrency Market Reacts To CPI Data As JPMorgan Awaits SEC’s ETF Decision

Amid dynamic global events, Bitcoin is once again in the spotlight. Currently trading at $26,831, it was up a little over 0.10% on Friday, but has fallen about 3% over the past seven days. The entire cryptocurrency market is holding its breath in anticipation of various influencing factors.

Consumer Price Index (CPI) data recently sparked a reaction in the crypto space, causing BTC to slide by 3%. As this unfolds, JPMorgan awaits the SEC's ruling on the ETF, which is set to become a major determinant of Bitcoin's short-term price path.

Adding another layer to the regulatory landscape, the commission has until midnight on Friday to respond to the SEC's August 29 deadline to challenge the grayscale approaches.

The escalating conflict in the Middle East poses a threat to the digital currency industry. Recognizing the urgency of the situation, Coinbase's CEO appealed to Congress, stressing the need for swift and reasonable cryptocurrency legislation in these tumultuous times.

Grayscale vs SEC: Friday midnight deadline August 29th will be a challenge.

Grayscale investments scored a major legal victory when the DC Circuit Court ruled in their favor on August 29, allowing them to turn Bitcoin Trust (GBTC) into an exchange-traded fund (ETF).

The court found that the US Securities and Exchange Commission (SEC) had arbitrarily and capriciously rejected the proposal.

The SEC was given a 45-day window to appeal, with a deadline set for midnight on October 13. If the SEC chooses not to appeal, it is tantamount to approval, potentially paving the way for the first Bitcoin ETF in the US.

However, the market speculates that alternative arguments could be used to reject the ETF, perhaps related to Coinbase's involvement. The result could have an impact on the cryptocurrency market, which is experiencing selling pressure.

Amid Middle East Tensions, Coinbase CEO Pushes for Swift Crypto Legislation

With the Middle East conflict on the rise, Coinbase Chief Legal Officer Paul Grewal has urged the US Congress to enact reasonable cryptocurrency legislation.

He stressed the need for the crypto industry to thrive in countries that respect the rule of law, rather than being forced into states with little regard for human rights and public safety.

The US Securities and Exchange Commission (SEC) classifies most crypto tokens as securities, with the exception of Bitcoin, which regulates crypto platforms.

Grewal's statement is in response to reports that Hamas received nearly $41 million in cryptocurrency, using Binance for fundraising. Coinbase is committed to preventing illegal use of cryptocurrency through strict measures such as KYC checks, sanctions screening and law enforcement cooperation.

Grewal's call for sensible cryptocurrency legislation is likely to find support from the crypto community as it seeks legitimacy and transparency.

This development may contribute to a more favorable market outlook as regulatory certainty attracts more institutional investors and increases general confidence in the cryptocurrency market.

Bitcoin price prediction

On October 13, Bitcoin (BTCUSD) traded at $26,793.09 for a 24-hour volume of $9.43 billion. Despite a small swing of 0.04% on the last day, it holds the #1 spot on CoinMarketCap with a market cap of nearly $522.79 billion.

This dominant cryptocurrency has 19,512,131 BTC in circulation out of a maximum of 21,000,000 BTC. Technical analysis from the 4-hour chart shows a pivot point at $27,208.

Resistance levels are marked at $27,909, $28,636 and $29,304, while support is seen at $26,461, $25,779 and $25,044.

With an RSI of 33, the momentum suggests an oversold condition. The 50-day exponential moving average stands near the pivot at $27,284.

If Bitcoin stays below $27,208, the immediate trend looks bearish.

Top 15 cryptocurrencies to watch in 2023

In the year Stay up-to-date with the world of digital assets by exploring our hand-picked top 15 alternative cryptocurrencies and ICO projects to watch in 2023.

Our list is compiled by experts from Industry Talk and CryptoNews, ensuring expert advice and critical insights for your cryptocurrency investment.

Take this opportunity to discover the potential of these digital assets and educate yourself.

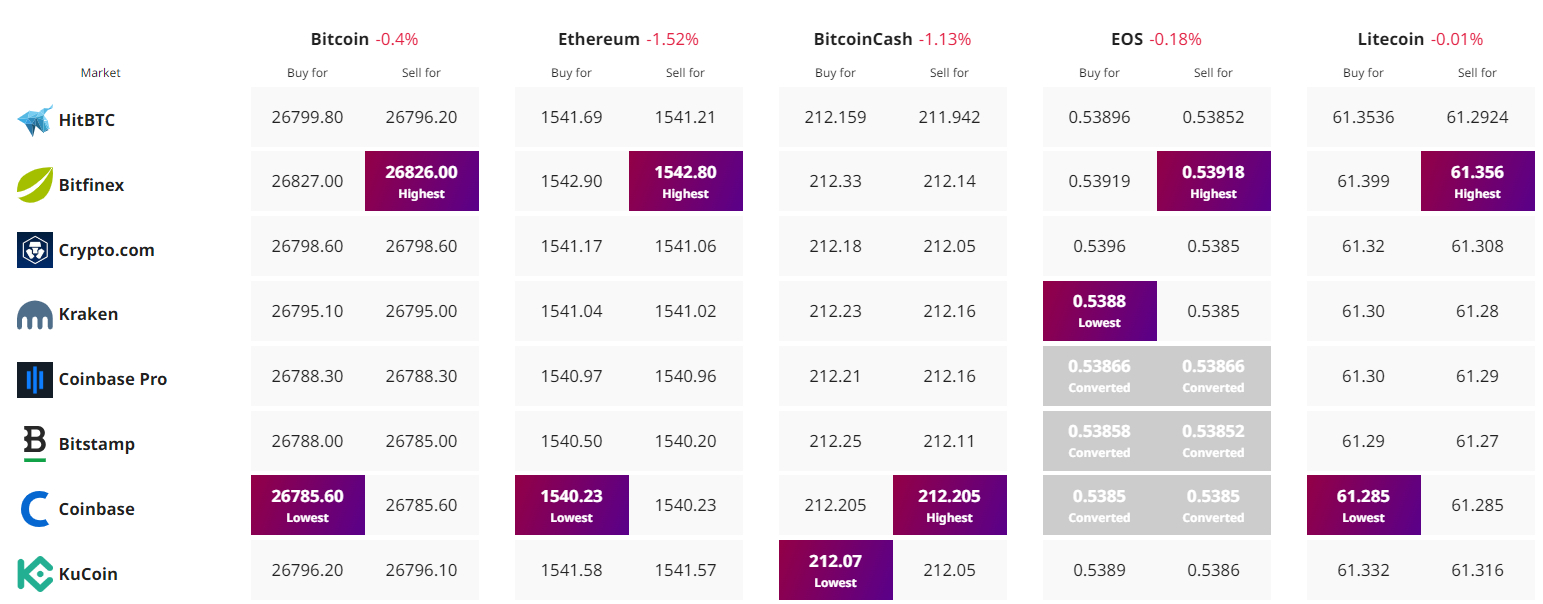

Find the best price to buy/sell cryptocurrencies

Disclaimer: Cryptocurrency projects endorsed in this article are not financial advice of the publisher or publication – cryptocurrencies are high-risk investments, always do your own research.